Forex.com broker is a renowned broker in the United States, which caters to the U.S. market and retail traders from all over the world. The broker’s parent company, StoneX, is a leading institutional-grade financial services network provider that connects different market participants to create one of the largest liquidity pools in the world. Unlike most institutional FX trading companies, Forex.com has a highly regulated trading environment that is custom-tailored for both beginner and advanced traders. In this Forex com review, we provide deeper insights into why Forex.com is one of the most recommended brokers for FX and CFD trading and whether you should open an account and trade FX and CFDs at the Forex com broker.

Although the broker accepts traders from the United States, some CFD products may not be available in the country owing to strict regulatory restrictions imposed by the CFTC and NFA. The Forex com leverage and other trading conditions may also differ for clients from the United States. Nevertheless, we have provided a detailed overview of the different products, services, and trading conditions in this detailed Forex com broker review by inspecting every individual broker attribute in minute detail.

Features

- Custom watchlists

- Integrated Reuters news

- Tight spreads

- Wide range of commodities

Special Offer

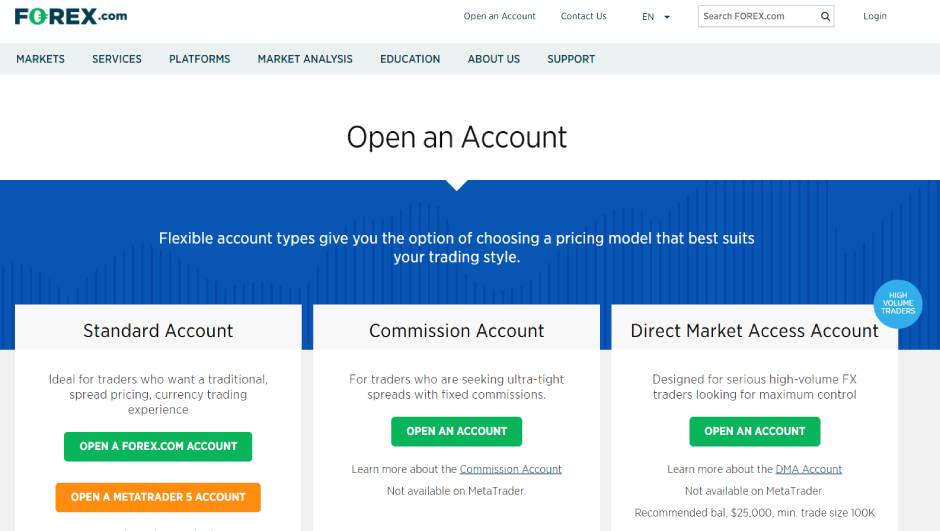

A Forex.com Review of Account Choices and Signup Options

Is Forex com legit, and do they possess trading accounts that are suitable for smaller traders? To answer this question, we must first address that Forex.com is a top choice for active traders, especially with its detailed market analysis, comprehensive trader education, and top-notch analytical tools. A Forex.com broker account offers access to over 4,500 products from a multitude of markets. The company also supports a wide range of platforms and charges competitive spreads for its forex and CFD products. Therefore, the company primarily targets high-volume traders, whether they be beginners or advanced traders. Therefore, to answer the question “Is Forex.com legit?” we would say absolutely yes; however, they might not be well-suited for small-volume retail traders looking for micro lot trading, as explained in subsequent sections of this Forex com review.

In the meanwhile, here is a quick peek at the different pros and cons of a Forex com trading account before moving on to the review of the accounts and the trader registration process.

- U.S.-based financial broker with hefty regulatory protection, backed by incredible liquidity.

- Offers multiple asset classes with access to more than 4,500 instruments.

- Supports both MT4 and MT5 terminals, along with a proprietary trading platform for desktop and mobile.

- Outstanding access to market analytics and research tools.

- Direct market access (DMA) trading through STP protocol.

- Competitive pricing with extremely tight Forex com spreads and commissions.

- Quick Forex com withdrawal times.

- Choice of instruments for DMA accounts is limited.

- Higher Forex com minimum deposit required than market standards.

