Modern FX and CFD brokers are forced to evolve rapidly to meet the ever-changing appetites of new-age traders. In the world of social trading and automated investing, it is important to develop new technologies that cater to diverse trading needs. Darwinex, one of the most advanced Forex and CFD brokers, has developed a Hedge Fund as a Service (HFaaS) brokerage concept, which offers a unique opportunity for professional traders to start up a hedge fund and attract investors to contribute to the trading capital.

Of course, the HFaaS platform is not the only advantage for Forex traders since the company also provides access to multiple asset classes through different trading platforms. Other benefits include competitive pricing, tight spreads, and instant order execution through liquidity aggregation from separate liquidity providers. These features contribute to a reliable trading platform perfectly suited for all types of traders and investors. For more information, please read the rest of our Darwinex Forex review to learn how you can take advantage of the innovative brokerage services offered by Darwinex.

Features

- Darwin API

- £1M Deposit Protection

- Professional accounts

- DarwinIA allocation

Special Offer

Darwinex Broker Accounts That Are Available to Traders and Investors

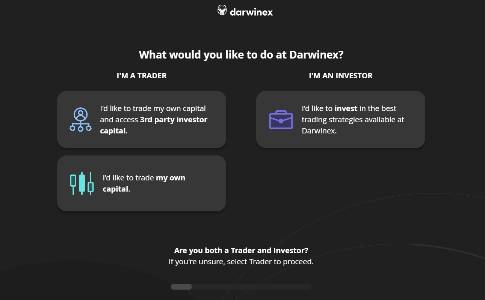

Darwinex markets itself as an advanced social trading platform through its HFaaS concept, which means that a Darwinex broker account is open to both traders and investors. Since this Darwinex review is more inclined towards evaluating the platforms from a Forex trader’s perspective, we will evaluate the company’s services accordingly.

However, we will also touch upon some of the crucial aspects of its investor account options since it may also appeal to our readers who prefer to copy the trades of more advanced traders. Nevertheless, before moving on to the different types of accounts, let’s evaluate some of the benefits and drawbacks of the company that we discovered through the course of this Darwinex Forex review.

- An FCA regulated broker with close to a decade of presence in the financial markets.

- Provides up to £1M cover for trading capital.

- Unique HFaaS brokerage model that enables individual professional traders to open and maintain a hedge fund.

- Tight and transparent pricing structure with competitive spreads.

- Availability of both MT4 and MT5 terminals.

- The Darwinex minimum deposit is just $500 for FX and CFD trading.

- Guaranteed Darwinex withdrawal with on-time processing of all withdrawal requests.

- Outstanding DARWIN and DARWINIA programs for professional traders.

- Absence of a dedicated Darwinex USA brokerage, but the company has a partnership with Interactive Brokers to offer access to the US markets.

- Despite offering access to almost all asset classes through its platforms, the actual number of tradeable instruments is quite low.

- Low Darwinex leverage for Forex instruments.

Darwinex has garnered a favorable, positive reputation among traders worldwide since there is virtually no threat of financial scams or abuse at the hands of the company. Nonetheless, our Darwinex review is designed to shed further light on the inner workings of the broker and how traders will be guaranteed an ideal worry-free investment platform.

Darwinex Broker Account Types

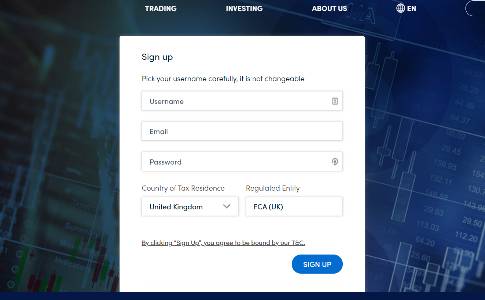

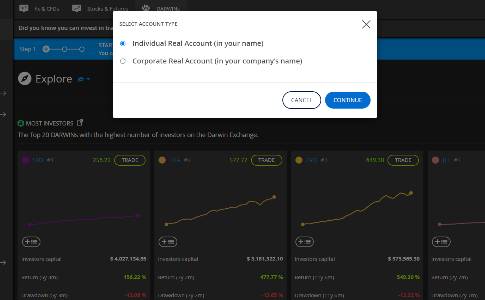

Traders must apply for a master account through the Darwinex broker platform, where they can choose between an individual account and a corporate account. Clients are taken through an elaborate signup procedure that requires detailed personal, residential, and financial information. Once the application form is complete, the broker assigns a unique username to each client. Clients can only have 1 unique username registered with Darwinex. This master account, with the unique username and password, grants access to the default Darwinex broker dashboard, where clients can open a trading account or an investment account according to their specific requirements.

