Interactive Brokers Review – A Preferred Choice for Professional Forex Trading

Interactive Brokers serves as the preferred trading platform for advanced traders. Its intent is clear: it wants to be the final authority in online FX trading by providing the most comprehensive gateway into the global financial markets. IBKR is renowned for its extensive portfolio of financial instruments. We were awestruck by the sheer levels of protection offered to traders as a part of the company’s regulatory compliance.

Interactive Brokers is a U.S. financial brokerage with branches in several leading global financial capitals. As a result, our Interactive Brokers review is one of the very few broker reviews relevant for traders from the United States. In this Interactive Brokers review, we discover the inherent traits of IBKR that sets it apart from the rest of the market.

- Lowest costs in the industry

- Crypto trading

- Real-time trade confirmations

- Free trading tools

Does an Interactive Brokers Forex Account Make Sense?

Traders have access to countless choices of FX brokers in the market, where only a select few brokerages offer users a dependable and regulated platform. In that sense, an Interactive Brokers forex account is one of the most reliable and regulated options available for traders in the market. However, is the company’s products and services suited to all categories of traders? In this Interactive Brokers review, we dive deep into the broker’s operating protocols, trading options, and other aspects that affect the overall trading experience. However, here are a few pros and cons of the company to help you determine whether an Interactive Brokers forex account suits your specific trading preferences.

- A regulated broker with licenses issued by top-tier regulators.

- Top choice for professional trading conditions.

- Simplified choice of Interactive Brokers forex accounts.

- No Interactive Brokers minimum deposit requirements.

- Excellent proprietary Interactive Brokers apps for comprehensive market access.

- Signing up for an account is lengthy and complicated.

- No third-party app options such as MT4 or MT5 terminals.

Our detailed Interactive Brokers review found several unique characteristics that set it apart from the rest. One of the key differences between IBKR and other brokers is that they consider their brokerage account part of an investor’s overall trading strategy. Therefore, they have developed their brokerage around an investor-centric model.

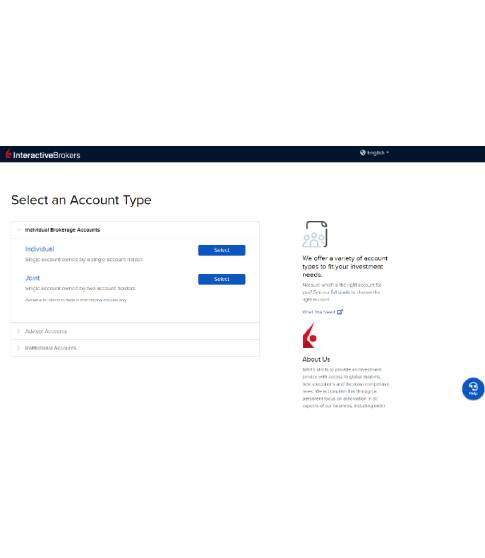

Choices of Interactive Brokers Forex Accounts

In terms of account choices, there are several options, such as an Individual/Joint account, Family account, Family Office account, Small Business account, Advisor account, Money Manager account, Broker and FCM account, Proprietary Trading Group account, Hedge and Mutual Fund account, Compliance account, and Administrator account. As far as trading features are concerned, there are only two choices of trading plans. The IBKR Pro plan is the default choice of trading account offered to professional traders, while the IBKR Lite plan is designed for smaller traders.

The IBKR Pro plan is a full-fledged trading account that offers fixed or tiered pricing for stocks, ETFs, options, futures, forex, bonds, and mutual funds. It grants access to the entire suite of products and trading functionalities, making it the perfect choice for professional and advanced traders. The Interactive Brokers margin rates are some of the lowest in the market since regulation does prevent the broker from offering massive leverages on its instruments. Nevertheless, the company has quoted minimum Interactive Brokers margin requirements of up to 0.75% for USD pairs, but they depend on market and regulatory implications. Traders from the United States can only use a margin of 2% for maximum leverage of 1:50, while new regulations in the EU have limited the maximum leverage to 1:30.