As you can see, our detailed Forex.com review has discovered a small number of drawbacks of the company, which are far insignificant when compared to its distinct advantages. Not many brokers successfully deliver or maintain the top levels of quality offered by Forex.com, especially for active traders. Of course, there are some issues for smaller traders while owning a Forex.com trading account, such as the slightly larger minimum deposit requirement. Still, for professional high-volume traders, Forex.com is undoubtedly one of the best choices in the entire market.

Choosing the Correct Forex.com Trading Account

There are three choices of Forex com trading accounts. The first option is the Standard account, which is perfect for moderate-volume retail traders looking for conventional trading conditions such as fixed spreads and no commissions. The Standard account provides access to all assets on offer, including cryptocurrencies, shares, commodities, and indices. If you want tighter Forex.com spreads, there is a Commission account option where traders will have to pay a commission for every standard lot traded. It is estimated that traders can save up to 15% in trading costs by signing up for the Commission account, leading to significant savings. Otherwise, Commission account holders are offered the same trading conditions, products, and services as the Standard account.

However, there is a small caveat; the Forex.com minimum deposit for both the Standard and Commission accounts is $1,000. It is considerably higher than other Forex brokers that offer similar services. Another issue is that the company specifies that these accounts adopt a market maker protocol, where orders are matched and executed internally. Although we are not worried about any instance where Forex.com will trade against its clients, we are not entirely confident in a market maker protocol primarily because of the conflict of interest between the broker and the trader. Regardless, our trust in Forex.com virtually guarantees that the company will act only in the best interest of its clients.

If you want no interference from the company and wish to trade with interbank liquidity conditions, then you should go for the third option, the DMA account. DMA accounts adopt a pure STP protocol for direct market access trading, accompanied by intermarket spreads and a commission charged by the broker. However, DMA account holders are only offered access to 60 markets, including popular FX pairs and gold and silver assets. There is no option to trade cryptocurrencies, shares, indices, or commodities, which is a drawback. Nevertheless, DMA traders are treated to a whole array of premium services, such as access to a dedicated market strategist, interest on cash balance, and waiver of transaction fees for wire transfers.

Regardless, the most persistent problem here is that the minimum Forex com account deposit for DMA trading is $25,000, which is quite steep. The high investment barrier can put off smaller traders, but as we initially mentioned, the broker has developed its services to target active traders, which is evident from the high investment barrier. Another issue that we found was that the company only offers access to the MetaTrader terminals for its Standard account holders. In contrast, commission-based trading is offered only via the company’s proprietary platform, including DMA accounts. This policy may put certain traders at a disadvantage, especially those who prefer trading with the MetaTrader terminals.

Overall, we believe that the company could have done better with the pricing of its low-tier accounts and offered MetaTrader access to all users. Aside from these minor inconveniences, all three choices of trading accounts offer something unique to the trader. However, as a trader, it is up to you to determine which one is best suited to your trading style and preferences.

Is the Trader Registration Process Quick, Easy, and Seamless?

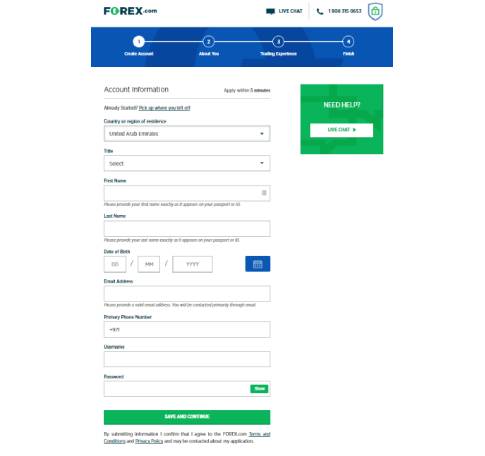

Trader registration can be done through their website, or users can sign up through the proprietary Forex com app itself. However, you must first choose the type of trading account that meets your trading specifications. Once you choose and click on the “Open an Account” link, you will be taken to a four-step registration process, which will take at most five minutes to complete.

