FXCM is a well-known name in Forex and CFD trading and has been a permanent fixture in the markets since 1999. Over the years, the FXCM broker has encountered its fair share of disputes and liquidity issues in several global markets, but to this day, it still retains its name as one of the most trader-centric brokers in the entire market.

The company offers a wide range of Forex, shares, crypto, and CFD instruments through its platforms, and there are several unique advantages to trading the markets with it. Nonetheless, we set out to discover whether the current line-up of FXCM Forex products and services is suited to the most pressing demands of the ultra-competitive retail trading market. To learn more about the latest FXCM promos, its brokerage services, costs, and several other parameters, please read our entire FXCM review!

Features

- Trading tournaments

- Award-winning trading platform

- Live forex charts

- API trading

Special Offer

What Should You Consider before Opening an FXCM Forex Trading Account?

The FXCM broker is undoubtedly a reliable choice for retail and institutional traders, but it doesn’t necessarily cater to traders in every country. However, the company has an elaborate range of trading accounts suited to different trading needs. Therefore, our detailed FXCM review should help you pick the account best suited to your requirements. Here are some of the pros and cons of the companies at a glance:

- One of the oldest and most established brokers in the market.

- Regulated by top-tier regulators.

- Diverse choice of trading platforms.

- Comprehensive support for algorithmic and social trading, including free VPS for active traders.

- Custom-tailored FXCM account solutions for both retail and institutional trading.

- FXCM minimum deposit of $50.

- The FXCM fees are pretty competitive.

- Attractive FXCM promo options and FXCM bonus offers for traders.

- Does not have a presence in key markets such as the US, despite being owned by a US company.

- Restrictive FXCM trading hours, as weekend trading is not offered, even for crypto products.

- ECN direct market access trading is only offered to institutional traders.

Choosing an FXCM account can’t go wrong since it’s a great choice for active traders. However, traders must be aware of a few concerns before committing their capital to the broker’s account. The following sections of this FXCM review offer an unmatched representation of what to expect by trading the markets with FXCM.

What Are the Different FXCM Account Options?

Owing to our previous experience with the broker, we were expecting the company to offer 3 separate categories of accounts categorized according to the FXCM minimum deposit requirements. However, to our surprise, the company appears to have distanced itself from such a strategy by offering only 2 distinct FXCM account options to traders. The first option is a retail account, which only requires an FXCM minimum deposit of $50.

The retail trading account grants traders access to a market maker protocol, which may have a conflict of interest between the broker and the client. Nevertheless, the retail account provides access to algorithmic and social trading options. The broker offers an option to copy trades of other successful traders or to become a trader to offer copy trading services. The social trading platform is offered by ZuluTrade, an independent third-party social trading platform. Since there is only a single account choice, we will discuss the trading parameters and other conditions in later sections of this FXCM review.

The second option is an institutional account reserved for high-value traders that trade significant volumes. Institutional accounts are offered to companies, fund managers, and other similar organisations, where quotes are derived from interbank liquidity providers that consist of tier 1 banks and non-bank liquidity providers. Therefore, this account offers full ECN conditions with direct market access trading. The minimum investment required for the institutional account is determined on a case-by-case basis and can vary for each institutional account. For this FXCM Forex review, we evaluated the retail trading option since it is more relevant for our readers.

