Vantage FX Review – Uncovering the Broker’s Secrets

Vantage FX is unlike any other conventional broker in the Forex market. It provides a global platform for traders to invest in 8 different asset classes, including Forex, commodities and share CFDs. The best part of trading with VantageFX is that it offers a regulated brokerage account with attractive bonuses for international clients. The Vantage FX trading brokerage was launched in Australia in 2009 and, since then, it has gone on to open offices in 4 different countries. The company continues to outperform in the highly competitive retail Forex industry with a truly global reach.

Several unique benefits of trading with Vantage FX WebTrader include an excellent set of social trading tools, minimal slippage, and transparent pricing policies. The broker has garnered good ratings in online rating forums, resulting from their amazing customer service policies. But does the company stay true to its promises? Does the broker provide the most conducive environment for online FX trading? In this Vantage FX review, we subject the broker to a comprehensive evaluation process to offer you the most thorough VantageFX review in the market.

- Pro trader tools & tutorials

- Active trader program

- Unlimited demo account

- Pro economic calendar

Analyzing the Vantage FX Account Types & Opening a Trading Account

This section of the FX Vantage review is all about understanding the Vantage FX account types and the different processes involved in opening an account. However, traders should first consider the advantages and disadvantages of Forex trading with VantageFX before opening an account. Here are a few of the pros and cons that we found through this VantageFX review:

- A direct market access broker with no conflict of interest.

- Impressive regulatory compliance.

- Low spreads and minimal slippage.

- True ECN trading conditions with no conflict of interest.

- MT4, MT5 and a proprietary Vantage FX app for mobile.

- Attractive bonuses for international clients.

- Outstanding customer service.

- Minimum investment for the Pro ECN account is high.

- The choice of instruments could be higher.

- International regulatory compliance is scarce.

We found several qualities and attributes that accentuated the broker’s Australian heritage, but some of these values were diluted by the broker’s global reach. We have seen this happen with other brokers since it would be impossible for a company to retain the same quality as it expands to newer markets. Nonetheless, our detailed review of the company did unearth enough evidence to suggest that there are still noteworthy qualities that make VantageFX an excellent broker for retail Forex trading.

Vantage FX Account Types for Different Levels of Traders

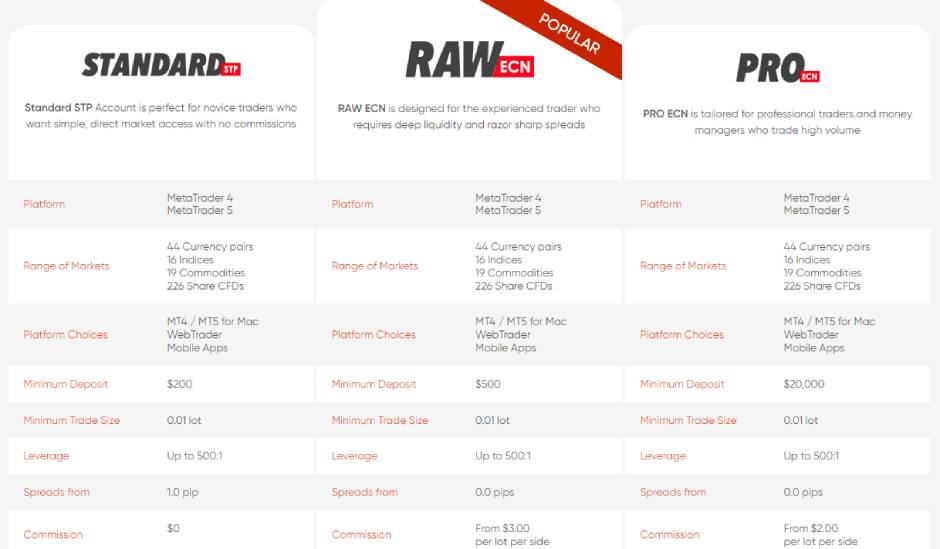

VantageFX is a direct market access broker that supports both ECN and STP protocols. There are 3 different Vantage FX account types: the Standard STP, Raw ECN and Pro ECN accounts. The Standard STP account is the least expensive option for Vantage FX trading in terms of minimum investment since it only requires a minimum deposit of $200. Although this amount may not appear to be too significant for a typical trader, it can be a fairly large amount of money for smaller retail traders. In comparison, other mainstream brokerages offer an STP account for just $5.