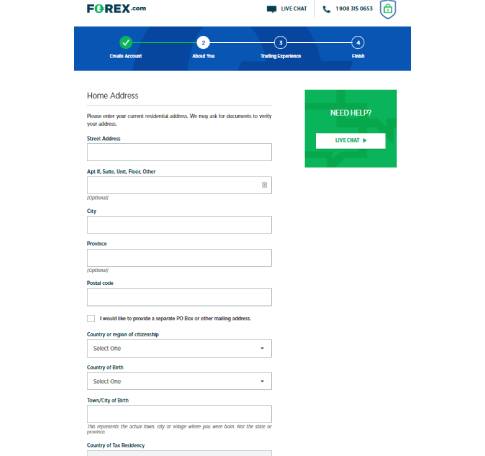

The first step in creating an account involves submitting your personal information: country of residence, name, date of birth, e-mail address, and phone number. You will also be asked to choose a username and password for your account during the first stage, after which you are taken to the second stage, where you have to enter your home address, submit your tax information, and choose proof of identity. Proof of identity can be any of your national documents, such as driver’s license, passport, or other valid documents issued by your country of origin or country of residence. Make sure you submit correct information at all stages of the registration process, as all information will be verified with original documents. Any discrepancies during verification will require you to submit additional proofs of identity, or your account may be blocked.

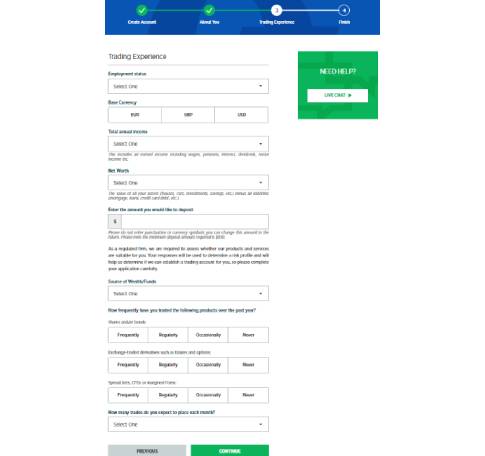

In the third stage of the registration process, the company asks you about your trading experience, employment status, net worth, annual income, and the source of your fund. At this stage, you will also be required to choose your preferred account base currency and specify the amount that you plan on depositing at Forex.com. During the final registration stage, you will be asked to verify the information you have provided to check for errors and correct them.

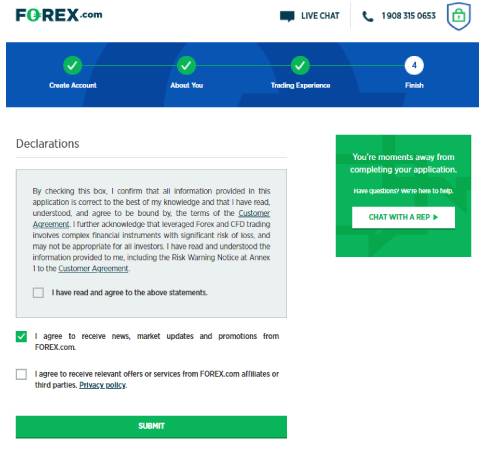

Once you click “Confirm,” you will be asked to read and accept the customer agreement, and upon acceptance, you will be taken to your account dashboard. Here, you are requested to submit your proof of identity and address since the broker performs a full account verification before you are granted access to the trading terminal. Of course, this is a highly beneficial step from a trader’s perspective, as account verification early on will ensure that all deposits and any future Forex.com withdrawal will be processed without any issues. If you run into any issues during the registration process, you can always initiate a chat with the company’s support team, and they will assist you with your concerns.

Full account verification can take anywhere from 24 hours to 4 working days, but in some cases, accounts may be verified within a few minutes of uploading the documents. If your account is still not verified after a week, you should contact the customer support team to raise an issue and inquire about the status. You can make your first Forex com deposit and trade only after verifying your account.