Setting Up an FXCM Account – How-To Guide for Retail Traders

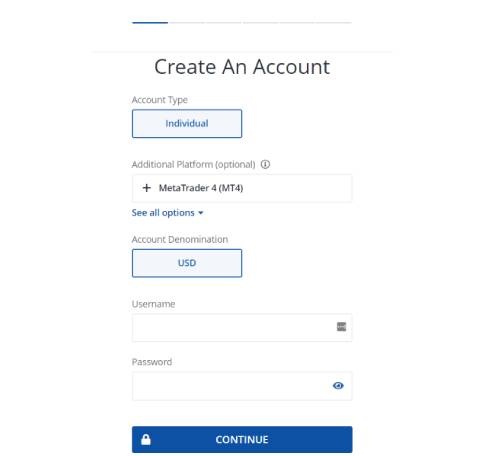

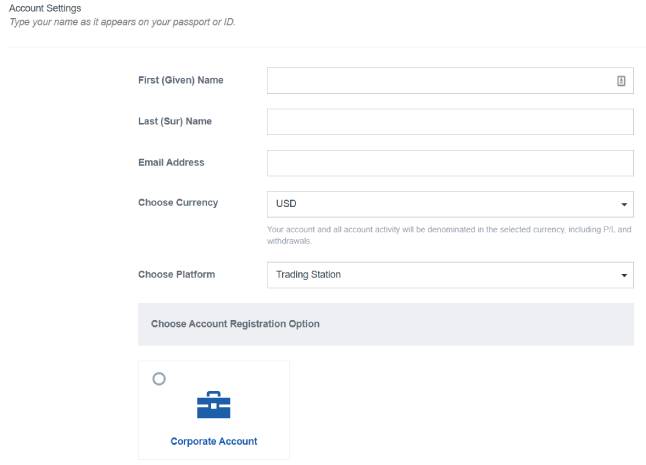

Retail traders can open an FXCM account by simply visiting the signup page, but institutional traders must contact the broker’s accounts department to set up an institutional account. There are 3 options for opening an individual retail account. The default choices give traders access to the proprietary TradeStation software; however, if you require access to MetaTrader, NinjaTrader, or ZuluTrade platforms, you will have to select these options at the time of signup.

Please note that traders cannot select all the platforms at once, so you will have to create different accounts for each platform. Once you have selected your preferred trading platform, the broker allows you to choose your account’s base currency and your preferred username and password parameters to log in to your FXCM account.

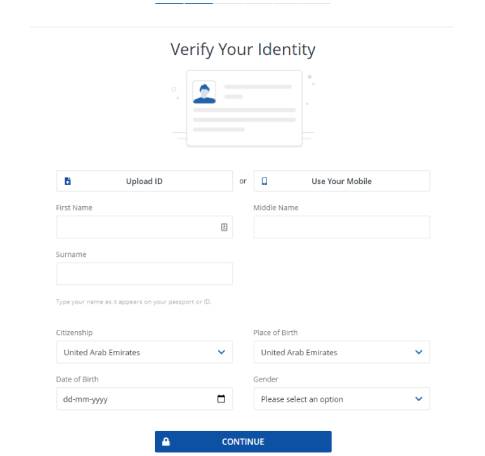

The next step involves verifying your identity, where you can upload an identifying document or use your mobile number to verify that you are a real user. Alternatively, you can enter your personal information manually, but you will still be required to upload your identifying documents later. We recommend uploading your identity documents and letting the broker fill in your details to ensure fast and secure verification of your account.