The broker only provides 2 distinct account categories for traders – a regular trading account and a professional trading account. The regular trading account, also known as the Classic account, is a conventional CFD trading option offered to traders who do not wish to attract investors or set up a hedge fund later. On the other hand, if you wish to advertise your pro trader status and invest on behalf of investors, you will be required to open a Pro account.

The Pro account should not be confused with the broker’s Professional account, which is just a more premium version of the Classic account that offers rebates, access to a dedicated account manager, and much more value-added benefits. There are numerous requirements to attain the Professional client status, including a minimum of $500,000 in the investment portfolio, prior trading experience, and experience in or knowledge of the financial markets.

The Pro account status, also known as the DARWIN status, is only provided to traders who can demonstrate a credible and verifiable trading record for a stipulated period. DARWIN accounts are not created instantly since the broker has a detailed DARWIN creation process that manually verifies the results before assigning a DARWIN. DARWINS can earn a performance fee that equates to a percentage of the profits generated for each investor.

Since the Darwinex broker acts as a fund manager for regulatory purposes, DARWIN traders need not hold a regulatory license or clearance for providing their services. The company acts as a fund manager by allocating funds and choosing strategies on investors’ behalf. DARWIN traders are free to exercise total control over their strategies and trade without any restrictions. However, DARWINS must be aware that any drop in performance or high-risk trading is frowned upon by the company, and the broker retains complete freedom and power to revoke the DARWIN status as it deems fit.

For this Darwinex Forex review, we primarily concentrated on the classic trading account. The Darwinex minimum deposit for individual account holders is $500, while the minimum Darwinex deposit for subsequent deposits is $100. For corporate accounts, the Darwinex minimum deposit is $10,000, which is understandable, and we are not too concerned about the minimum investment requirements imposed by the company.

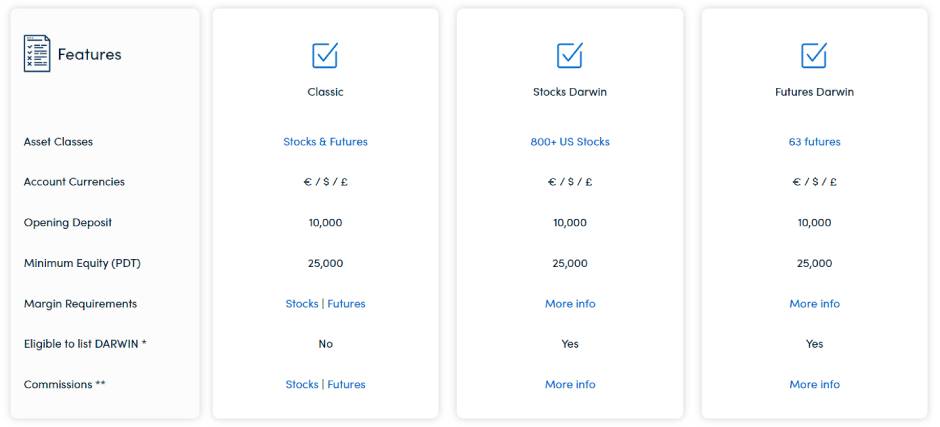

Apart from the Classic and Pro Darwinex broker accounts, the company does provide stock and futures trading options, which require a minimum Darwinex deposit of $10,000. These are the Classic, Stocks Darwin, and Futures Darwin accounts, and as the account names imply, the Classic option is not eligible for DARWIN status. Nevertheless, the choice of accounts is quite straightforward, and it is easy to choose an account category that suits a trader’s precise needs.