However, VantageFX has just followed the established template adopted by most Australian Forex brokers, where $200 is the norm. Nevertheless, the Standard STP account adopts a commission-free variable spread model with average Vantage FX spreads starting at 1.4 pips.

The Raw ECN account is the second type of account that promises zero pip trading, where the real-time Vantage FX spreads start at 0 pips. There is a $3 commission per lot per side, but the minimum Vantage FX deposit is pegged at $500. The Raw ECN account is not that expensive compared to the Standard STP account, but $500 is certainly more costly than the traditional ECN accounts offered by other mainstream brokers.

However, what bothered us was that the Pro ECN account, which is the third type of Vantage FX trading account, had an insanely high minimum deposit requirement of $20,000. For $2 per lot per side commission, the Pro ECN account does not offer any substantial advantage over the Raw ECN account. As a result, we highly recommend the Standard STP or Raw ECN account over the Pro ECN account.

All 3 Vantage FX trading accounts have similar trading conditions, including access to 305 instruments, MT4/MT5 access, minimum trade size of 0.01 lot, and a maximum Vantage FX leverage of 1:500. Since the broker adopts a direct market access protocol, there is no conflict of interest between the broker and the trader. All orders are passed to the interbank liquidity pool, which means that orders may be partially filled. Therefore, the broker has a minimal slippage policy, where all orders are executed at market conditions.

All Vantage FX account types come with a free unlimited demo, where you can trade with an unlimited virtual balance. There are no restrictions on market analytics, strategy testing, robot performance back-testing and trading strategies. You will have to sign up for a live account to access the demo account, but you can use the demo account for any amount of time and move to the live trading account as you get comfortable with your trading experience. There is also the option to open a SWAP-free Islamic account for Muslim traders, which offers Sharia-compliant trading conditions. However, the broker will charge an administration fee for overnight positions, and it will be deducted from the main account balance.

The Procedures Involved in Opening a Vantage FX Trading Account

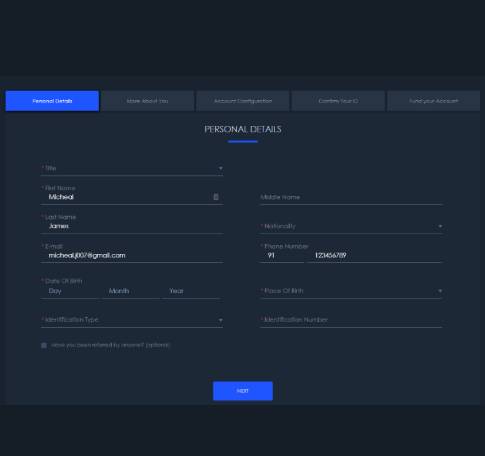

There are 2 options to open a live Vantage FX trading account: the Individual account and the Company account. The Company account is designed for firms and institutional traders, while Individual accounts are aimed at individual clients. The entire account registration process requires only 5 minutes at most, which means that you can start trading almost instantly. Traders can access the signup page through their mobile or desktop device, where the first step is all about submitting your contact information to the broker. You should provide your name, country, phone number and email address during the first step of the signup process, after which the broker takes you directly to the Vantage FX WebTrader client portal.

