The retail Forex trading market is jam-packed with brokerage firms that are trying to offer a satisfactory Forex trading platform. Nevertheless, only a handful of companies are truly devoted to presenting the best trading tools designed with traders in mind. Incidentally, HotForex broker is one of the extremely few companies that have successfully kept up with the strenuous demands of modern-day traders through unique and innovative product offerings. HotForex has received multiple awards for its unparalleled reach and customer satisfaction, supplemented with the strong regulatory oversight, which the company is under that makes it one of the best brokers for FX and CFD trading.

HotForex was founded in 2010 and has offices in several key financial centers worldwide. The company keeps itself in the limelight through numerous high-profile sponsorships. Furthermore, it appears that HotForex is committed to its corporate social responsibility initiatives through the numerous charitable and environmental activities that it engages in. In this detailed HotForex review, we look at how the company has managed to amass over 2.5 million live accounts in its brokerage portfolio, focusing on the broker’s Forex products, spreads, bonuses, trading platforms, and other trading parameters.

Features

- Wide range of free trading tools

- Educational resources

- Weekly live webinars

- Live Q&A sessions

Special Offer

Why Does It Make Sense to Open a HotForex Account?

We will cover the company’s merits in great detail throughout this HotForex review. However, before we move on to how to open a live trading account on HotForex, here is a quick reminder of all the pros and cons of a HotForex account:

- A HotForex minimum deposit starts at $5.

- There are tight Forex spreads and competitive HotForex fees on all other instruments.

- There is an impressive collection of bonuses and offers for retail clients.

- It supports both MT4 and MT5 terminals along with a diverse range of trading tools and FIX/API.

- PAMM and HFcopy options are available for social trading and fund management.

- There are multiple choices of trading accounts.

- HotForex is overseen by several top-tier regulators, ensuring financial security and transparency.

- Quick HotForex withdrawal policies ensure timely processing of all withdrawal requests.

- The proprietary HotForex app for mobile does not support full trading capabilities.

- HotForex does not offer cryptocurrency instruments and the HotForex trading hours are not extended into the weekend.

HotForex has numerous custom-tailored account solutions that suit varying trader requirements, which is one of the main reasons you will feel instantly at home with the broker. We opened a live trading account to perform a detailed HotForex review. We will provide a detailed overview of how to open a live trading account on HotForex in subsequent sections.

Understanding the Different Types of HotForex Accounts

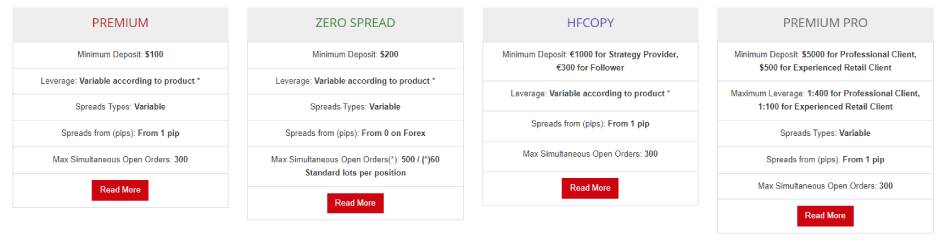

Retail traders can choose from six different types of HotForex accounts, each offering a unique access point to trade the markets. The cheapest option is the micro account, available for a minimum deposit of $5. The micro account adopts a variable spread hybrid market-maker model, where the minimum spread starts at 1 pip for major currency pairs. It grants access to the entire list of trading instruments, with the maximum HotForex leverage set at 1:1000.

There are a few trading restrictions for micro traders, including a limit on the maximum number of simultaneous orders of 150 and a maximum total trade size of 7 standard lots. We understand the implications of such restrictions on micro lot traders since trading with many lots with high leverage can lead to liquidity issues under live market conditions. Nevertheless, the micro HotForex account is a great option for small retail traders with limited trading capital access. If you are looking for better trading conditions, you will have to opt for a premium account.

