OANDA broker is one of the oldest FX brokerages in the US and, for that matter, around the world. It is also one of the very few companies that has successfully kept up with the changing dynamics of the ever-growing retail market. The company was responsible for bringing several innovative solutions to the market, which ultimately paved the way for retail traders to make a foray into the once highly exclusive Forex trading industry. With live streams of OANDA Forex rates, feature-rich online trading platforms, and unhindered market access, an OANDA Forex account continues to be a popular choice in the global market.

The company has undoubtedly faced numerous hurdles along the way and has often been on the receiving end of both regulators and investors. Despite these challenges, the OANDA has a considerable presence in several key financial markets, including the EU and the Asia–Pacific. So, is OANDA a good Forex broker, and can it be trusted?

To give you an unbiased opinion, we analyzed several critical trading parameters in this OANDA Forex broker review, including the OANDA minimum deposit requirements, the available choices of trading platforms, bonuses on offer, order execution policies, and OANDA Forex trading fees. Please make sure that you read the entire OANDA review before opening an account with the brokerage.

Features

- Wide range of global CFD instruments

- Real-time rates for all the major FX pairs

- Fully automated trading platforms

- Currency data and analytics

Special Offer

Is an OANDA Forex Account the Right Choice for Your Trading Needs?

The company became a pioneer in the FX retail trading sector by introducing OANDA Forex rates through its website during the late 1990s. The brokerage also facilitated a web-based trading platform that allowed traders to speculate on currency rate fluctuations, which became a great success. However, over the years, several new technologies and key players have entered the market, and this begs the question as to whether OANDA broker is still relevant in the current online trading scene. We have listed below a few of the company’s pros and cons that we unearthed during this OANDA Forex broker review.

- One of the oldest Forex and CFD brokerages in the world.

- US-based, with branches in the EU and Asia–Pacific.

- Overseen by top-tier financial regulators.

- Supports FX and CFD instruments from a wide range of asset classes.

- No OANDA minimum deposit requirements for regular trading accounts.

- Offers MT4 and MT5 terminals as default trading platforms. The broker also has a proprietary mobile app.

- Attractive bonuses for international clients.

- Has an outstanding market research and analytics platform known as Market Plus.

- No account verification required for deposits under $9,000.

- Despite being one of the oldest companies around, OANDA broker is not as robust as other US-based Forex brokers.

- OANDA Forex trading fees are strictly average for Standard and SWAP-free accounts.

- No zero-spread guarantee for ECN accounts.

Our detailed OANDA Forex broker review should help our readers familiarize themselves with the fundamental characteristics of the company’s products and services. It should also serve as an excellent reference while opening an OANDA Forex account. However, before moving on to our review of the sign up process, let us take a look at the different varieties of accounts offered by the company.

Decoding and Comparing OANDA Forex Account Varieties

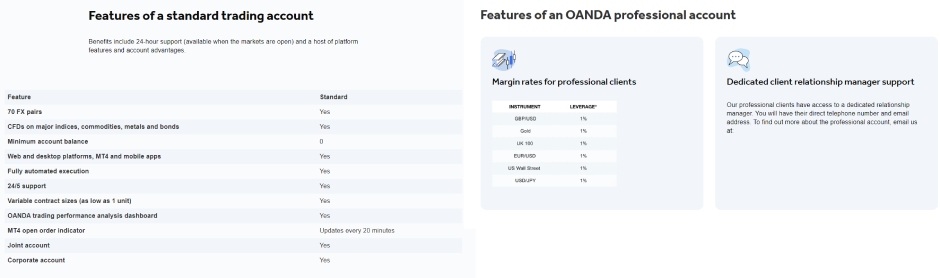

The company offers five different types of trading accounts with varying trading conditions and OANDA Forex trading fees and distinct dealing desk policies. The first category of the OANDA Forex account is the Standard—the most basic option available for FX and CFD trading. It is also the most expensive, with a basic spread for the major currency pairs starting at 1.1 pips. There is no OANDA minimum deposit requirement for this account option, which is a unique precedent that other brokers should adopt.

While such an option gives flexibility to small traders, trading without a plan and proper money management principles can be risky. Nevertheless, the Standard account provides access to over 200 instruments, offers standard lot trading conditions, and comes with several value-added services, such as trading signals and market research. The Standard account is indeed a great choice for beginner traders, but we are not entirely convinced due to the high OANDA Forex trading fees for this option.

The second category of an OANDA Forex account is the Core—a commission-based ECN account. It offers competitive OANDA FX trading fees, with spreads starting at 0.2 pips for major pairs and a commission of $40 per $1 million traded. This commission is highly competitive, and, while the spreads are competitive, we are slightly disappointed that the company does not offer a zero-spread guarantee for major currency pairs.