The FX Vantage WebTrader client portal is an integral part of maintaining an account at the company. You can change your trade settings through the account configurator, deposit/withdraw funds, update your profile, access Pro Trader tools and use the broker’s different market widgets such as technical analysis and video tutorials. However, before trading, the broker is very keen on verifying its clients’ identities, which can be done through the client portal itself. You will be asked to update your personal information, inform the broker about your trading experience and choose your preferred account specifications. You will also be asked to confirm your identity by uploading supporting documents, which the broker’s verification team will verify. The entire registration process should be complete within 5 minutes, but verification can take anywhere from 24 to 48 hours. You can deposit funds and start trading as soon as your identity has been confirmed.

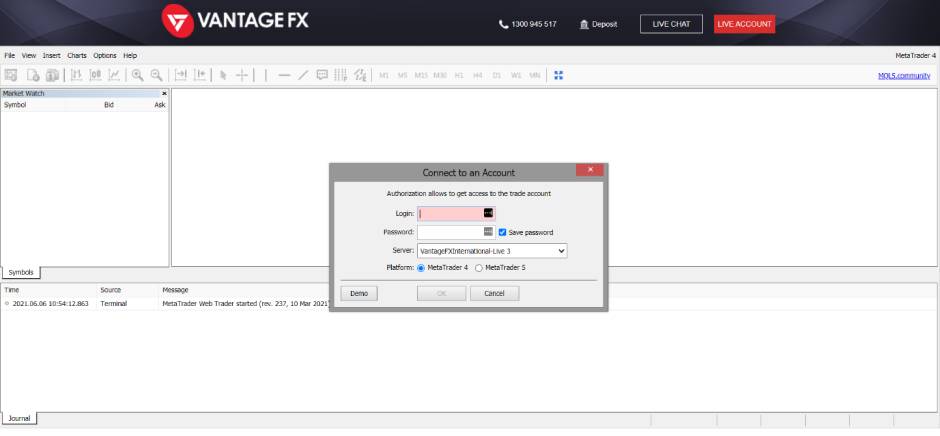

Do the Trading Platform Options Include a Vantage FX WebTrader?

The main FX Vantage trading platform duties are split between the MT4 and MT5 terminals. The broker does not provide any specialized proprietary platforms for desktop users, but it does support a Vantage FX WebTrader in the form of the MT4/MT5 WebTrader. Nevertheless, the MT4 and MT5 terminals are considered the best retail trading platforms, complemented by the broker’s excellent STP and ECN products. Another advantage of the company’s trading platforms is that they support a full suite of third-party social trading tools such as ZuluTrade, MyFXBook Autotrade and DupliTrade. Additionally, traders can also install EAs and custom indicators to the terminals, making it highly flexible for individual trader needs.

The performance of the MetaTrader terminals remains on a par with other brokers, but the company’s STP and ECN bridges did offer slightly better trading conditions than other brokers. For instance, the company has a minimal slippage policy that ensures most orders are matched at the quoted prices. Even the Vantage FX spreads were extremely competitive, which is the result of real ECN trading. The speed of order execution was fabulous, which ensures that traders can enjoy transparent market conditions with no conflict of interest.

Analysis of the Proprietary Vantage FX App for Mobile

Despite traders having the option to download and trade the markets with MT4 and MT5 apps on their iOS and Android devices, it was encouraging to see that the company has developed a standalone proprietary Vantage FX app for its mobile users. The proprietary Vantage FX app is available via the Apple App Store and the Google Play Store and is characteristically different from the MetaTrader mobile apps. The Vantage FX app is more aesthetically designed to offer a much better trading experience and is graphically superior to the MT4 and MT5 mobile platforms. It also contains several unique features that provide many advantages over its MetaTrader counterpart.

For instance, traders can sign up for an account through the app and complete the entire registration process without a desktop device. The broker even provides 24/5 multilingual customer support through the app, making it easier to contact support representatives while on the move.

The mobile app adopts a standard platform layout where traders can create a watchlist, place orders, monitor open traders, and set T/P and S/L levels. Furthermore, the app enables traders to analyze their trading statistics, which is a significant advantage over the MetaTrader apps. The Vantage FX mobile app also provides market analysis, trading signals, FX TV and a real-time economic calendar. Traders can even set price alerts and reminders via the app, allowing them to perform all trading activities through the mobile platform. Therefore, we believe that the broker has one of the most advanced and feature-intensive mobile Forex apps in the entire market.