The premium account adopts the same variable spread hybrid market-maker model as the micro account, and their trading conditions and HotForex fees are quite similar. The major difference is clearly that the HotForex minimum deposit for the premium option starts at $100, while the maximum HotForex leverage is lowered to 1:500. Moreover, the maximum number of simultaneous orders rises to 300, while the maximum trade size increases to 60 standard lots. There is also a small difference in the margin call and stop-out levels. For micro traders, the margin call and stop out levels are set at 40% and 10%, respectively, while for premium traders, these levels are set at 50% and 20%, respectively.

If you do not prefer the high spread quoted for the micro and premium accounts, you can opt for the ZERO Spread option. As the name suggests, this account offers a zero pip spread guarantee for the EUR/USD pair and extremely low spreads for other pairs. The broker works with multiple banks to access the quotes directly from an interbank liquidity pool, ensuring that the HotForex fees for Forex trading remain highly competitive. However, the company will charge a commission for tighter spreads, which equates to around $3 per lot per side, or $6 per round turn trading.

Nevertheless, the trading conditions for the ZERO Spread account are largely similar to those for the premium account-except for the HotForex minimum deposit – which rises to $200 for the ZERO Spread account. These three account choices represent a majority of the retail trading market. Hence, we are happy that they are offered to traders at a significantly lower minimum investment than are offered by other mainstream brokers.

HotForex has also devised specific accounts for social trading and investments, categorized into Auto, PAMM, and HFcopy. The Auto account is a replica of the Premium account with the only differences between them being that the minimum deposit requirement is increased to $200, and there is a restriction on the choice of account base currency.

The Auto account allows traders to subscribe to trading signals-both free and paid-from the MQL forum. However, for those who wish to invest their capital into managed funds through a percentage allocation module system, the broker also provides the option of a PAMM account, which is the predecessor of the present-day social trading concept. It is still one of the best options for investors and account managers, especially since it provides them with a tried and tested platform.

The PAMM account is of two types-Premium PAMM and Premium Plus. Their only difference is in the HotForex fees. The Premium PAMM option charges a minimum spread of 1.3 pips, while the Premium Plus PAMM option charges a minimum spread of 0.3 pips and a commission of $8 per round turn trading.

Finally, the company has developed a proprietary social trading system, known as HFcopy account, similar to the conventional copy trading systems in the market. There are two types of accounts-the Follower and the Strategy Provider options. Followers can open an HFcopy account for a HotForex minimum deposit of $100, while Strategy Providers must deposit at least $500 for the HFcopy account.

Strategy Providers can publish their trades and strategies on the platform in exchange for a performance fee, which allows Followers to copy their trades. These performance fees are only paid for trades with a positive performance-a continued negative performance can lead to a Strategy Provider getting banned from the program. Therefore, with three unique CopyTrade and investment options, HotForex broker has covered all the essential requirements of a comprehensive social trading network.

How to Open a Live Trading Account on HotForex Broker Platform

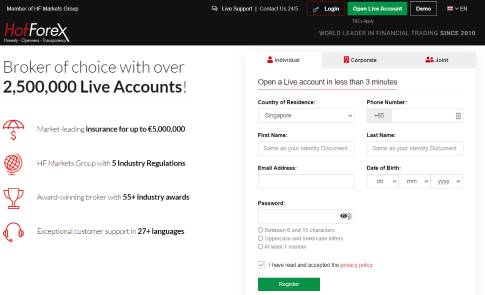

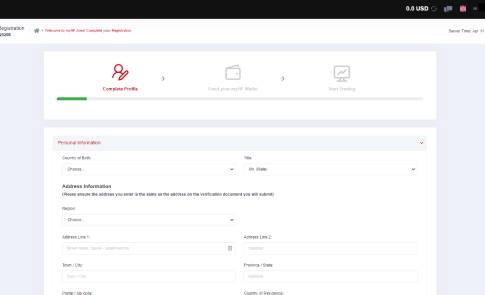

As the broker states on its signup page, you can open a HotForex account within three minutes. First, you must submit your contact information and await an activation link via email. Once you have confirmed your email address by clicking on the activation link, the broker takes you straight to your account dashboard. You must then complete your profile by providing your detailed personal information and choosing your preferred myHF wallet base currency. You can then manage your account through the account dashboard, where you can open a trading account, add funds to your trading accounts, transfer funds between trading accounts, and place a HotForex withdrawal request.