Nevertheless, all other trading conditions are similar to those of the Standard account. The only difference is that all orders are routed through the broker’s ECN bridge to a global liquidity pool. Therefore, the Core account offers direct market access trading devoid of any conflict of interest and ensures that the OANDA FX rates are some of the best in the market.

If you are a high-volume trader who does not want to pay a commission but still enjoy tight spreads, you can opt for the Premium account, which brings down the spread to 0.8 pips for major currency pairs. It has a few differences in trading and order execution conditions compared to the Standard account. Nevertheless, the most eye-watering fact is that traders will have to cope with a vast OANDA minimum deposit requirement. The Premium account requires a minimum investment of $20,000, and traders must maintain a monthly notional trading volume of $10 million or its equivalent in other currencies.

The costly OANDA minimum deposit requirement and the high trading volume mandate feel absurd for an account that quotes minimum spreads starting at 0.8 pips. Nevertheless, traders are provided with several unique benefits for their investment. For instance, all Premium account holders are assigned a dedicated account manager and are assured of a free VPN, priority support, free deposits/withdrawals, and other perks. Nonetheless, we believe that other ECN broker options in the market may offer account options with more value for your investments with their lower minimum deposit requirements while providing the same trading conditions offered by OANDA.

Although the Premium account may appear to be the top category at OANDA, the broker offers another option known as the Premium Core account. The Premium Core account is simply a combination of the Premium and Core accounts, where traders can enjoy the lowest OANDA Forex trading fees. Spreads start at 0.2 pips, while the commission is at a low of $35 per $1 million traded. All other trading conditions, order execution policies, and additional account benefits are similar to those of the Premium account. We offer a detailed evaluation of order execution policies, leverage, and other trading conditions in later sections of this OANDA FX review.

Finally, the broker also provides a SWAP-free option for Sharia-compliant trading to Islamic traders. This option is suited for those who cannot, due to their religious beliefs, pay SWAP fees. The SWAP-free account is based on the Standard account, but traders will have to factor in a higher spread, starting at 1.6 pips. The real-time OANDA Forex rates may differ from those quoted in other account categories. Still, this is understandable, considering that the broker will have to recover the charges for holding its clients’ long-term overnight positions.

There are certain limitations to trading conditions with this option, including access that is restricted to the MT4 terminal, account base currency support offered only in USD, and other factors related to order execution. Nevertheless, all other trading conditions are similar to the Standard account.

Is It Easy to Sign Up for an OANDA Forex Account?

Is it easy and secure to register a trading account at the OANDA broker? Is OANDA a good Forex broker for FX and CFD trading? To answer every one of our readers’ questions in detail, we signed up for a real OANDA Forex account, and the following is a report of our sign up experience.

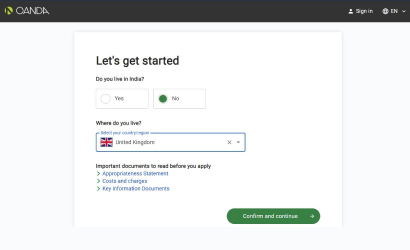

The first hurdle that traders might face at the sign up is their geographic location as the company does not accept traders from all regions. However, the broker does make it easy for traders by checking their IP address on their behalf and only allowing them to proceed with registration if they reside in a country that is accepted by its T&C.

Do not worry if you are temporarily located in a country that the company does not accept since you are allowed to sign up by choosing the country of your primary residence from the dropdown menu provided at the beginning of the registration process. This removes the uncertainty of ascertaining whether one is eligible to open an account or not, which is something that we wish other brokers would adopt as well.

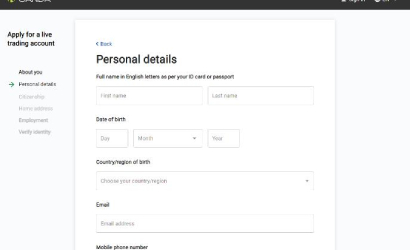

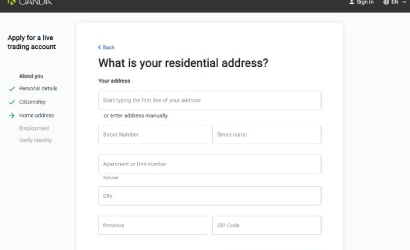

Once you determine that you are eligible for a trading account by choosing your country from the drop-down list, you will be taken to the detailed account registration page. Account registration can be done through the broker’s website or its proprietary mobile app. To open an account, you have to submit your details, citizenship information, tax number, residential address, employment status, and financial information.