A Brief Darwinex Review of the Account Opening Process

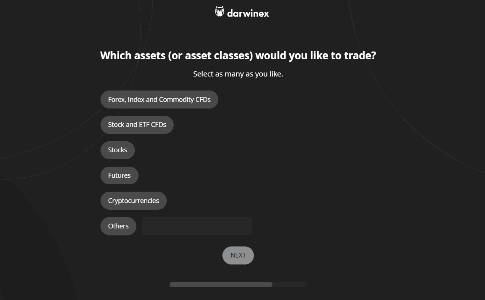

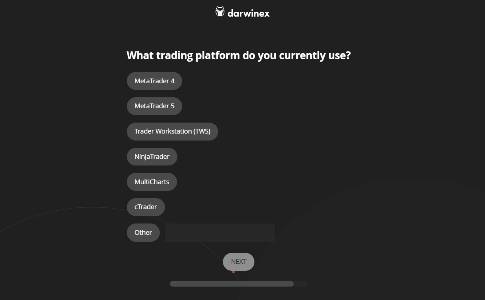

We were quite frankly impressed with the overall account application process adopted by the broker. To open a master account, traders are only required to choose an username and password, choose whether they would like to be a trader or an investor, and pick the default trading platform. The master account can be created within a couple of minutes, and traders can access the Darwinex broker dashboard as soon as they verify their email address. However, to start trading, you should open a live or demo trading account, which is where the broker asks you to choose between an individual account and a corporate account.

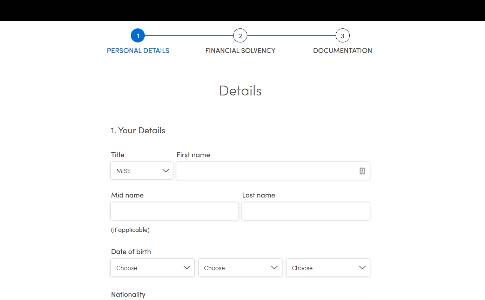

Opening a live trading account can be more time-consuming than creating the master account. Here, you will need to submit your personal information, including contact details, tax information, and preferred account base currency. Moving on to the Financial Solvency form, you will be asked to declare your income information, net worth details, trading history, knowledge of the markets, and other similar information.

Finally, in the documentation section, you will be asked to read and accept the broker’s terms and conditions, along with a declaration that you are not a politically exposed person or an immediate relation to one. These are designed to ensure that you don’t have a conflict of interest while trading the financial markets with a Darwinex broker account.

One major gripe we had with the broker was that it doesn’t have a Darwinex USA brokerage division. Instead, it works with Interactive Brokers in the US to access the American financial market. A key aspect of this partnership is that the funds and trading capital can be transferred between the 2 brokers, which is a massive advantage. However, the broker’s absence from the US market due to regulatory issues is a drawback.

Darwinex Broker Platforms – Plenty of Options for Traders and Investors

During this Darwinex Forex review, we discovered that the broker is highly committed to providing the most diverse range of trading platforms to suit varying investor needs. It has developed a proprietary browser-based platform for investors accessible through the trader dashboard while also offering the very popular MT4 and MT5 trading terminals for most of its FX and CFD products. Furthermore, the broker connects its traders to the US financial markets through its IBKR partnership, where traders can access the award-winning Trader Workstation interface for stocks and futures trading.

For this Darwinex review, we consciously stayed away from reviewing the IBKR’s Trader Workstation platform since we have covered it in detail through our Interactive Brokers review. As far as the MetaTrader platforms are concerned, the broker supports all versions of the MT4 and MT5 platforms, including web, mobile, and desktop versions.

DARWIN traders are also given access to the MetaTrader platforms, thereby ensuring that traders can use the excellent features of the MT4 and MT5 platforms. An added benefit for DARWIN traders is that they don’t have to modify their trading style to suit a proprietary app, which is usually the case when a broker develops an innovative copy trading system such as DARWIN and HFaaS.