The myHF wallet interface also provides several options to download trading platforms, access trading tools, and use the broker’s excellent educational materials. Traders can receive updates about the latest contests run by the broker, get information on bonuses, and stay abreast of new trading products-all through the myHF wallet dashboard. Clients can also seek assistance from the broker through the “Help” section, which includes a detailed FAQ segment and guides on the different products and services offered by the company.

Although the company makes it easy for traders to deposit money and start trading as soon as they verify their email address, we would not recommend doing so. It is imperative to take some time to complete the personal identity verification process by uploading your identity documents. Please ensure that you get HotForex broker‘s team to give you full confirmation before making your first deposit. This will ensure that your account is fully active when making a HotForex withdrawal.

An Evaluation of Desktop Trading Platforms

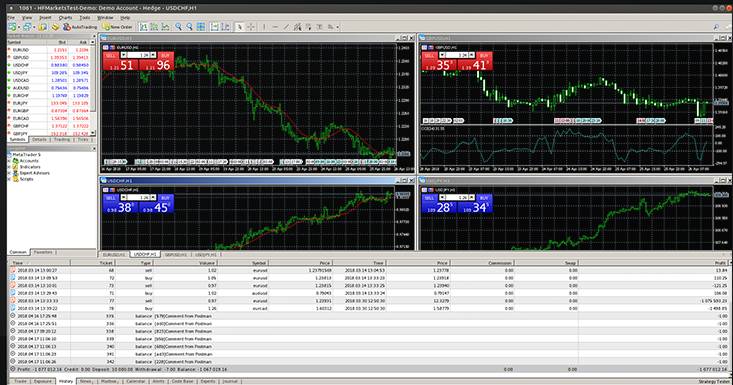

The company has opted to play it safe by offering the MetaTrader terminal as the default trading platform for its clients. We are quite content with the overall performance and flexibility of the platforms, especially since the broker offers a choice between MT4 and MT5 terminals. However, we cannot hide our slight disappointment at the lack of a proprietary HotForex app, which could have sweetened the deal. Nevertheless, let us analyze how the broker’s MetaTrader terminals perform under live trading conditions.

Both the MT4 and MT5 terminals are mutually exclusive, which means that you have to open a separate HotForex account for each platform if you wish to trade the markets using both interfaces. The company allows its clients to open and maintain multiple HotForex broker accounts, making it easy to switch between terminals according to your trading preferences. Naturally, the MT5 platform is largely superior to the MT4 terminal in performance and features. However, a few ardent fans of the MT4 terminal prefer the platform due to its customization options.

In outright trading terms, the performance of both terminals was in line with our benchmark results, and both platforms performed relatively well under all market conditions. Latency was quite low, and a connection to the trading servers was established within milliseconds. There were no visible delays in charting, and neither did we come across any instance of requotes or server disconnections in the middle of order execution. The broker’s server locations determine the HotForex trading hours, and they are mostly aligned with international markets’ regular opening and closing hours to ensure consistency.

Traders can tap into MetaTrader terminals’ full potential using the broker’s numerous ancillary services, such as free VPS, FIX/API, and other premium trading tools. Both versions of the MetaTrader terminals support custom indicators, EA trading, trading signals, copy trading, and even the MT4 MultiTerminal, which promises unhindered access to markets. Furthermore, the broker also provides several value-added tools, such as Autochartist, Correlation Matrix, Sentiment Trader, and other premier trader tools, which can assist traders in performing a comprehensive evaluation of the markets. As a result, it is easy to see why HotForex app choices are remarkable for desktop trading.