A Comprehensive Forex.com App Review of the Desktop Platforms

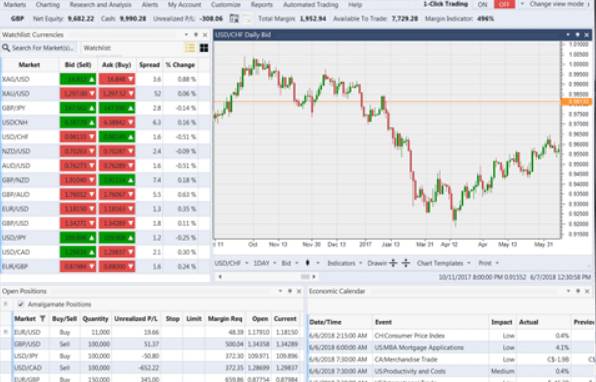

As we outlined in the above sections of this Forex com review, the company offers an excellent set of trading apps for FX and CFD instruments. These include the MT4 and MT5 terminals alongside a proprietary trading platform available as an installable app and a webtrader. However, we are not entirely satisfied with the company’s selective policies concerning access to these trading platforms. For instance, Standard account users are only offered access to the MT4 and MT5 platforms. In contrast, Commission and DMA account holders are only offered the option to trade with the company’s proprietary desktop app. We were even more surprised that the company’s DMA protocol is not offered on the MT4 or MT5 terminals, especially since it only supports 58 FX currency pairs and gold and silver instruments. Other leading ECN and STP brokers offer unhindered market access via the MetaTrader terminals, putting Forex.com at a severe disadvantage.

Nevertheless, as far as real-world trading performance is concerned, the MT4 and MT5 terminals are used to match orders internally through the market maker protocol. Therefore, the speed of order execution is commendable, while the latency remains low. Since the broker adopts a hybrid model to minimize conflict of interest, liquidity is never an issue for most traders, especially with the company’s extensive network of liquidity providers that comprise leading institutional market participants. Furthermore, traders are free to use the entire suite of trading tools offered by the MetaTrader terminals, including EAs, custom indicators, trading signals, VPS, and a host of other third-party tools available through the MQL forum. Both the MT4 and MT5 terminals are available as a desktop app, as well as a webtrader, so you can access the markets while on the move. Overall, the MetaTrader platforms did perform remarkably well in our trading performance tests, aside from the inconvenience of not tapping into the excellent interbank liquidity provided by Forex.com.

For a reduced conflict of interest and better pricing of instruments, the proprietary Forex com app is an excellent choice for active traders. The advanced trading platform is a powerful platform with sophisticated tools designed for serious traders. The advanced trading platform resembles a conventional trading app and has many features and layouts similar to the MetaTrader terminal. The dashboard can be customized infinitely to create a workspace that is highly suited to a trader’s preferences, while charting tools offer more than 80 technical indicators and drawing tools. These are supplemented with hundreds of predefined templates, which help traders set up their charts and start trading instantly.

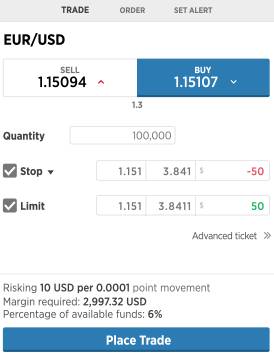

We noticed a significant difference between the broker’s MetaTrader platform and the advanced trading platform from a trading perspective. The speeds of order execution, pricing of assets, and spreads were considerably superior in the advanced trading platform. However, larger volumes may induce slippages and partial order executions owing to the DMA nature of the platform. The proprietary Forex.com app provides access to various trading tools such as SMART signals and Performance Analytics, where traders receive trading signals, market analysis, and assistance from expert market strategists. Even the webtrader has excellent functionalities and provides almost all the charting tools and analytical modules offered by the desktop app. Both apps allow trading directly from the charts, while the smart trade ticket module acts as an outstanding tool to place orders, manage trades, and close them with extreme ease and accuracy.

The smart trade ticket module provides detailed information about an order, which further helps traders evaluate their P/L, spreads, rollover, and margin used for any given order. Additionally, traders can manage their accounts, make a Forex.com deposit, withdraw funds, and change their account settings via the app. Overall, our hands-on Forex com app review of the proprietary platform does indicate that most professional traders will be largely satisfied with the performance and features of the advanced trading platform. Still, we also believe that the absence of MetaTrader terminals can discourage a significant portion of the professional trading community.