Interactive Brokers margin requirements are accompanied by interests charged on these margin loans. The margin rates for the IBKR Pro plan begin at a premium of 1.5% over the benchmark rates, while higher loan values are offered lower rates at the broker’s discretion. However, the broker also pays interest on idle cash balances, which pays up to 0.5% lower than the existing benchmark rates for IBKR Pro accounts. The IBKR Pro account also comes with many other advantages, such as low-cost data bundles, a la carte subscriptions, API support, algo trading, and more. This plan’s trading conditions are top-notch, making it the perfect choice for trading the entire global financial market.

The IBKR Lite plan, aimed at smaller traders, has all the same terms and conditions as the Pro plan. There are a few subtle differences, though; for instance, the Interactive Brokers margin rates are slightly higher for the Lite plan. The interest rates on margin loans are charged at a premium of 2.5% over the benchmark rates, while the interest paid on idle cash balance is 1.5% lower than the benchmark rates. Furthermore, the IBKR Lite plan is developed for individual users only, and access to market data is slightly restricted. Another significant drawback with the Lite plan is that the Interactive Brokers webtrader is only offered to Pro plan users. Lite traders will have to download the Trader Workstation, which is a huge pain. Nowadays, most brokers are moving to a complete web-based webtrader interface. We don’t see why IBKR would fail to understand the significance of offering its webtrader access to Lite users.

Despite these minor drawbacks, the Lite plan is an excellent choice for retail traders, especially when we consider the broker’s excellent regulatory protection and outstanding trading conditions. However, if you need unhindered market access, the Pro plan can also work wonders for your trading career. Being a full-fledged financial broker regulated by top regulators in the market, we feared that the broker might stipulate a high minimum investment requirement. However, we discovered that the Interactive Brokers minimum deposit is zero for all account options. It was indeed a pleasant surprise since brokers that fall in the same category as IBKR often stipulate very high minimum investment barriers, where the initial deposit requirement can be as high as $10,000.

Signing Up for an Interactive Brokers Forex Account

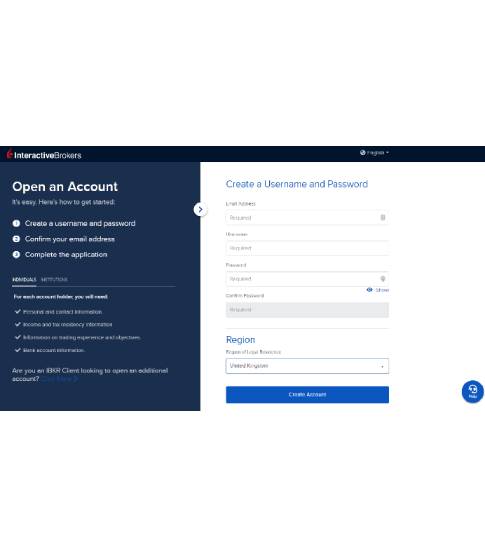

Traders can open an Interactive Brokers forex account through the company’s mobile app or their website. Since our Interactive Brokers review is designed to analyze all the different aspects of trading, we opened a real trading account with both the IBKR Pro and the IBKR Lite plans. The account opening process is a bit complex owing to the severity of the regulatory compliance measures adopted by the company. Nevertheless, traders can initiate an application request by clicking the Open Account link, which takes them directly to the registration page. The broker provides detailed instructions on all the information sought during the process, which helps us keep all our information at hand to submit them during the account application process.

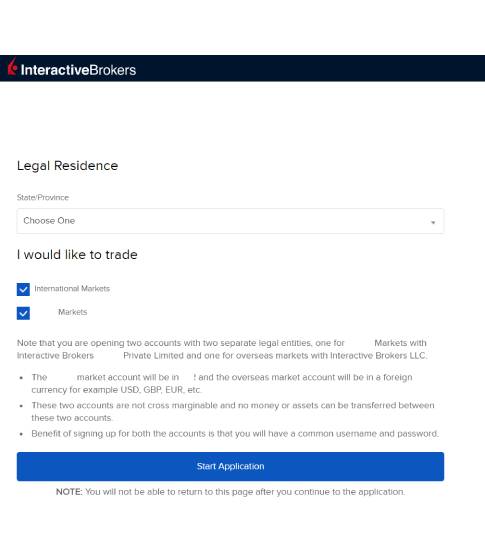

You must first create a username and password to sign up for an account, and you will also be required to verify your e-mail address and choose your region of legal residence. A verification e-mail will be sent to your preferred e-mail address, but if you wish to change your e-mail address or resend the verification e-mail, the broker allows you to do so. After e-mail verification, you have to continue your application by logging in with your username and password, where you will be asked to choose your preferred type of trading account. You will also be asked to select your location and your preferred financial market where you would like to trade. Here, you have the option of choosing the international market, your local market, or both.