In terms of trading performance, the MetaTrader terminals performed brilliantly, especially with the direct market access and no dealing desk conditions supported by the broker. All quotes are aggregated from multiple liquidity providers, where orders are passed to the interbank liquidity without broker intervention. If anything, we found that Darwinex trading platforms offer even better order executions speeds when compared to other similar NDD brokers.

Another thing we noted was the negligible lag, which is the result of several secure trade servers working seamlessly in the background. At this point of the Darwinex review, the broker certainly appears to be developed for professional trading with excellent trading performance.

Additionally, these MetaTrader platforms are fully configurable and compatible with ExpertAdvisors, third-party indicators, and other custom trading tools available on the MQL forum. Advanced traders can also use the API function to configure the MetaTrader platform to suit their unique trading requirements. On the other hand, DARWIN accounts are hosted on the company’s innovative fund management tool, which automates trading and investments.

Traders are only required to join the DARWIN program, and then they are free to concentrate on their trading strategies, all the while ensuring that they adhere to the strict conditions stipulated by the broker. Investors can choose DARWINS through the Darwinex trader dashboard, where DARWINS are ranked according to many parameters to ascertain the best-performing traders on the platform.

Trading the Markets with Mobile Darwinex Apps

We encountered a mixed bag of feelings when it came to choosing a Darwinex mobile trading platform. Of course, traders have access to the mobile versions of the MT4 and MT5 app on their iOS or Android-enabled mobile devices to access the Darwinex broker platform. Still, we expected the company to develop a proprietary trading app to cater to the ever-growing mobile trading community. This is not helped by the fact that most modern traders expect a well-developed proprietary app from their broker, especially when most mainstream companies have an advanced proprietary trading platform in their arsenal.

Nevertheless, the mobile versions of the MetaTrader terminals are compatible with the broker’s entire range of services, including the DARWIN accounts and full API integration. The performance levels and order execution policies are at par with their desktop counterparts, which means there are no surprises in this aspect.

However, things are a bit different from an investor’s perspective. The company offers a dedicated mobile app to investors who can choose DARWINS or invest in the company’s pooled fund through their iOS or Android devices. The mobile app fully utilizes the broker’s internal algorithmic performance measurement metrics to list DARWINS according to their performance, risk appetite, and potential ROI.

The mobile Darwinex app for investors performs remarkably well, and the user interface is a breeze to use. We would go out on a limb here to proclaim that this is one of the best social trading systems in the market, mainly due to the app’s authenticity and how Darwinex goes about choosing DARWINS and ensuring credibility in the performance metrics. Therefore, if you are an investor and want to keep away from trading the markets yourself, then the mobile Darwinex invest app is excellent.

Our Darwinex Opinion of Their Limited Promotions, Cash Rebates, and Bonuses

While developing our detailed Darwinex opinion, we found that the broker doesn’t offer any free money promotions, which directly results from the strict regulatory guidelines imposed on it. Nevertheless, the company has an elaborate cash rebate program that offers 2 different cashbacks directly linked to the trader’s trading activity.

The broker’s “Talent-Linked” rebate program is the first offer, which is complicated and only available to DARWIN traders. It is based on a D-score, which reflects the trader’s performance levels that take several factors into account. The D-score is a reverse performance measurement metric, where traders earn a maximum of €5 commission per lot if their highest D-score is less than 55. Traders with a D-score between 55 and 60 are eligible for a commission of €4 per lot, while traders with a D-score of 60 and above are only eligible for a maximum commission of €3 per lot.

Of course, if you are not a DARWIN trader, or if you prefer cash rebates that represent your trading volumes, then the “Volume-Linked” pricing model offers a price reduction of up to 40% to high-volume traders. It is a tiered cashback program, where traders must spend at least $250 in monthly commissions to be eligible for a price discount. Traders who accumulate or have paid a total monthly commission of up to $750 can qualify for a 10% price reduction, while commissions paid up to $2,250 qualify for a 20% price reduction.

The third tier corresponds to a commission spend of up to $6,750, where the discount is 30%, while commissions paid beyond $6,750 are eligible for the full 40% discount. While these figures may not mean much for smaller volume traders, they can certainly make a huge impact for high-volume traders, so the Darwinex opinion is clearly in favor of the company among high-volume professional traders.