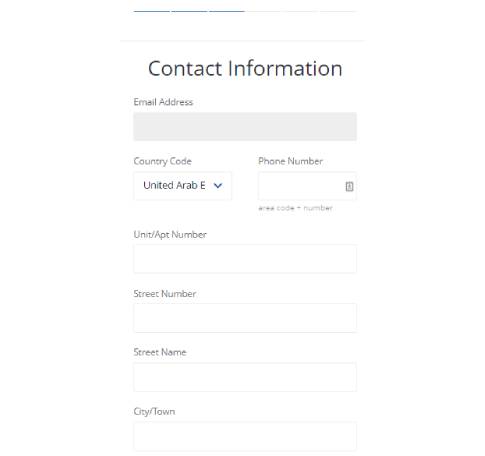

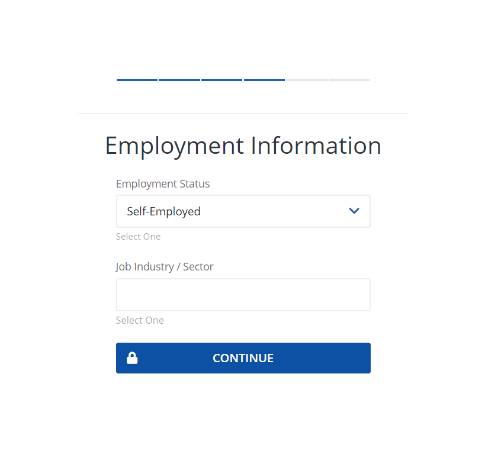

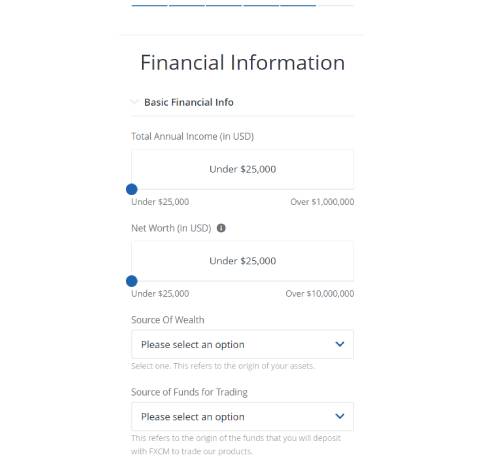

The next few steps ask traders to enter their contact information, employment information, and financial information. These stages are an important part of your account opening procedure, and we would suggest you be very careful when filling in these details. They are mandatory for KYC as part of regulatory compliance, and the broker will verify the authenticity of the information you have provided.

Finally, traders are asked to agree to the business terms and in particular are required to read the broker’s rate card and execution policies. Once you have read and agreed to the terms and conditions, the broker moves your application to its accounts verification department. You might be asked for additional documents to support your information. All accounts are subjected to a manual verification process, but traders will be allocated a trading account to start trading before all the documents are verified. The login parameters will be sent by email, so make sure that you provide a valid email address and save the broker’s email address to your contacts to ensure that you don’t miss any emails sent by the broker.

Although you are free to start trading as soon as you complete the signup process, we recommend waiting until the broker verifies your identity completely. Doing so will ensure that your deposits will be held safely and that you can initiate a withdrawal at any time.

FXCM Broker Platforms – Excellent Interfaces with Algo Trading Support

Traders are required to choose their preferred trading platform when signing up for an FXCM account, and there are several options on offer. The first option is the company’s proprietary Trading Station interface, which includes a Web 2.0 platform accessible through a web browser and an installable desktop platform for Windows users.

Trading Station Web 2.0 is the broker’s recommended choice for all types of users since it is compatible with both Mac OS and Windows OS. The web-based platform runs on HTML5 and has a clean, uncluttered user interface that provides all the essential features at your fingertips. The FXCM trading hours, quotes, trading widgets, and other useful features make Web 2.0 a compelling choice for most traders.

If you prefer a more conventional trading platform, the desktop-based installable Trading Station platform offers many more trading and charting options. For instance, the desktop interface supports advanced charting options, strategy backtesting, and custom indicators, which will be useful for professional traders.

Additionally, the desktop FXCM Forex platform provides real-time data on volumes traded, trader sentiment, and market depth, offering better insights into the market trends. Although we were incredibly pleased with both versions of the Trading Station platform, we were disappointed that the installable desktop version is not directly available for Mac OS users. Of course, the company does provide a few workarounds for its Mac users, but all of them involve using third-party services to run the Windows Trading Station version on Apple devices. Using such an option can be expensive and is not recommended due to privacy and security concerns.

For those who seek the stability and familiarity of a MetaTrader terminal, the company offers the MT4 option, which should once again be chosen as the preferred trading platform when signing up. The MetaTrader 4 terminal is compatible with both Mac OS and Windows OS, making it easy for all users to access the markets as soon as they download and install the platform. Of course, if you don’t wish to download the MT4 app, you can always access the web version of MT4 through a compatible web browser, and you are good to go.

The MetaTrader4 interface supports customizability options, including custom indicators, EA access, ZuluTrade, and automated trading. The broker has a dedicated app section where traders can download free and paid apps from the MQL forum, including EAs, indicators, scripts, and other add-ons. Furthermore, the broker also offers a free VPS option for active traders, which ensures that your trading bots can operate around the clock without any stoppages.