Choosing the international market will give you access to a trading account at Interactive Brokers LLC, while the local trading option will provide access to the company’s local brokerage. Both can only be operated as independent accounts, and the Interactive Brokers margin requirements will be different for each of them. You will only be allowed to choose this option once, and you can’t transfer money between the two accounts, so make your choice carefully. Nevertheless, once you select your primary account and trading preferences, you will be asked to complete the remainder of the application form.

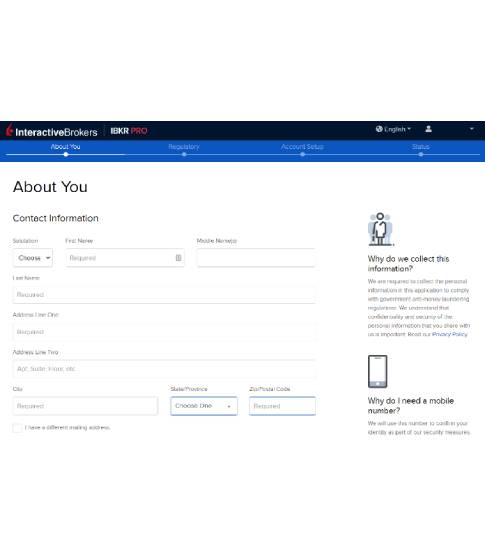

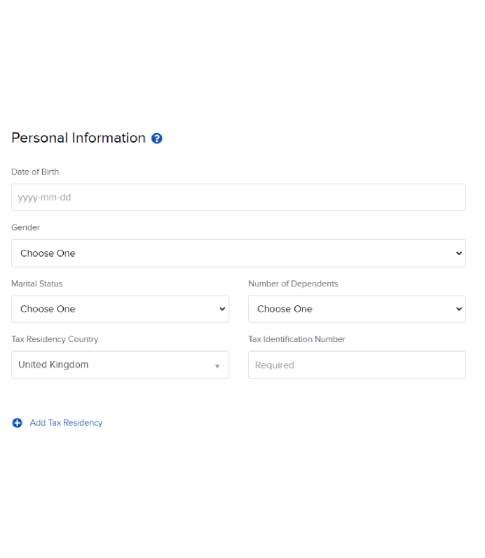

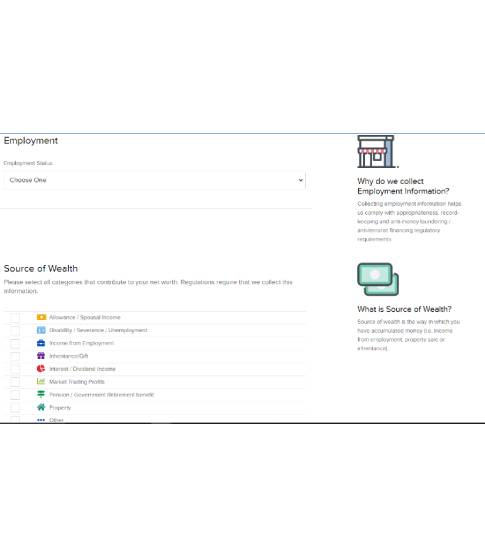

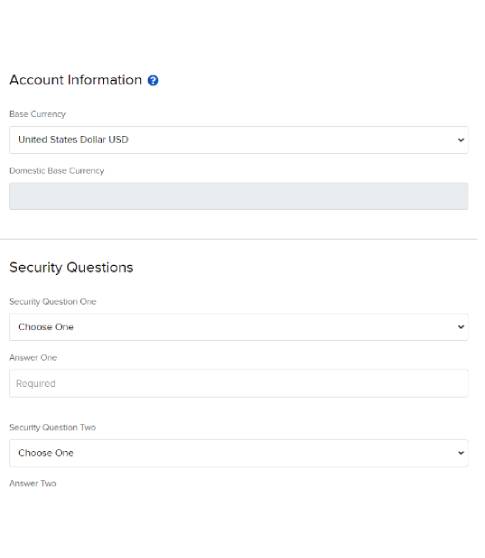

The first step of the detailed application form asks you to submit your personal information, contact details, employment status, and the source of your wealth. You are also required to select your preferred account currency for your international trading account and choose a few security questions with its answers to retrieve your account in case you lose access to your IBKR account. The entire process can take some time, but you should be careful about entering the correct information, as you may not be able to change the details later. Furthermore, the information that you provided at this step of the application will be verified when the broker asks you to upload your identifying documents to verify your identity.

The next stage concerns the regulatory implications of the information that you provided in the previous step. It addresses any anomalies that the broker might find in the details that were provided and seeks an explanation from the trader through a detailed questionnaire. The broker is committed to ensuring that it follows all legal guidelines and regulatory protocols while offering its services. Clients are expected to be honest and truthful in their answers. If the information is verifiable, you will be taken to the third stage of the IBKR, where you can configure your trading account.

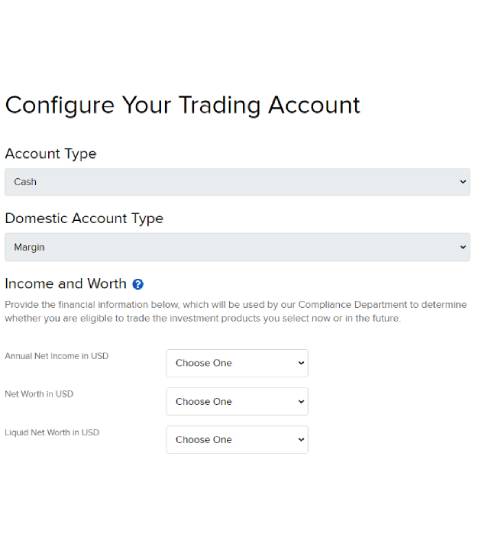

Configuring your trading account is just an extension of the previous steps, where you will be asked to declare your net worth, annual income, investment objectives, and purpose of trading. You also have to apply for permission to access certain markets, which the broker grants on a case-by-case basis. You should also ensure that trading the financial markets with IBKR does not involve any conflict of interest or regulatory hurdles by way of your relationship with the financial community, financial entities, regulators, or any other persons who might be politically exposed. Additionally, you can also participate in the IBKR Stock Yield Enhancement Program, an additional income stream generated by lending your owned securities to other traders for a 50% share in the interests earned. This program is optional, and you can enroll or exit anytime.

