Disclaimer: BestForexBrokers.com and this report are not associated with myfxbook.com in any capacity. We have used publically available information from myfxbook.com to prepare this report and the views in this report are the opinions of BestForexBrokers.com only and do not in any way represent the views of any entities mentioned in this report.

Report Objective

With the increasing popularity of forex trading amongst everyday traders, it has become apparent that a lot of people are diving in head first without fully understanding the risks involved in trading forex.

This report focuses on the subject of forex systems, where traders simply invest money and follow a set of trades generated either manually by a human trader, automatically via a set of configured rules, or a combination of both.

Note that there is nothing wrong with an automated trading system. Computers and algorithms are used in many industries to make predictions. When it comes to financial trading however, it is the risk management and money management placed behind these systems which can make or break an account.

In many ways, for a novice trader it’s far better to invest in systems if they have been built or managed by a professional trader. It’s not possible to become a professional trader and trade for yourself in such a short time. It would be no different to trusting a professional to do any job whether it be electrical work, car repairs, building homes, etc.

The trouble with the forex industry is that more often than not, the interactions with so called professional traders are faceless and this is where many people can fall into the trap of trusting their money with a system which looks amazing, but in reality is a failure waiting to happen and may not even be built by a professional forex trader.

Our aim with this report is to educate you on the real differences between systems which on face value may look very profitable. We want to teach you the ability to identify the danger signs of systems which will present a high level of risk to your money.

System #1

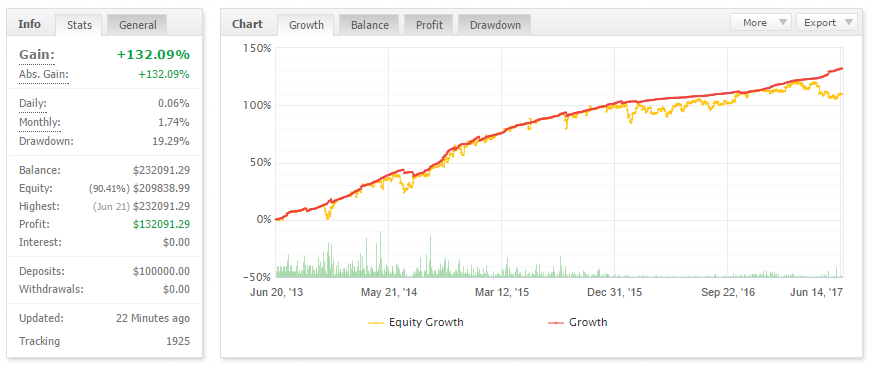

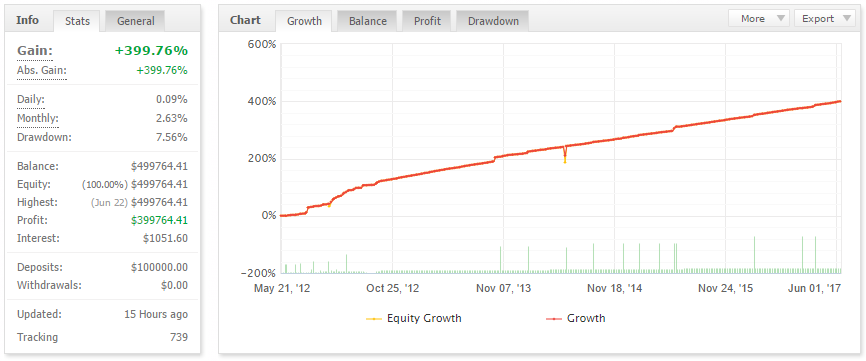

On first glance: An account which over a 4 year period has blossomed from an initial balance of $100,000 to $232,091. Consistent growth, very little volatility and a drawdown of under 20%. Looks like a stable system that’s not too greedy (+132.09% over 4 years is conservative compared to most other systems). Only 1 losing month since inception!

The red flags:

- The large gaps which appear between the red (growth line) yellow (equity growth line) indicates a possibility that there are losing trades being held in open positions and the possibility that stop losses are not used on the trades.

- The winning trade percentage is incredibly high (92% for buys, 97% for sells), again indicating the possibility that losing trades are held until they come back around into profit.