Overall, the performance of the MT4 platforms is indeed similar to the Trading Station platform, with no conceivable differences in terms of the pricing of assets or speeds of order execution. With access to a wide range of customizable options, we are very satisfied with the broker’s MT4 offering. However, if we are truly forced to find an issue here, it would be that the company does not offer the MT5 terminal, which is the preferred platform for many professional traders.

Under normal circumstances, we would have stopped our FXCM review of platforms after evaluating the MT4 terminal. However, we were a bit surprised to see that the company also provides its traders with the option of trading the markets with NinjaTrader, a third-party trading app akin to MetaTrader and cTrader. NinjaTrader 8 is largely similar to its competitors, such as the MT4, MT5, and cTrader platforms.

Still, it has several unique advantages in advanced charting options, automated trading, order execution, and trade management. It also supports spread betting for British and Irish traders, which may not be available for traders from other parts of the world. Nevertheless, NinjaTrader is a good option if you are looking to diversify your trading platforms for comprehensive market access.

The FXCM broker also supports custom-tailed options for those who prefer automated or social trading. The ZuluTrade social trading platform is a third-party copy-trading service that connects traders with investors through a tried and tested automated social trading interface.

There are different subscription options: traders can copy the trades of successful traders in exchange for a subscription fee or they can allocate capital to a professional trader’s fund and enroll in a profit-sharing scheme. Additionally, traders can use their FXCM account to offer their services through the ZuluTrade platform. They can monetize their trading strategy or offer trading signals for a subscription fee.

Finally, the broker has partnered with Capitalise to offer CapitaliseAI, where traders can create a trading strategy, type their code, backtest their strategies, simulate live market trading, analyze performance metrics, and modify them through an automated strategy creator. It uses several advanced programs and a library of automated strategies to help coders develop the best-automated trading strategy. The CapitaliseAI feature is devoid of any FXCM fees, which is an incredible advantage for traders when we consider it in terms of value addition alone. Therefore, with so many FXCM Forex platforms to choose from, the company has developed one of the best brokerages.

Taking a Brief Look at the FXCM Apps Available for Mobile Trading

It is not surprising that a company that has given due thought to offering some of the most advanced desktop platforms has also provided some of the most feature-rich mobile trading platforms for trading on the move. The broker’s proprietary Trading Station interface is available for iOS and Android devices and can be downloaded from the respective app stores. It adopts the same trading engine as its desktop platform but is lacking some advanced charting and custom indicator options.

Of course, we are not too bothered about this since we should expect mobile trading apps to be slightly inferior to dedicated desktop apps due to the obvious dissimilarities in processing power. Even the broker is aware of the shortcomings, and it only recommends using its apps for quick market access while trading on the move.

Mobile trading is also available for MT4 users, where the dedicated MT4 app is available for download from the Apple App Store and the Google Play Store. The MetaTrader mobile apps are some of the best mobile platforms in the market, and they continue to do an excellent job for FXCM users as well. While mobile trading is available for Trading Station and MT4 platforms, there is no such option for NinjaTrader users. NinjaTrader8 is available for iOS and Android devices, but FXCM does not support such an option. It is indeed a massive inconvenience for NinjaTrader users, and we have yet to receive a satisfactory response from the broker regarding this issue.

For social and automated trading, the ZuluTrade and CapitaliseAI apps are readily available for managing trades on the move. These services have dedicated mobile apps that allow traders to link their FXCM accounts to the respective accounts in ZuluTrade and CapitaliseAI, where traders have complete freedom and flexibility over their trading strategies. Therefore, as far as mobile trading is concerned, traders are indeed treated to some of the best mobile FXCM apps in the market.

FXCM Promo, Bonus, Cash Rebates, and Other Offers

Due to the strict regulatory compliance enforced on FXCM by some of the top regulators in the market, we honestly didn’t expect any FXCM bonus or promotional offers. However, to our surprise, a few sizeable FXCM promo offers are available to both new and existing clients. For new account holders, the broker offers an initial FXCM bonus of up to $300 for an FXCM minimum deposit of $5000. The bonus is only available once per client and cannot be clubbed with other offers. Traders are expected to trade at least 1 standard round lot before the FXCM bonus funds are credited to their trading account.