Unlike other brokers, you are not granted access to an account immediately. Instead, the broker puts your application through a manual authentication process, taking anywhere from three hours to three business days. If you apply for an account during holidays, there can be further delays since the broker has a strict Forex market hours OANDA Forex account registration policy.

In the meantime, the broker may contact you by email or phone for any clarifications and may ask you to submit documentary proof to substantiate your claims. However, please do not mistake this with personal account verification, which is another process. Instead, the authentication process is put in place to prevent bogus sign ups. Nevertheless, once the authentication team reviews and accepts your application, they will assign you an account number and email you the login details. You can use these login parameters to access your account dashboard, where you can make your first deposit, download your preferred trading platform, and start trading.

An interesting aspect about the OANDA Forex account is that the broker does not require its users to verify their accounts for deposits of up to $9,000. We are not entirely sure about how this works since all brokers are required by international anti-money laundering laws to verify their clients’ personal information before releasing funds at the time of withdrawal. We doubt whether the broker will process its clients’ refunds without verifying their identity.

Nevertheless, we always send in our documents and verify our trading accounts before depositing funds as it helps us avoid any verification-related issues. Consequently, we verified our OANDA account and received our withdrawal without any issues. We would also recommend our readers always verify their OANDA account before depositing funds to avoid taking any unnecessary risks.

Exploring Forex and CFD Trading Platforms

We had half-expected the OANDA Forex rates to be delivered through an innovative proprietary trading platform, just like we have seen with several mainstream brokers—especially those from the US.

The broker’s history also suggests that the company has the know-how and the technical capabilities to develop a fully functional web-based trading interface. However, we could not hide our disappointment when we discovered that the broker had taken the safest route by offering the MT4 and MT5 platforms for all traders across its product portfolio. Of course, we prefer trading on MetaTrader platforms, but, at this point, OANDA should have realized that there is a niche market where a proprietary trading platform is highly sought after.

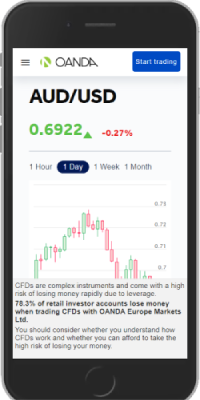

The MT4 and MT5 platforms offer direct market access trading through ECN bridges and quote some of the most competitive OANDA Forex rates. The Forex market hours OANDA time is synced with the servers located in London (Equinix LD4) and New York (NY4). Both the MT4 and MT5 platforms offer excellent trading conditions, and the latency of trading is one of the lowest that we have experienced so far.

Furthermore, both terminals can be run on a VPS for algo or EA trading, but the broker does not offer dedicated VPS service access. Instead, it offers VPS service through third-party service providers, which means traders must pay for the VPS, and there is no free option. Nevertheless, VPS works well for ultra-low latency trading and is quite handy for running EAs without interruptions.

Traders are free to download the MetaTrader app on their desktop or access the web browser-based interface through a supported browser. In our view, MT5 is highly advanced in terms of trading tools, indicator options, MQL programming capabilities, and the varied choice of instruments. However, MT4 does have its unique advantages, which are preferred by a large community of traders even to this day.

Although both MT4 and MT5 terminals are available for Standard and Core account holders, SWAP-free account holders are only given access to the MT4 platform. For Premium and Premium Core account holders, the broker only supports the MT5 terminal, which appears to be a strange choice. Therefore, if you want a free choice of platform, then you should choose the Standard or Core account; but if you prefer Premium account trading conditions, you will have to choose the MT5 platform and cope with the higher OANDA minimum deposit requirement.

Is the OANDA Forex Proprietary App for iOS and Android Good for Mobile Trading?

The broker’s proprietary fxTrade mobile app is a convenient mobile trading platform with all the usual features, such as an account management dashboard, charting layouts, one-click trading for market and pending orders, and a customizable interface with support for multiple asset classes. The app is available for trading on iOS and Android devices, and the broker ensures excellent compatibility for smartphone and tablet users. The interface is well thought out and can be used to register an OANDA Forex account, modify account parameters, manage multiple accounts, place or modify trades, and initiate a deposit or a withdrawal.

However, there are a few downsides to using fxTrade since it does not offer the same level of performance as its MetaTrader counterparts. This is especially true when comparing the charting tools and the general trading features of the fxTrade app and the MetaTrader mobile apps. One particular problem that we faced was the absence of any technical analysis tools for the charting layouts, which appears to be a severe oversight. Proprietary mobile apps from other mainstream brokers offer several basic technical analysis tools, numerous charting timeframes, and multiple order types. Nevertheless, the app does offer a pleasing and vibrant trading interface. It can indeed be a good option if your main priority is only to manage your account and monitor your trades on the go.