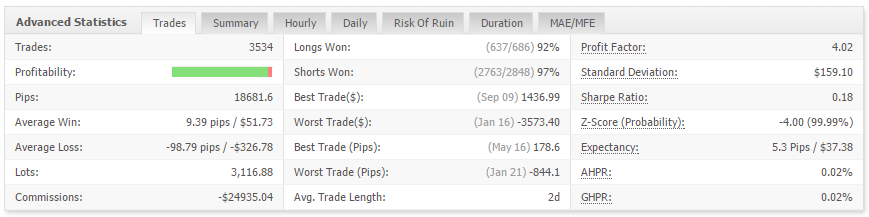

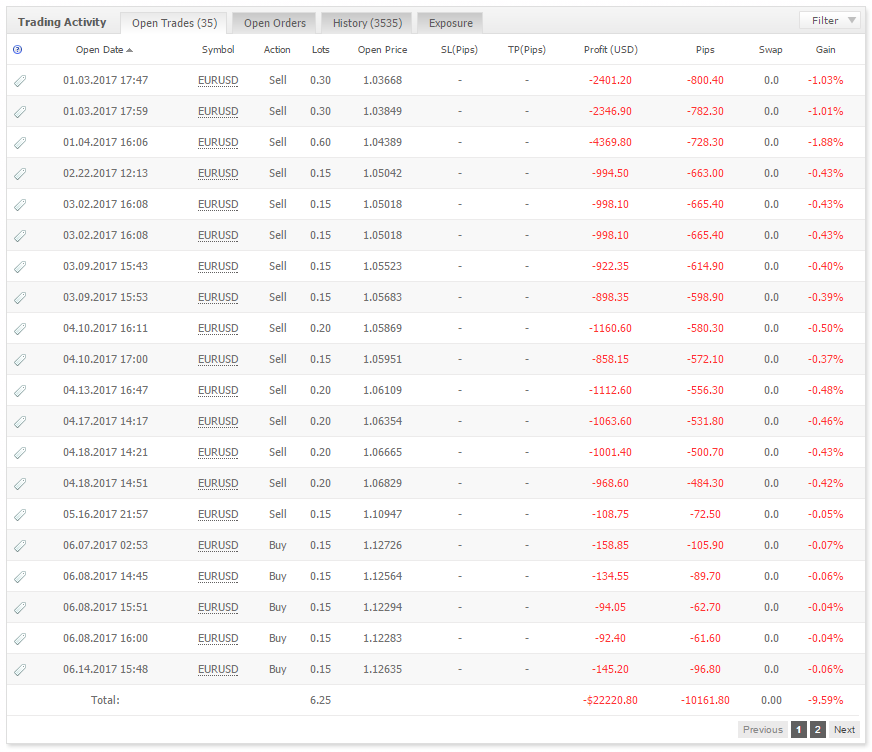

Closer look: Let’s inspect the “Open Trades” of which there are 35:

33 of the 35 open trades are losing and the oldest trade has been open since January 1st 2017, that’s over 6 months! The total value of these losses amount to $22220.80 which is just under 10% of the balance of the account.

You can clearly see that these trades do not have a stop loss or take profit set, so they just ride the trades until a favourable outcome occurs.

Any good forex trader would not allow this to happen. This is a dangerous, risky style of trading.

It also goes to show why the win % of trades is so high. Rather than close losing positions which would record a loss, it’s kept open until it (hopefully) comes back around to a profitable trade.

Who could actually invest in this system: The saving grace for this system as it stands is the account balance and trading size. Because the balance is large yet the trades are only 0.15 of a standard lot, there is very little being risked on each trade. This is why, even with the above amount of losing positions that are kept open, the total account balance does not suffer more than 10% and the account can continue to trade with minimal risk of losing the entire balance.

To trade with this system you need a big starting bank that can withstand holding losing trades. Unfortunately, this is not possible for most average investors.

To invest in this system with a much lower starting balance you would need to reduce the purchase size per trade proportionately.

System #2

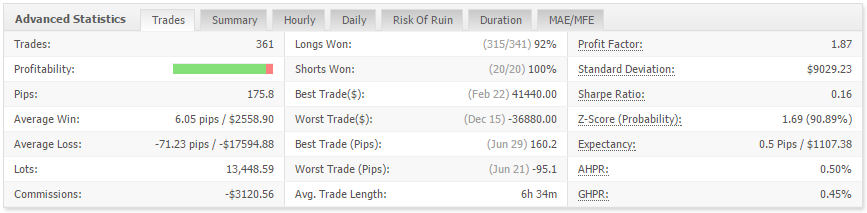

On first glance: An account which over a 5 year period has grown at a very steady, consistent rate and now stands at close to $500,000 from an initial balance of $100,000. Unlike the first system, both the growth and equity growth lines are very close together, indicating that this system most likely does not hold open positions.

Are we onto a winner here? Let’s find out.

The red flags:

- The winning trade percentage once again is incredibly high (92% for buys, 100% for sells), but this system doesn’t look like it holds losing trades open until they become profitable. So what could be the reason for such a high winning percentage?

- The average win is just 6.05 pips but the average loss is a whopping -71.23 pips. So, win small and often but lose big?