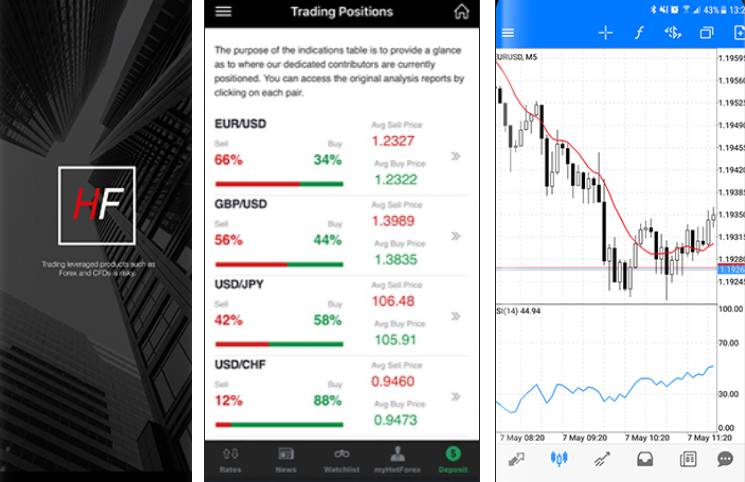

HotForex App Choices for Mobile Users

The company has developed a proprietary HotForex app, known as the HF Mobile Application, for mobile users. It is an account management interface where the company has incorporated several trading tools and charting options to help traders stay abreast of the market while on the move. Despite having several unique features, the HF Mobile Application does not possess full trading capabilities; for these, you should download the mobile versions of the MT4 and MT5 terminals on your Android or iOS device.

Nevertheless, the proprietary HotForex mobile app does provide several account management features, including depositing funds and initiating a HotForex withdrawal. Additionally, the app delivers live quotes, offers a detailed economic calendar, and even grants the option of managing a PAMM account while on the move.

The mobile versions of the MetaTrader terminals are a must-have for active traders since they provide a comprehensive trading platform with full trading capabilities. MT4 and MT5 mobile apps have the same performance attributes as their desktop equivalent and support all the different premium tools. These apps are also compatible with most modern smartphones and tablets running on the latest versions of Android and iOS. Therefore, we highly recommend using the MetaTrader mobile apps for trading and the proprietary mobile HotForex app for account management on the go.

Did We Uncover Any Offers in This HotForex Review?

We came across several exciting HotForex bonus offers and promotions, but these promotional campaigns are not offered to traders in the UK and the EU due to regulatory restrictions. Nevertheless, here are some of the current bonus programs we discovered during this HotForex review. The company offers a 50% deposit match bonus for first-time clients through the “Welcome Bonus” offer, which requires a HotForex minimum deposit of $50.

The bonus is offered for all eligible deposits made across multiple accounts by a single trader, but there is a maximum cumulative limit of a $1000 bonus per user. The deposit bonus cannot be withdrawn and can only be used as a margin for trading. If traders withdraw their funds either partially or in full, the corresponding bonus amount will also be removed from the trading account. Hence, the broker advises its traders to be mindful of margin requirements while placing a HotForex withdrawal, especially if they have the deposit bonus and open positions.

Another popular HotForex promotional offer is the “Supercharged Bonus,” which is nothing but a trading-based rebates program. Here, traders can earn up to $2 per lot as daily cash rebates, with a 100% maximum bonus qualifying for a maximum cumulative cash rebate of $8000 per user. The HotForex minimum deposit for this program is $250, and the company imposes a few restrictions on withdrawing these cash rebates. However, if you are not comfortable with the restrictions on your bonus, the broker also offers a loyalty program, where traders can earn points or rewards for their trading.