Aside from cash rebates, there is a performance-based trading contest in which traders are allocated a certain AUM according to their trading performance. We have seen several brokers offering different variations of trading contests to reward top-performing traders on their platform. However, unlike a conventional trading contest, the DarwinIA program is based on a hedge fund or a fund management concept. The broker picks and ranks the 150 best performing traders from its DARWIN platform each month, determined through the trader’s D-score. These 150 traders are then allocated a certain sum of money from the broker’s notional capital of €10 million, with the top-ranked DARWINS getting the highest share of the fund as their AUM.

The top trader in this program may be allocated up to €500,000 as AUM, while the second and third places are allocated €400,000 and €300,000, respectively. The prize money AUM is reduced for subsequently ranked traders, and the funding is provided for the entire 150 traders on the list. Traders can then use this AUM to trade the markets under normal conditions and are awarded 15% of the profits they manage to make each month.

Such a program offers a great incentive for traders to increase their AUM while also helping them earn a significant sum of money through their trading activities. However, the DarwinIA program is highly selective and imposes several strict trading conditions, where the company constantly monitors the trading performance, D-score, and risk perception. Suppose a trader deviates from the norm or indulges in high-risk trading activities. In that case, the Darwinex broker reserves the right to cancel the trader’s privileges and recover the allocated AUM.

Minimum Deposit Requirements, and How to Initiate a Darwinex Withdrawal

The Darwinex minimum deposit requirement is just $500, which is very reasonable for a regulated NDD broker. While we do realize that we often mention other mainstream brokers that offer their services for an initial capital outlay of just $1, Darwinex broker is a bit different from those companies. Unlike a dealing desk or market maker broker, trading with any amount less than $500 through a direct market access broker can be disastrous due to the immense liquidity implications of an interbank liquidity pool.

Additionally, the Darwinex leverage is quite low, which means that you will need at least a $500 margin to make any meaningful trades. Therefore, when considering all the different aspects of professional trading, the Darwinex minimum deposit makes absolute sense.

However, if you are in the market for shares and futures trading, the minimum Darwinex deposit requirement increases to $10,000, which is very steep. Many other brokers offer shares and futures CFDs and their conventional Forex products for a fraction of the cost. There are 4 different options for depositing funds into your trading account. The first option is a bank wire transfer with no maximum deposit limits, but the funds may take anywhere from 1 to 3 days for processing. The broker does not charge any commission for deposits but be aware of any transaction fees that the banks might charge.

The second deposit option is to fund your account via a credit/debit card; the broker supports both Visa and Mastercard payments. There is a maximum Darwinex deposit limit of $20,000 per transaction, but the payment is immediate and there are no commissions. The third funding option is through Trustly, which allows traders to deposit funds up to $10,000 without any fees, and the funds are credited to the trading account within 1 business day. Trustly bank transfers are preferable to a bank wire if your deposit amount is less than $10,000.

| Darwinex Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: up to 3 business days | Min. Deposit: $500 | Deposit Fee: Depending on choosen method |

|

Payment Methods:

VISA

MASTERCARD

SKRILL

|

||

Finally, the broker also supports e-wallet payments through Skrill, where traders can deposit up to $5,000 per transaction. Although the deposits are instantly credited to the trading account, we are not fond of the 0.5% processing fee, which can eat into the deposit capital. Once again, unlike other FX brokers, Darwinex does not reimburse the charges or commissions charged by the bank or payment gateways, which means that you will always receive lesser amounts in your trading account.

One of the key benefits of trading with a Darwinex broker account is its withdrawal policies. There are no concerns about broker fraud or financial malpractice. The broker mandates that all of its customers verify their identities and only allows its traders to deposit funds and start trading after the verification process is complete. Therefore, there is no risk of default on Darwinex withdrawals, making it one of the safest brokers in the market. A withdrawal will only be processed to the source account of the deposit, which is done to satisfy anti-money laundering laws.