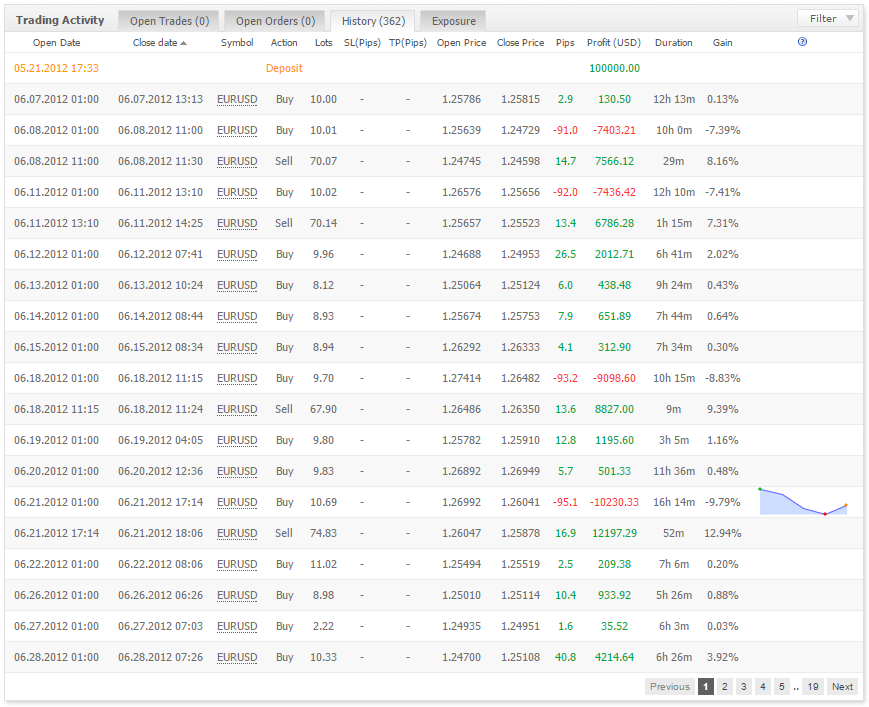

Closer look: For this system we are going to inspect the “History” of trading activity, sorted from the earliest (when the system first started):

The system started in 2012. The very first trade was for 10 lots. Let’s make this very clear – 10 lots! That’s $1,000,000 of currency being traded, EUR in this case. This means for every pip that the currency moves, it’s worth roughly $81 USD (at that time) and as you will see with the second trade, this account lost 7.39% of the total balance in just 1 trade!

Things get a lot worse from here and if you do your due diligence on this system you will see that this is a massive pitfall no matter how good it looks on paper. Notice what happens after the 2nd trade (which we will point out again, wipes out 7.39% of the entire balance). The 3rd trade is executed at the exact time that the 2nd trade closes and takes up the opposite position AND the lot size is 70.07!

70.07 lots – what is going on here?

It’s obviously an algorithm set up to try and win back the losses. You can see that the 3rd trade takes roughly 1/6th of the pips of the 2nd trade to make back the loss and also take a bit of profit. As the system opened a trade on the opposite side to the previous losing trade, it looks like they are trying to ride a trend and hence they are buying over 6 times the amount of currency to try and make the losses back in a small amount of pips.

This pattern continues whenever there is a big loss.

Oh, and notice that there are no Stop Losses used? This system has all the signs of danger.

System #3

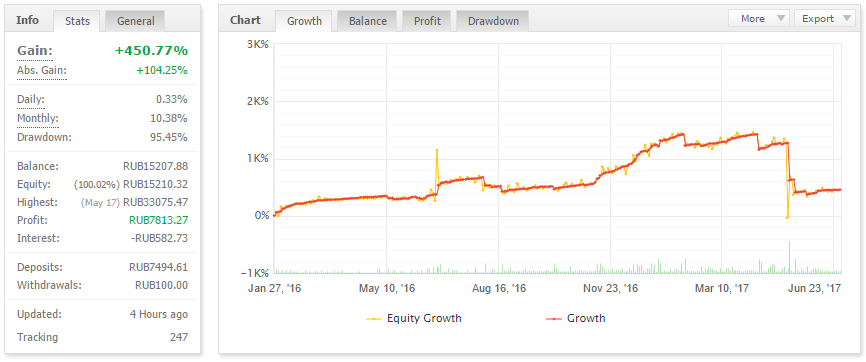

On first glance: An account which in just a year and a half has doubled in balance. We’ve included this system because it’s an easy one to identify the flaw. Can you see it?

The red flag:

- The account took a massive dive in May 2017. You can see that the “Highest” balance on the left side stats panel was over 33,000 RUB (Russian currency) but currently is just over 15,000 RUB.