These reward points can be exchanged for cash, a credit bonus, or premium services. The cash prizes earned through the loyalty program can be withdrawn, but the credit bonus is not eligible for a withdrawal. There are four levels in the loyalty program: red, silver, gold, and platinum. Traders who trade consistently can climb up the reward levels faster to earn more trading points and larger rewards.

The broker also organizes routine trading contests that offer several prizes, including a cash prize, gadgets, merchandise, and access to global sporting events. The total value of prizes and cash rewards in these contests usually exceeds $1 million, which makes HotForex one of the largest brokers for FX trading in the world in terms of giveaways. Besides having one of the best promotional campaigns in the market, the broker provides its clients with an option of earning a nominal return on a free margin.

Essentially, this program allows traders to earn up to 3% on free margin, credited directly into the trader’s account. The return on free margin program adopts a tiered structure, where the actual rate of return can fluctuate between 2% and 3%, where the free margin is calculated by finding out the average lots traded over multiple days. Nevertheless, it is a great bonus for traders since small increments can add up to a significant sum of money at the end of a trading month.

Minimum Deposit Requirement, Withdrawal, and Funding Options

Traders can deposit funds through their myHF wallet on a desktop or through the HF HotForex app on a mobile. The company accepts all the conventional and modern payment options that we have come to expect from mainstream brokers. However, the minimum and maximum deposit limits may vary for each funding method. For instance, the minimum deposit amount is $100 for a bank wire transfer and Perfect Money payment, but the initial deposit amount is at a lower $5 for all other funding options. These include credit/debit card payments, FasaPay, Skrill, Neteller, WebMoney, and BitPay.

BitPay is a good option for those looking to deposit funds via their cryptocurrency wallet. The broker does not charge any deposit fees, and the broker’s “Free Account Funding” scheme reimburses any fees charged by intermediary payment systems. With an excellent bonus structure, low HotForex minimum deposit requirement, and free account funding, it is easy to understand why the company remains the most preferred FX and CFD brokerage firm for more than 2.5 million traders.

| HotForex Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: up to 10 minutes | Min. Deposit: $5 - $250 | Deposit Fee: No fees |

|

Payment Methods:

VISA

MASTERCARD

SKRILL

BANK-WIRE

|

||

We are even more impressed with the broker’s withdrawal policies since a HotForex withdrawal is processed instantly. All e-wallet payments, including Skrill and NETELLER, are processed instantly, but there may be minor delays for bank wire transfers and crypto payments. Nevertheless, the broker promises to process these withdrawal requests within 2 days, and the funds should arrive in the trader’s account within 10 days. These are conservative figures as the funds will be processed faster.

The company also refrains from charging any fees for withdrawals, but beware of inter-bank transfer charges if you initiate a HotForex withdrawal via a bank wire transfer. Regardless, always ensure that you abide by the broker’s bonus terms and conditions before initiating a withdrawal request. Get in touch with your account manager to know whether you are eligible to withdraw the free money that the broker has given you.

| HotForex Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 2-10 business days | Min. Withdrawal: $5 - $100 | Withdrawal Fee: Depending on choosen method |

|

Payment Methods:

VISA

MASTERCARD

SKRILL

BANK-WIRE

|

||

HotForex Leverage, Real-time Spreads, and Trading Conditions

Small, high-frequency, low-volume traders are in for a treat as they can enjoy a maximum HotForex leverage of 1:1000. However, the maximum leverage is only available for the broker’s global clientele-those from the EU and UK will have to demonstrate proof of their expertise in the financial market and waive their protection under EU guidelines to be eligible for the maximum leverage. Under normal circumstances, the broker restricts the maximum leverage to 1:30 for retail traders in the UK and the EU. Nevertheless, we still recommend our readers exercise extreme caution while trading with high leverage and only use the maximum margin if they are familiar with the risks of the market.