Speaking of MetaTrader mobile apps, OANDA broker supports MT4 and MT5 for both Android and iOS users. These apps are generally more conducive to advanced trading and can offer more options than the proprietary OANDA app. The trading latency and general order execution conditions are excellent in the MetaTrader mobile platforms. The OANDA Forex market hours for mobile trading are synced perfectly with the broker’s New York and London-based servers. Therefore, if you largely depend on your mobile devices for trading, you can try installing both apps on your smartphone or tablet for the best of both worlds.

Is OANDA a Good Forex Broker with Regard to Bonuses?

OANDA broker operates different divisions of its brokerage in multiple cities, with various regulators governing the broker’s promotional policies in particular regions. For instance, the broker cannot offer bonuses or free money to its clients in the US and Europe. However, OANDA global is a separate international entity that is free to offer a bonus program to its international clients. As a result, the broker’s international clients are eligible for a 50% deposit bonus up to a maximum of $1000. Of course, there is an OANDA minimum deposit requirement of $25 to qualify for the bonus offer, and such an offer is only available for new clients and that too for their first deposit. All subsequent deposits are not eligible for a bonus.

Traders have to agree to certain terms and conditions while availing themselves of the bonus. They cannot withdraw the bonus amount, and neither are they able to retain the bonus if their total account equity falls below 50% of the bonus amount. Furthermore, suppose you place a withdrawal request after accepting the bonus. In that case, the broker reserves the right to cancel the bonus and will only process the initial deposit along with any profits or losses incurred.

Finally, the bonus amount will be cancelled within a 30-day notice period if OANDA finds the trader to have violated any of its terms and conditions and has sent a notice outlining the same. Nevertheless, the broker also reserves the right to withdraw the bonus at any time and has full discretion on all matters related to its free money promotions.

What Are the Funding Options and the OANDA Minimum Deposit Requirements?

The broker accepts all mainstream funding options, including bank wire transfer, credit/debit card payment, e-wallets such as Skrill and Neteller, and several region-specific local payment methods. Despite seeing all the usual suspects, we could not help but notice—especially when most brokers now support some form of cryptocurrency deposits in one way or the other—that the broker does not support cryptocurrency payments.

This is even more perplexing because the broker does provide cryptocurrency CFDs as part of its product portfolio. Nevertheless, the company does not specify any OANDA minimum deposit requirements, which means that traders can deposit and start trading with as little as $1. However, there are some restrictions here as well.

| OANDA Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: 1-5 busuness days | Min. Deposit: $1 | Deposit Fee: Depending on choosen method |

|

Payment Methods:

BANK-WIRE

CREDIT-CARD

NETELLER

SKRILL

|

||

For instance, traders are only given access to a maximum OANDA leverage of 1:200, but the leverage is restricted to below 1:50 in the US and even further in the EU. Therefore, it can be difficult to trade the markets with a small capital. Furthermore, the broker’s Premium account options require a high minimum deposit requirement, where traders must deposit at least $20,000. If you want a bonus, you should deposit at least $25, which is not a substantial amount. Therefore, the OANDA minimum deposit requirements can vary according to your location, type of account, and appetite for a bonus.

You can make an OANDA withdrawal regardless of whether you have accepted the bonus. The broker does not impose any restrictions on withdrawals but placing a withdrawal automatically nullifies your bonus. The company processes all withdrawals to the source account. Even though it does not require its traders to verify their identity for deposit amounts lower than $9,000, we do not recommend our readers deposit funds without completing the verification process. Anti-money laundering laws and broker regulations play a key role here. We have seen the broker leaning towards regulatory compliance while handling its clients’ funds to prevent any form of regulatory backlash.

The broker processes all withdrawals instantly, and the funds are sent to traders’ accounts within one to five business days. Naturally, e-wallet and credit/debit card withdrawals take the least amount of time for processing, with funds reaching your account within a day. However, you should expect some delays if you use a bank wire transfer for your withdrawal since it can take anywhere from five business days to a week for a complete transaction. Withdrawals are not entirely free of cost—especially for bank wire transfers, which can cost a minimum of $20.