The penultimate step of the application deals with the terms and conditions of trading, along with disclosure and policy agreements. Traders are expected to read, review, and sign all the documents, after which the application process will be forwarded to the broker’s accounts department for review. However, traders will be offered one last chance to modify any information in this step if they find any errors or mistakes in their entered details. By submitting all the documents and digitally signing the application form, traders consent to the broker’s extensive T&C and are liable for the information they provided. Finally, the broker asks you to submit a host of different documents to verify the accuracy of the information that you provided. You will have to confirm your mobile number and upload a variety of documents, including your photo ID document, proof of residential address, signature image file, proof of financials, proof of bank account, photograph, and the IBKR application document that must be printed out, physically signed, scanned, and uploaded. Your application will only be processed after uploading these documents, and once all information is verified, the broker opens a trading account in your name. However, you should wait up to 48 hours for the broker to process your application, but it can take longer in some instances.

Interactive Brokers Webtrader and Trader Workstation Platform Evaluation

The Interactive Brokers app options are restricted to a couple of proprietary interfaces, as the company does not offer third-party platforms such as the MetaTrader or the cTrader. There are two trading platforms, the Interactive Brokers webtrader and the installable Trader Workstation platforms, both of which were developed in-house. With the market access and trading features on offer, we were not surprised to see the company develop its proprietary trading platform. It offers greater flexibility in incorporating new features and functionalities without depending on external third-party sources. However, we are indeed disappointed that the Interactive Brokers webtrader is not available for Lite plan users, who have to download the Trader Workstation for their trading needs.