The FXCM broker also hosts several tournaments for traders through various contests, where traders can compete against each other to win prize money. Most of these contests are organized through the broker’s demo trading platforms, which prevents live traders from participating in most of these contests. Nevertheless, these tournaments are indeed open to all new and existing clients, with the only requirement being that traders must have a fully verified account at the broker.

Each contest has a fixed prize pool and certain rules and regulations regarding the tradeable markets and acceptable trading strategies. The top 3 traders are usually rewarded from the pool, while the prize money will usually be paid out until the tenth-ranked trader. The FXCM bonus winnings from these contests do not involve any restrictions and can be withdrawn.

There is another FXCM promo offer in a “Switch Bonus,” which pays out $25 if you switch your trading account from your existing broker to FXCM. It is not a huge sum of money in terms of liquidity or trading capital, so we are not fond of this particular promotional campaign. Had the broker increased the switching FXCM bonus to a more considerable amount, it would have made more sense for traders to switch to FXCM. Nevertheless, if you are working with a small amount of trading capital, the $25 “Switch Bonus” FXCM promo option may help increase your equity.

The broker offers active traders its Active Trader Rebate program, which rewards traders for every lot traded. The tier-based rebate program pays anywhere from $5 to $25 per million traded, with the maximum rebate of $25 paid to traders who trade at least 400 million in notional volumes. Finally, a few value-added services are available to traders without any FXCM fees or subscription charges. These include a subscription to TradingView Pro and a VPS option for automated trading.

TradingView is a third-party service provider that combines social networks and detailed trading data into a single web-based interface, allowing traders to interact with other traders and perform a detailed analysis of the markets through a web browser. VPS is a virtual private server that allows traders to run automated trading bots 24/7 without worrying about connectivity issues.

These free services require traders to trade a minimum volume each month, or they may be suspended at the broker’s discretion. We wholeheartedly believe that these value-added services and the cash rebate program offer more value to a trader than an outright FXCM bonus. Still, we are ultimately glad that there is indeed an FXCM promo offer that caters to every unique segment of retail and institutional traders.

The Most Preferred Funding Option and the FXCM Minimum Deposit Requirement

The broker provides a wide range of funding options through its client-service portal, where traders can make a deposit as soon as they open an account. We would urge our readers to verify their FXCM account before depositing funds, even if the broker has not mandated account verification for the first deposit. However, verification is necessary to initiate a withdrawal, which is why we usually recommend that our readers verify the account first before depositing.

As far as the actual deposit methods are concerned, there are 6 different options. The broker supports conventional deposit methods such as a debit/credit card payment or bank transfer, while e-wallet payment options include Skrill, NETELLER, and Union Pay. Traders may also deposit funds via their crypto wallets since the broker supports a wide array of cryptocurrencies.

| FXCM Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: up to 2 business days | Min. Deposit: $50 | Deposit Fee: Depending on choosen method |

|

Payment Methods:

BANK-WIRE

SKRILL

NETELLER

|

||

The FXCM minimum deposit is $50 for retail traders, and the most preferred funding method is through an e-wallet transfer or a credit/debit card payment. These payment systems allow instant transfers, where the deposit amounts are credited instantly. A bank wire transfer can take longer, with domestic transfers taking up to 2 days for funds to arrive and international transfers taking up to 5 days for a full payment settlement. All payment options may include transaction fees, and it is good to consult with your FXCM account manager to learn more about the FXCM fees associated with each funding method.