However, the broker claims that e-wallets and credit/debit card withdrawals are free. Still, you may have to pay any fees charged by the e-wallets as well as exchange fees if you have a different account base currency at OANDA from the one in your e-wallet or debit/credit card. The OANDA FX rates and the exchange rates quoted by the payment processors may have precedence at the time of withdrawal, so you should be mindful of these fees while withdrawing funds from the broker.

| OANDA Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 1-5 business days | Min. Withdrawal: - | Withdrawal Fee: Depending on choosen method |

|

Payment Methods:

BANK-WIRE

CREDIT-CARD

NETELLER

SKRILL

|

||

OANDA Forex Trading Fees, Spreads, Margin, Leverage, and Order Execution Conditions

We subjected the company to a detailed evaluation of its trading conditions to offer an unbiased and accurate OANDA Forex broker review. Generally speaking, OANDA has some of the best trading conditions in the market. Aside from a few minor issues, we found the broker to offer competitive asset pricing and excellent order execution policies.

However, the spreads were not as low as expected, with ECN spreads starting at 0.2 pips and commission-free premium accounts charging a minimum spread of 0.8 pips. The spread for the Standard account starts at 1.1 pips, which is not competitive at all. We would have preferred the broker to offer a zero-pip spread guarantee for its ECN offerings, while a nominal spread of 0.6 to 0.8 pips for regular accounts would have been bang on the buck.

Other OANDA Forex trading fees include a commission of $40 per $1 million for Core account holders and $35 per $1 million for Premium Core account holders. The broker also charges a financing cost for overnight positions, which includes SWAP and an admin fee that can cost anywhere from 1% to 2%. Therefore, the financing price may be slightly higher at OANDA than at other brokers, adding to the overall OANDA Forex trading fees. There is a SWAP-free option for Islamic traders, where the financing costs are eliminated, but the OANDA Forex rates reflect a sharp rise in the spreads, which starts at 1.6 pips for the major currency pairs.

As far as the broker’s order execution policies are concerned, the OANDA Forex rates are derived from multiple liquidity providers for institutional-grade trading. All orders are transferred to the interbank liquidity pool through ECN bridges, and the broker has no role in price markup or order execution. Direct market access trading is a key advantage of using OANDA broker, and we can attest to the brokerage’s pricing policies, especially with its low-latency trading, fast order execution conditions, and minimal requotes.

There are certainly instances of slippages and partial order fills, which is a direct consequence of direct market access trading. However, the broker’s extensive network of liquidity partnerships with top financial providers ensures that instances of slippages and partial order fills are kept to a minimum.

The maximum margin offered to traders depends on their location, account equity, and regulatory restrictions. Nevertheless, international traders are provided with access to a maximum leverage of 1:200, but the broker does not provide an option to lower the leverage for individual account holders. The broker has set the default leverage to 1:200 for all trading accounts, with no option to modify the leverage according to individual preferences.

OANDA expects its clients to manage leverage through position sizing, which is not an entirely feasible way of lowering leverage for beginner or small traders. Once again, we would wish for the company to reconsider this approach and enable its clients to change their account leverage.

Regulatory Information and Locations

OANDA is one of the few brokers that has been a regulated financial service provider for more than two decades. Although the broker’s international division is supervised by its office in the British Virgin Islands, OANDA has proper regulatory clearances issued by top regulators in the US, the EU, and the Asia–Pacific. OANDA is a registered retail foreign exchange dealer with the US Commodity Futures Trading Commission and a Forex dealer member of the National Futures Association.

In Canada, the broker is regulated by the Investment Industry Regulatory Organization of Canada. In the EU, the broker is regulated by the UK’s Financial Conduct Authority. The company is also tightly regulated in the Asia–Pacific region, with regulatory licenses issued by the Australian Securities and Investment Commission, the Japanese Financial Services Agency, and the Monetary Authority of Singapore.

With proper financial compliance, routine auditing, and robust financials, OANDA is guaranteed to act in the best interests of its clients. It is no surprise that all of the broker’s policies and operational guidelines are created to comply with some of the best investor-centric rules in the entire market.

The company must maintain a minimum operating capital in each of its regulated divisions, perform a routine audit of its financial transactions, and segregate clients’ funds from its operating funds. It should also offer insurance to its clients in the US and EU against broker insolvency, which will provide an additional layer of protection to traders from these regions.

The only disadvantage here is that international traders are not protected by such insurance. Still, we can rest assured that the broker will extend the same quality of service to its entire client base without any discrimination.

Customer Service: Getting Help When You Need It

The customer support department at the broker is not the best in the market as it gets the job done on a need-only basis. Nevertheless, you can interact with the broker through email, phone, and live chat, but you must first go through an online support assistant—a programmed bot designed to get your query answered without human interaction. We are not great fans of this strategy since Forex brokerage is a highly stressful business, and account managers should be available on hand to deal with any client issues instantly. Nevertheless, once you get hold of the concerned department, the broker will ensure a speedy and satisfactory resolution.