Trading Performance Review of the Forex.com Mobile App

There are two Forex com mobile app options. For Standard account holders, the broker offers access to the mobile versions of the MetaTrader apps, which are available for both Android and iOS devices. The MT4 and MT5 mobile apps adopt the market maker protocol, where trading performance is mostly similar to the desktop versions of the MetaTrader terminals. The overall design and layout are pretty much the standard affair, and regular users of the MetaTrader mobile apps will instantly feel at home.

The company has developed a proprietary Forex com mobile app for Commission and DMA account holders, which uses a TradingView license to display charts and enable traders to trade directly from the charts. TradingView is one of the leading charting tools in the FX market, which offers excellent analytical tools, drawing options, and other innovative features. The Forex.com mobile app supports more than 10 types of charts, over 14 timeframes, and around 60 technical indicators, similar to the MetaTrader mobile apps in terms of charting options. However, the biggest difference here is that the proprietary app supports direct market access trading for DMA account holders, which is unfortunately not offered for MetaTrader users.

The user interface of the proprietary mobile platform is also much smoother and more functional than the MT4 or MT5 mobile apps, with users having the option to choose between light and dark themes. Furthermore, traders can manage their accounts, perform a Forex com deposit, manage orders, save chart templates, and initiate a Forex com withdrawal through the app, negating the need for a dedicated desktop trading platform. Therefore, we sincerely feel that the mobile platform can get the job done, especially if you are the sort of trader who is very keen on trading on the move.

Bonuses, Rebates, and Offers at Forex.com

Is Forex com legit a regulated broker that does not offer any bonuses or offers? In short, yes, the broker is regulated by top regulatory organizations, which virtually prevents it from offering any bonuses, offers, or promotions to new or existing clients. However, if you are an active trader who transacts high volumes, the company does provide a rebate-based Active Trader program. The Active Trader program promises to reduce trading costs by up to 15%, including bank fees for wire transfers.

Of course, traders must deposit a minimum of $10,000 to qualify for the rebates program or transact at least $25 million in notional volumes every month. The rebate varies from $3 per million for transaction volumes up to $50 million to $10 per million for trade volumes exceeding $500 million. There are five levels in the Active Trader program, categorized according to trading volume, and the rebates increase for every level. Nevertheless, aside from cash rebates, the broker does not offer any other promotions or offers.

Depositing Funds, Payment Methods, and Forex.com Withdrawal Review

The Forex com minimum deposit for the Standard and Commission account is $1,000, while the minimum Forex.com deposit for the DMA account is $25,000. Therefore, the company only accepts payments via credit/debit cards, bank wire transfer, or Skrill/Neteller. The broker mandates the first transaction to be $1,000, but it may allow traders to start trading with as low as $100 in some cases. Nevertheless, the maximum deposit is $10,000 for both credit/debit card and Skrill/Neteller payments, while there are no maximum deposit limits for a bank wire transfer. The broker does not charge any fees for transactions, and the accounts are credited with the exact amount of deposit instantly.

| Forex.com Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Immediate | Min. Deposit: $100 | Deposit Fee: No commission |

|

Payment Methods:

BANK-WIRE

SKRILL

NETELLER

|

||

Since the broker verifies all trader accounts at the time of account registration, a Forex com withdrawal initiated by clients is processed without any delays. The minimum deposit limit is $100, and the funds will only be returned to the original source of deposit. If you use multiple deposit methods, the Forex.com withdrawals will be processed in proportion to the deposits made through individual funding sources. This is done to ensure adherence to anti-money laundering laws. Credit/debit card and Skrill/Neteller withdrawals are processed within 24 hours, while wire transfers can take up to 48 hours. Nevertheless, funds will be released much sooner, and traders can expect the money to reach their account within a couple of days. There are no fees for card and e-wallet withdrawals, but wire transfers may include additional fees charged by the intermediary and receiving banks.

| Forex.com Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: From 24 hours to 48 hours | Min. Withdrawal: - | Withdrawal Fee: No commission |

|

Payment Methods:

BANK-WIRE

SKRILL

NETELLER

|

||

Forex.com Spreads, Rollover Costs, Leverage, and Other Trading Conditions

The Forex com spreads are competitive for both market maker and DMA accounts. The Standard account quotes an ultra-tight spread of 0.8 pips for the EUR/USD pair, with a typical spread hovering around 1.1 pips during regular market hours. It is extremely competitive indeed, but the spreads are even reduced for the Commission account, where the same pair quotes an impressive 0.2 pips at its lowest. Of course, the Commission account does charge a commission of $5 per 100K traded, but the commission is pretty much the standard cost for a typical ECN account. However, the broker reduces the commission even further for its DMA accounts, where all DMA traders are enrolled into the Active Trader program. In this account category, the commission can be as low as $20 per $1 million traded, provided the trader transacts a monthly notional volume over $2 billion. Therefore, the Forex com spreads and commissions are a cut above the rest, making it the perfect choice for professional and high-volume traders.

The broker’s rollover rates are impressive as well since there are no hidden or continuous SWAP charges that may add up to a trader’s existing positions. Traders earn or pay the rollover rates at a predetermined cut-off time, making it cost-effective to hold on to overnight positions for longer periods. Rollover rates fluctuate constantly, but the company advertises the rollover rates for every instrument on its website for complete transparency. However, we could not find a SWAP-free Islamic account that foregoes rollover rate, which may deter traders following Muslim religious beliefs. We performed a detailed evaluation of the broker’s pricing policies, trading costs, and other miscellaneous charges for this Forex.com broker review and are pleased to report no hidden charges. Therefore, you can trade the markets with a fairly reliable pricing policy.

The Forex.com leverage is limited to 1:50 for traders in the United States. At the same time, the margin requirements may be lowered for international traders with a maximum Forex com leverage of up to 1:300. Of course, leverage and margin requirements change according to the underlying asset and trading protocol since DMA traders are bound to face restricted leverage usage because of the underlying market volatility. In terms of trading conditions, the broker releases its key trading metrics by entrusting third-party auditors to monitor the real-time trading performance. It is indeed encouraging to see that the broker managed to ensure an order execution time of less than 1 second for over 99.83% of its trades, with the average execution speed rated at 0.04 seconds. The slippage was also at a highly manageable 4.6 pips, which is good news for scalpers and high-frequency traders. These impressive statistics do imply that Forex.com has one of the best trading conditions in the entire market.

Is Forex.com Legit with Its Operational Policies and Handling of Clients’ Funds?

The broker is regulated by top regulators in the market, and as we mentioned at the beginning of this Forex.com review, Forex.com is one of the select mainstream brokers that accept traders from the United States. The broker has regulatory licenses issued by top regulators such as the CFTC and NFA in the United States, the FCA (Reference number: 446717) of the UK, the ASIC of Australia, the FSA of Japan, and the IIROC of Canada. At the same time, it is also regulated by lower-tier regulators such as the SFC of Hong Kong, the MAS of Singapore, and the CIMA of the Cayman Islands. These regulators enforce several strict guidelines to enhance the safety of FX trading, which includes minimum capital requirements, routine audits, segregation of clients’ funds, and the development of robust insolvency guidelines through insurance programs.

The Forex com broker also discourages third-party funding. Of course, this policy is in line with the numerous regulatory and anti-money laundering laws that are in place to prevent financial malpractices. To enhance the security of funds, the company segregates its clients’ funds daily, and such funds are kept well away from the broker’s capital. Additionally, Forex.com also maintains sufficient capital to meet liquidity, and in the case of a default, the broker promises to credit all clients’ funds before settling its other claims and debts. All financial transactions are processed through secure payment gateways, which also helps safeguard sensitive financial information. Overall, Forex.com is a strongly regulated broker that operates according to leading industry guidelines to offer a safe and secure financial trading platform.

Client Support and Contact Options

Client support is facilitated through live chat, phone, e-mail, and web contact form, all of which are available on the broker’s website, as well as its proprietary Forex.com app. Traders can contact the broker 24 hours a day during live market hours, but if the call volumes are high, the broker may ask you to send an e-mail outlining your concerns. Alternatively, you can also check the broker’s FAQ section to find solutions to the most commonly asked questions, which should give you information on the most common concerns. However, you can contact the customer service team directly for more urgent problem resolution, where an agent will tend to your concern in the most professional and friendly manner.