Traders can initiate a withdrawal request, provided they have a verified account and haven’t accepted a bonus from the broker. All withdrawal requests are handled with priority, and the broker ensures that all eligible withdrawals are processed on time. Of course, there is reason for concern among a certain section of traders, primarily due to the liquidity issues that the company faced in the past. However, today, the risks have diminished massively since FXCM is one of the most robust and heavily regulated Forex brokers in the entire market. During our FXCM review, the company processed almost all withdrawals within 48 hours, and the funds usually reached us within 3 to 5 days.

| FXCM Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 3-5 business days | Min. Withdrawal: - | Withdrawal Fee: - |

|

Payment Methods:

BANK-WIRE

SKRILL

NETELLER

|

||

FXCM Trading Hours, Fees, Leverage, Spreads, and Other Parameters

The company’s dealing policies for retail traders adopt a hybrid model that works with a combination of market maker and direct market access protocols. The orders are matched internally through an automated trading desk. However, during a liquidity crunch the broker may opt to pass on trades to an interbank liquidity pool.

Still, it all depends on the underlying market conditions and the liquidity of the markets. Therefore, there can be an element of conflict of interest for retail traders. The broker addresses this issue by following a no-look policy, where the broker avoids being a counterparty to its clients’ positions in the market. As a result, all orders are executed at market conditions with maximum transparency to minimize the risk to traders.

However, institutional traders get access to ECN conditions through a direct market access protocol, where all quotes are derived from an interbank liquidity pool. Consequently, the FXCM fees for institutional traders are also considerably lower than those experienced by retail traders. For reference, the average spread for the major EUR/USD pair is quoted at around 0.3 pips for institutional accounts, while the spread for the same pair increases to 1.3 pips on average for retail traders.

Of course, the FXCM broker promises a zero-pip spread guarantee. Still, our detailed FXCM review revealed that the average spread for the major currency pairs in an institutional account revolved around 0.3 to 0.7 pips. The average retail spread was around 1.2 to 2 pips for the major pairs.

ECN trading does involve a commission, which in FXCM’s case is $4 per side lot traded, or $8 for round turn trading. This is a bit expensive since most of FXCM’s competitors offer ECN accounts where the commission starts from just $3 for round turn trading.

Combined with the spreads, the FXCM fees aren’t what we would call competitive, but the overall trading conditions are excellent. For instance, traders can use a wide range of apps, indicators, and custom tools to enjoy unprecedented market access, backed by the broker’s remarkable partnerships with leading liquidity providers. The liquidity is usually excellent, but slippages and partial order fills are common due to the nature of direct market access.

Despite the immaculate trading conditions, a few issues need to be addressed. For instance, the FXCM trading hours are very restrictive for exotic markets such as cryptocurrencies. In real-world conditions, cryptocurrencies remain open and liquid for trading over the weekend, but the FXCM trading hours for these instruments end on a Friday. Furthermore, the leverage and margin requirements vary for traders according to their geographic location since retail traders from the UK and other parts of the world can only use a maximum leverage of 1:30. Of course, professional traders can use a maximum FXCM leverage of 1:400, but they will have to waive their right to be protected under the ESMA guidelines.

How Regulation Ensures a Safe and Secure Environment

FXCM is one of the most heavily regulated Forex brokers in the market. In the UK, FXCM is regulated by the Financial Conduct Authority, while in the EU, the broker is regulated by the Cyprus Securities and Exchange Commission under the ESMA guidelines. The European regulation ensures that the company adheres to strict regulatory guidelines to ensure the security of clients’ funds and personal and financial information. Furthermore, the broker is regulated in Australia by the ASIC and in South Africa by the FSCA, which increases its presence in Africa and Asia-Pacific.

For other international markets, the broker offers its services through its branch located in Bermuda, which might not be as secure as its other divisions. Still, we can trust the FXCM brand to act in the best interests of its clients. Client security measures include routine auditing, insurance against broker insolvency, segregation of clients’ funds, on-time processing of withdrawals, ensuring the security of trader information, and more. As a result, an FXCM Forex account is indeed one of the safest options in the market.

Contact Information and Customer Service

One look at the broker’s customer service department offers an unprecedented account of its overall trader-friendly approach. From multiple access points to region-specific toll-free numbers, the broker ensures that it remains accessible even for the most remote traders, who can contact the broker through live web chat, toll-free numbers, WhatsApp messaging, email, and a web contact form. The detailed FAQ section is also pretty handy for answering the most common queries that clients may encounter while trading with the FXCM broker. Overall, we believe that customer satisfaction is a top priority at the company.