As far as dealing desk policies are concerned, the broker adopts a hybrid of market-maker and ECN protocols. Moreover, all orders are accumulated through an automated dealing desk using a “no-look” policy. Essentially, the broker only acts as an intermediary to a transaction and does not trade against its clients. The automated dealing desk policy accumulates orders at the broker level and matches them internally. However, in case of absence of liquidity, the broker passes its clients’ orders to an interbank liquidity pool, thereby reducing conflict of interest.

The ZERO Spread HotForex account adopts the ECN direct market access protocol, where all quotes are derived from an interbank liquidity pool and orders are placed at market conditions. Therefore, the HotForex fees for these accounts remain low as some major currencies quote an extremely competitive spread ranging from 0 to 0.4 pips. The commission for ECN trading is also moderately competitive but beware of high commissions in the CopyTrade accounts, where the higher commission can lead to higher HotForex fees.

Our detailed HotForex review of the costs and speed of order execution under a real-time environment showed that the broker’s trading conditions are among some of the best in the market-especially the lower HotForex fees for the ZERO Spread accounts. The fees were also competitive for regular premium and micro-accounts, where the spreads fluctuated between 1.2 and 2.5 pips for major currency pairs. The company’s order execution policies ensure that orders are filled at minimum slippage and minimum requotes. The latency of trading was also quite low, and with the availability of free VPS, traders using bots are sure to appreciate the broker’s excellent automated trading platforms.

HotForex trading hours reflect the actual market time of the market, which is no surprise. Aside from Forex instruments, the broker supports all other asset classes, including commodities, energies, metals, indices, stocks, and ETFs. However, we found that the company does not support cryptocurrency trading, which is a huge drawback in our opinion. Nevertheless, the broker’s execution policies, competitive spreads, and automated trading support are outstanding, contributing to an overall excellent trading environment.

How Regulation Plays a Key Role in HotForex’s Secure Brokerage Operations

It is refreshing to see that HotForex is always at the cutting edge of developments by bringing secure financial products to the retail trading market at a staggering pace. Clearly, the company is also quick to realize that its customers expect the very best in terms of security and financial transparency.

Therefore, along with a great Forex trading platform, the company has given importance to ensuring that it adheres to the strict regulatory guidelines imposed by leading regulators in the financial market. To that end, the company has obtained regulatory clearance from the FCA of the UK (Ref. 801701), the DFSA of Dubai, the FSCA of South Africa, CySEC of Cyprus, and the FSA of Seychelles to offer its financial products to traders across the EU, Africa, the Middle East, and Asia.

The broker’s strict regulatory compliance ensures that traders get the best treatment, devoid of financial malpractices or broker abuse. The company is routinely audited by independent organizations. It is required to hold a minimum operating capital as per the strict regulatory guidelines of the regulators of the UK and the EU. It is also illegal for the company to take an opposite position to its clients’ orders, and the broker must segregate its clients’ funds from its operating capital.

Although the broker is legally bound to enroll its clients in the UK and EU under several insurance programs to protect them against broker insolvency, the company has gone a step further and insured clients of its own accord with up to €5,000,000 in total insurance to its traders. Therefore, there are no questions regarding the safety of clients’ money and the security of their personal or financial information.

Is HotForex True to Its Promise of Delivering the Best in Customer Service?

For this HotForex review, we used the company’s numerous customer access points to evaluate their effectiveness, and we are pleased to report that we could not find any major concerns. Of course, the customer service department is only open during regular HotForex trading hours, which means that you will not be able to contact the broker during weekends.

Apart from this minor inconvenience, all customer service representatives were courteous and knowledgeable, ensuring that our queries were resolved at the earliest. For detailed assistance or help during weekends, traders can always send an email or fill in the web contact form. You can also browse the FAQs to get answers to the most common questions, and, more often than not, the FAQ section will have an answer to your query.

With multi-lingual support for 27 languages and a wide range of options to contact the broker, including live chats and phone calls, we are indeed satisfied with the company’s overall approach to customer service.