However, unlike a deposit, a Darwinex withdrawal will charge commissions, depending on the withdrawal method. Skrill and Visa/Mastercard withdrawals are charged a 1% commission, with a minimum fee of $2 per transaction. At the same time, there is a maximum limit of $5000 and $20,000 for Skrill and Visa/Mastercard withdrawals, respectively. There are no such restrictions for bank transfers and Trustly, and all withdrawals are processed within 3 working days.

| Darwinex Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 1-3 business days | Min. Withdrawal: - | Withdrawal Fee: Depending on choosen method |

|

Payment Methods:

VISA

MASTERCARD

SKRILL

|

||

Darwinex Leverage, Liquidity, Spreads, and the General Trading Conditions

This part of our Darwinex Forex review concerns the different trading conditions that traders may encounter at the broker. Let’s start with the trade execution conditions, whereby the broker aggregates all quotes through multiple liquidity providers. Darwinex often chooses 2 liquidity partners that provide a market without the “last look,” ensuring the best order execution speeds and liquidity even during the most volatile market conditions.

All Darwinex servers are connected to the London Equinix LD4 Data Centre, which promises low latency and instant order fills. While the speed of order execution is impressive, traders must note that slippages and partial order fills might be a common occurrence. Direct market access trading often minimizes requotes or order cancellations, increasing the probability of slippages and partial order filling.

Most retail traders choose Forex and the CFD market for their insane leverage. Margin trading is very risky, but the most common leverage offered by brokers ranges from 1:30 to 1:888. However, the regulatory intervention has brought down the leverage considerably in recent years, and the same has been implemented with FCA-regulated brokers in the UK. For Forex trading, the maximum Darwinex leverage is 1:30, while the leverage is further reduced to 1:20 for minor currency pairs.

The leverage for other asset classes—namely, indices and commodities—require a higher margin, where the maximum Darwinex leverage may be restricted to 1:15 or 1:10. The margin required for Stocks and ETFs is even higher, with the maximum leverage pegged at 1:5 for these instruments.

The broker offers interbank liquidity spreads for all of its instruments, where the average Darwinex spread can be around 0.2 to 0.5 pips for the major currency pairs such as the EUR/USD. The spread quoted was a bit high for a few minor and exotic pairs, but the overall costs were representative of the average spreads prevalent in the market. A commission is charged on each order, which amounts to 0.005% of the base currency. Expect the commission to be around $5-$6 per round lot traded, which is rather economical.

We have traded with brokers that charge a nominal commission of just $3 per round lot traded in terms of outright competitiveness. That said, the broker indeed provides up to 40% discounts on its commissions for traders with a higher D-score, which means that low-risk, high-volume traders will be able to reduce the overall commission to 0.003% of the base currency. Therefore, active high-volume traders with excellent risk-reward ratios and high trading performance will find Darwinex to be a cost-effective broker.

Safety Aspects

The safety of clients’ funds at Darwinex is guaranteed by the regulatory supervision of the UK’s Financial Conduct Authority (FCA – FRN 586466). All clients’ funds are held in segregated accounts maintained at tier 1 banks of the UK, which virtually eliminates any risk to the trader. In addition to the Financial Services Compensation Scheme that offers cover up to £85,000, the broker has separate insurance from Lloyd’s, which covers up to £1 million in traders’ funds, which will be paid out to the trader in the unlikely event of broker insolvency.

All of these insurance premiums are borne by the broker, which clearly states the broker’s intent to ensure world-class security for its clients’ investments. We have yet to find any negative aspects of the broker, despite actively searching for them throughout our Darwinex review journey, which further solidifies our positive Darwinex opinion.

Customer Service

Customer service is not what we would call outstanding, but the broker does get the job done when it comes to resolving all client issues promptly. There was no live chat option, limiting the ability to interact with a customer service representative online. However, a number is provided that traders can call should they wish to speak to an actual person. Alternatively, the web contact form and email also serve for sending detailed requests to the broker, and the company has also developed an emergency contact form for certain specific issues.

The emergency contact form is reserved for errors in live streaming pricing, failure to place trades, trade settlement issues, and other similar concerns. Failure of the limit orders to be triggered or other trade-related queries do not fall into this purview. Therefore, even though our Darwinex opinion is largely positive, we feel that the customer service department may benefit from a few subtle improvements here and there.