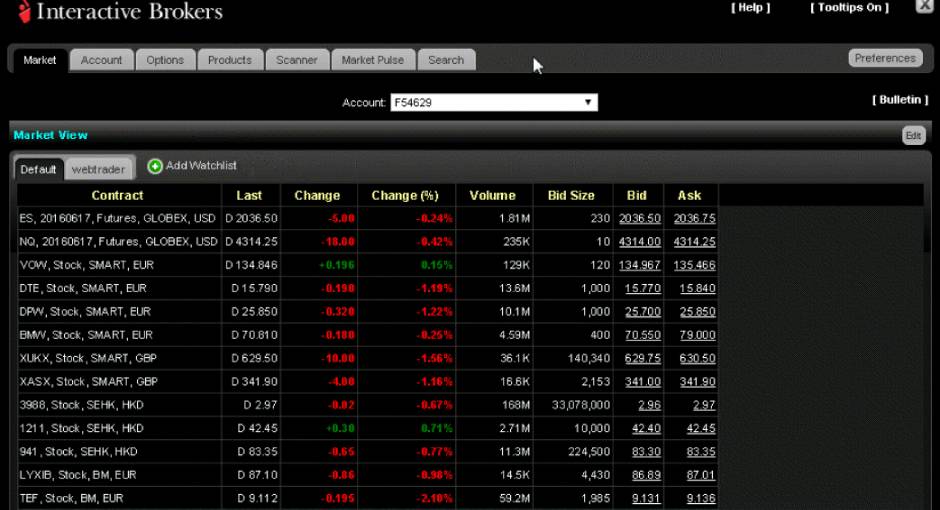

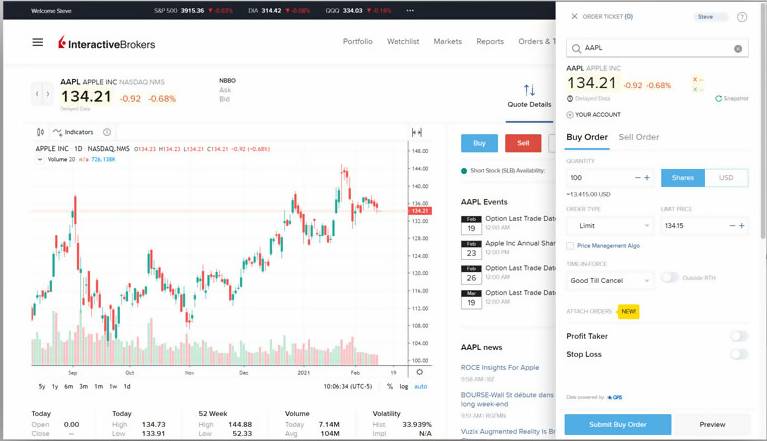

The Interactive Brokers webtrader is not as graphically advanced as most browser-based platforms in the market, but it offers some of the most advanced trading tools that a trader would ever need. If you have been trading with webtraders from other Forex brokers, it might take some time to get used to the IBKR webtrader, but you will soon get the hang of it. However, if you want a bit more flexibility, you can always check quotes, open charts, and place trades via the Client Portal, which has a much smoother and visually pleasing trading interface. The Client Portal may not offer most of the advanced trading tools and features offered by the webtrader, but you can still manage your account through the portal. It allows you to make an Interactive Brokers deposit, change your account settings, open additional trading accounts, and even initiate an Interactive Brokers withdrawal.

For the best trading conditions, advanced charting options, and full access to the broker’s trading tools, traders can opt for the IB Trader Workstation (TWS) platform. It is an installable app available only for Windows 64 bit users, which is a severe inconvenience for 32 bit Windows and MacOS users. Therefore, together with the nonavailability of the webtrader for Lite plan users, we feel that a large chunk of Windows Home and MacOS users will not be able to trade the markets with an Interactive Brokers forex account unless they opt for the Pro plan. It does appear that the broker expects its traders to have an advanced Windows trading system capable of running its TWS platform.