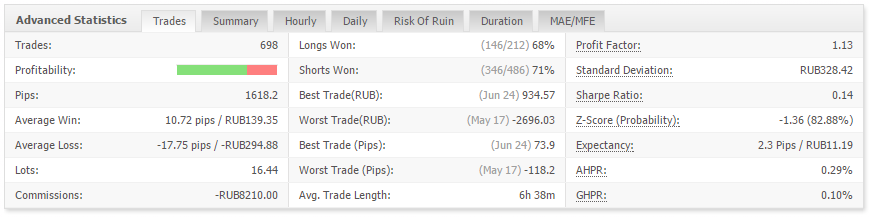

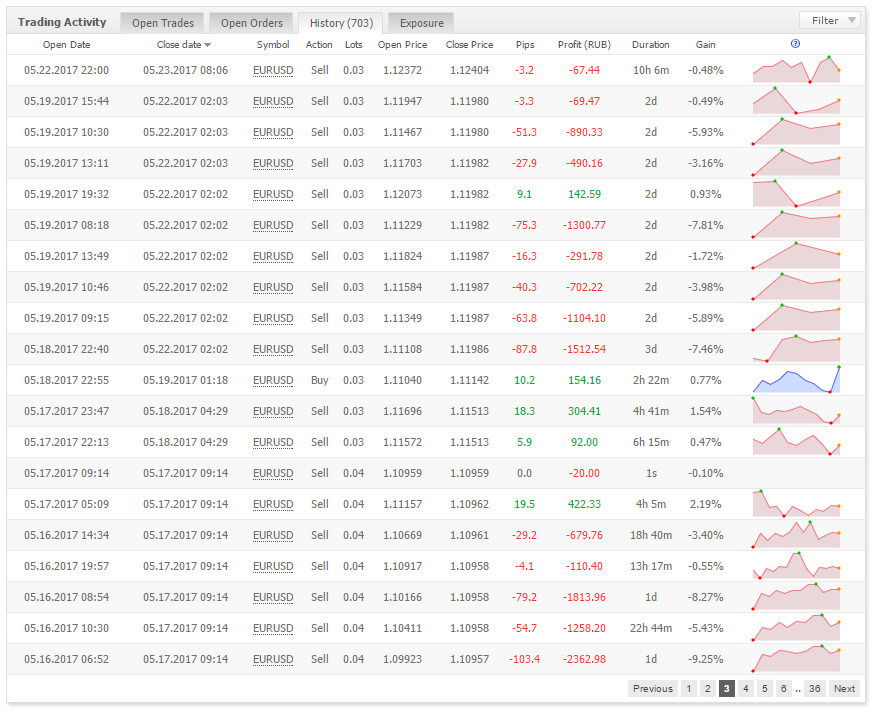

Closer look: For this system we are going to inspect the “History” of trading activity, in a period from May where the account lose over half the balance:

Take a look at the trades from the bottom. You can see 7 of them were all closed at the same time, most of them for huge losses. Notice something else? Each trade was opened within the same day, at different times. This system keeps adding new trades in the same direction!

Why not stay with 1 trade and if it doesn’t go well, close it with a sensible stop loss and wait for another opportunity? You can see in this screenshot that a similar pattern occurs another time and once again for massive combined losses.

Losing half your balance in 1 month after you have done so well to build it up suggests very poor discipline.

Summary

If you are considering investing your money into a forex system, managed fund, or any other arrangement where you rely on the trades of a 3rd party provider, be extremely cautious and make sure you do your due diligence.

Whilst there are genuine funds out there that perform consistently and follow the correct principles of risk and money management, they are few and far between.

A lot of sceptics often ask: “If a system makes so much money, why would they tell anyone?” The answer is quite simple and lies in the depth of the forex market. It trades over $5 trillion a day so there’s no risk of negatively affecting the market if a trader decides to allow other people to follow their trades. So, why not make some extra money by charging a performance fee for allowing people to copy your trades? You wouldn’t say no to free money.

Top 5 Tips on Assessing Forex Systems

- Look for consistent growth over time. Is the account steadily growing and does it have a history of at least 6 months? You want at least 6 months’ worth of data to assess. Anything less and you are taking a risk. Growth should be steady and consistent.

- Look through the current open trades. Are there any losing trades that have been open for a long time? Holding onto a losing position for a long time may mean that no stop loss is used. Check how many pips they are down. If the winning % is ridiculously high, the system is likely holding losing trades until they eventually come back around.

- Look at the closed trades. Are there bunches of the same position being opened within a short period of time but all closed at the same time? You typically would not cascade multiple trades of the same currency pair and same position. If you enter a trade and you are wrong, you would deal with it, close it at a stop loss and move on.

- Look at the lots purchased. Are they consistent or does it fluctuate wildly? Trading in lot sizes relative to the account balance is good money management. If trades are all of a sudden increasing in size, especially after a loss, beware! It’s similar to doubling your bet at the roulette table betting on red or black.

- Look at the average pips in winning trades vs losing trades. What’s the ratio? A system where average pips in losing trades are much larger than in winning trades is a worrying sign. Combine it with the % of winning trades to get a clearer picture.