Although the TWS interface feels slightly more premium than the web-based Interactive Brokers app, it does not look as rounded as a MetaTrader or cTrader terminal. Nevertheless, the TWS interface is highly customizable, with traders able to open multiple charts, windows, snippets, and trading terminals through the interface. The platform also provides several innovative technical and fundamental analysis tools to ensure that traders perform a comprehensive analysis of the markets. Additionally, the TWS platform offers in-depth research, news, and market data alongside several risk management tools such as the IB Risk Navigator, Model Navigator, and Option Analytics. Traders are even offered the API option for building custom trading applications and integrating trading into existing applications, which provides excellent flexibility for advanced traders.

You do not have to make an Interactive Brokers deposit to test the platforms, as the broker offers paper trading access to all verified users through its demo account option. The demo platform provides the same trading environment and functionalities as the real account. Still, the paper-trading option ensures that you do not incur any losses owing to your inexperience with the Interactive Brokers app. Overall, we are extremely satisfied with the platform options, efficiency, market access, trading tools, and the general trading environment.

Evaluating the Performance of the Interactive Brokers App for Mobile Trading

The broker offers a mobile Interactive Brokers app for both iOS and Android users. It works brilliantly on all types of smartphones and tablets, which makes it a must-have platform for traders on the move. The IBKR mobile app is available for download from the Google Play and Apple App Store, and our first impressions were incredibly positive. Unlike the desktop interface, the mobile Interactive Brokers app felt modern and usable, adding to the appeal.

The IBKR mobile app offers access to over 135 markets with almost all advanced order types and trading tools available with the TWS desktop interface. It even provides an immersive charting option, along with access to an automated artificially intelligent trading system known as the IBot. Moreover, mobile apps employ several state-of-the-art security measures, including preauthorization and two-step authentication, making them one of the most secure mobile trading platforms in the market.

Interactive Brokers Forex Promotions and Offers

As soon as we started working on this Interactive Brokers review, we realized that IBKR would not be our first choice if bonuses were our priority. The sheer amount of regulation prevents the broker from indulging in any bonus programs. It need not be a cause of concern for traders since most bonuses have strict trading conditions that may be impossible to satisfy within the given duration. However, the broker is not devoid of all free money promotions, as traders do get an option to earn a $200 referral bonus for every referred trading account that maintains a minimum Interactive Brokers margin of $10,000. The referred traders also have a chance to receive up to $1,000 worth of IBKR shares, where every $100 of cash or asset added to the account results in a compensation of $1 in IBKR share.

There are several restrictions to the refer-a-friend program, including a maximum number of 30 referrals, a prerequisite to have placed at least one order through the platform, and several guidelines on marketing and advertising of IBKR services. Therefore, traders must fully understand the company’s referral terms before referring clients and earning payouts.

Evaluating the Deposit Options and the Interactive Brokers Withdrawal Policies

The broker does not specify any minimum Interactive Brokers deposit, which may appear to be great news for smaller traders. However, some other pressing concerns prevent traders from making a smaller deposit. For instance, the broker does not support e-wallets, card payments, or cryptocurrency transfers, which essentially alienates a significant portion of the retail trading community. The supported Interactive Brokers deposit methods only include ACH, bill payment, bank wire, and check. These are the conventional payment methods typically used for high-value transactions. Therefore, the company has indirectly hinted that it only supports high-value traders who can transfer funds through conventional means.

| Interactive Brokers Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: 2 hours | Min. Deposit: $100 | Deposit Fee: $1 - $10 |

|

Payment Methods:

BANK-WIRE

|

||

Depositing funds will take time, owing to the delays involved in a bank wire or check clearance. These payments also incur a transaction fee, but it does ensure comprehensive security against modern-day threats. As for the Interactive Brokers withdrawal, the company allows its users to initiate any number of withdrawals as they want, but only the first withdrawal of the month is free. All subsequent withdrawals may be charged an Interactive Brokers withdrawal fee, the details of which are provided on their website. Regardless, the transfers with IBKR are not as expensive as one would assume, but the only drawback is that traders will face delays for both deposits and withdrawals.

| Interactive Brokers Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: Same business day | Min. Withdrawal: - | Withdrawal Fee: $1 - $10 |

|

Payment Methods:

BANK-WIRE

|

||

An Analysis of Interactive Brokers Commissions, Fees, and Other Trading Conditions

IBKR has a transparent cost structure that incorporates the best trading conditions for all traders. The Interactive Brokers fees are quite competitive primarily because of the broker’s access to a deep interbank liquidity pool with level II pricing from over 17 different dealers. Of course, we expected the company to offer the most competitive Interactive Brokers fees in the entire market, with the spreads on currency pairs quoted as low as 0.1 pip. However, you need to pay Interactive Brokers commissions for forex trading, which costs around 0.08 to 0.20 bps times the trade volume. In sheer percentage terms, the Interactive Brokers commissions range from 0.0008% to 0.002% of the trade size, which is highly competitive in the FX industry. There are no additional markups or hidden spreads for any instruments the company offers, thereby ensuring traders can enjoy some of the lowest-cost trading conditions in the entire market.

Other Interactive Brokers fees include costs for deposits and withdrawals. The deposit and Interactive Brokers withdrawal fees vary from $1 to $10 for different withdrawal methods. Still, the best part is that the company allows its traders to maintain a trading account in 22 different currencies. Accordingly, the company has outlined the fees charged for its different funding methods on its website, ensuring a fair and transparent pricing structure.

Although the broker allows its traders to trade on margin through minimum Interactive Brokers margin requirements, you must pay a SWAP fee in the form of interest on margin. The interest charged differs between the Pro and the Lite plans, where it follows a tiered structure according to the account equity. The Interactive Brokers margin rates can be from 1.5% to 2.5% above the benchmark rates for USD-denominated accounts, while accounts held in other currencies have different margin rates. Once again, the broker offers in-depth details of the Interactive Brokers margin rates on its website for reference.

Since IBKR acts as a direct market access broker, securities and other derivatives are purchased from the market at interbank rates. Therefore, these instruments may incur additional Interactive Brokers fees such as holding costs, handling charges, commissions, processing costs, and delivery fees. Traders are expected to do their homework before trading with an IBKR account and be aware of all the associated trading costs. Nevertheless, in terms of trading terms, all orders are free from any conflict of interest with the broker, with each order passed on to the global liquidity pool. Partial order fills, slippages, and order cancellations can occur, so it is paramount for traders to be well aware of the potential pitfalls of DMA trading. The broker limits the maximum leverage by stipulating the Interactive Brokers margin requirements according to the levels enforced by the regulator, which helps traders minimize their risk exposure. Nevertheless, you can expect an excellent trading environment at IBKR.

A Few Key Notes on the Interactive Brokers Regulation and Licensing Aspects

Our detailed interaction with the broker for this Interactive Brokers review gave us a sneak peek into how strongly regulated brokers operate in the market. IBKR operates in 11 different jurisdictions, with each region renowned for its significance in the global financial market. Interactive Brokers forex brokerage and its allied financial entities are regulated by several top regulators, which include the following:

- United States – FINRA, SIPC, SEC, CFTC

- Canada – IIROC

- The UK – FCA

- Luxembourg – SIIL and CSSF

- Ireland – Central Bank of Ireland

- Europe – Central Bank of Hungary, under the EU MiFID and ESMA

- Australia – ASIC

- Hong Kong – SFC

- India – SEBI

- Japan – KLFB

- Singapore – MAS

With such strong regulatory protection, traders will feel at ease while trading the markets with IBKR. The broker guarantees the complete safety of funds and even offers investor protection per the laws and regulations imposed by region-specific regulators. The company adopts all the usual security protocols such as segregating clients’ funds, enrolling traders in investor compensation programs, and conducting routine third-party audits. Overall, IBKR is one of the safest brokers in the market for FX trading.

Customer Service Aspect of IBKR

Contacting customer support at Interactive Brokers is not as straightforward as some of the other leading brokers, but new customers will soon get the hang of it. For starters, the broker provides a round-the-clock status update of its system status so that traders will be well-informed of any bugs or other platform issues. Further, the broker offers an elaborate information page where traders can browse through commonly asked questions, watch video tutorials, and obtain more information about the broker.

However, if your question is still unanswered, or you want to contact the broker for detailed assistance, you can do so by sending an e-mail, calling them through their phone support, or chatting with a company representative via the live chatroom. The company also provides a community forum to help IBKR users meet up for collaboration, while traders even have the option to report bugs, request/vote for new features, and search for contracts. Immaterial of the communication medium, clients can address their concerns through IBKR’s excellent customer support system.