Vantage FX Review of the Offers, Bonuses and Referral Promotions

We found it surprising that Vantage FX provides a bonus for its clients despite being regulated. Of course, these promotions are only offered to international clients, but it is quite noteworthy in the current regulatory environment. More and more regulated Forex brokers are turning away from the concept of bonuses entirely. On the contrary, VantageFX provides 3 unique promotions to its clients, making it more attractive to retail traders. The first bonus category is a credit bonus on deposits, which offers up to 50% trading credits on the first deposit. It is a tiered bonus program, where all deposits up to $1000 are eligible for a 50% bonus. For deposits beyond $1000, traders are eligible for an additional 10% bonus for a maximum bonus of $20,000.

However, the deposit bonus is only offered as trading credits and cannot be withdrawn. It also includes several trading conditions, which can put some restrictions on the Vantage FX withdrawal. Therefore, if you are looking to avoid the deposit bonus, you can always opt for the refer-a-friend bonus. The referral bonus is worth around $250 cumulatively, of which the referrer earns $150, and the referral earns $100 in bonus. The referral bonus amount can be withdrawn without any restrictions, which is a huge advantage for traders.

Active traders can also earn up to $8 per standard lot as rebates through the Active Traders Promotion. However, the program is only available for traders maintaining a minimum account balance of $10,000. It is also a tiered rebates program, where the rebates start from $2 per standard lot for a $10,000 balance, going all the way up to $8 per lot for account balances over $300,000. The rebates can either be redeemed as cash or as gifts, which include smartphones and gift cards. The rebate bonuses can be withdrawn without any restrictions.

Payment Options – Vantage FX Deposit and Withdrawal Methods

We discovered that the broker offers a wide range of funding options for both retail and institutional clients during our detailed Vantage FX review. The most preferred Vantage FX deposit method is wire transfer, which is available as both domestic and international transfer. Wire transfer is free of fees or processing charges, but the broker does not take responsibility for intermediary bank charges. It may take up to 2-3 business days and can be the slowest funding option.

The broker also supports other online payment methods such as credit/debit cards and e-wallet transfers for faster payments. Skrill, NETELLER, JCB, Visa and MasterCard are some of the most popular Vantage FX deposit options, but some e-wallets such as Skrill and NETELLER may charge a transfer fee.

| Vantage FX Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Depending on chosen method | Min. Deposit: - | Deposit Fee: Depending on chosen method |

|

Payment Methods:

SKRILL

NETELLER

VISA

|

||

To initiate a Vantage FX withdrawal, traders must always ensure that they have a verified account and satisfy all the bonus T&C. The FX Vantage withdrawal methods should also be the same as the deposit methods since the broker will enforce anti-money-laundering laws to prevent third-party payments. Therefore, even if you deposit funds using multiple payment methods, the broker will proportionally split up the payments between the different funding methods. We can’t fault the broker for this initiative since it is something that traders must understand before using multiple FX Vantage deposit methods for their trading accounts.

| Vantage FX Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 3 - 5 business days | Min. Withdrawal: Depending on chosen method | Withdrawal Fee: Depending on chosen method |

|

Payment Methods:

SKRILL

NETELLER

VISA

|

||

The actual Vantage FX withdrawal will take around a day or two, but it can depend on the Vantage FX withdrawal methods. For instance, e-wallet withdrawals will be processed within 24-48 hours, while wire transfers can take longer. We did not face any issues with our withdrawals, and we found the case to be the same for many other traders. Although we came across a few negative Vantage FX reviews from a small section of traders, the overall deposit and withdrawal experience was quite positive. Therefore, we concluded that these reviews might have been left by disgruntled former clients who have lost money in the markets of their own accord.

Vantage FX Trading Conditions – Fees, Leverage and Tools for Traders

The company adopts a transparent policy that ensures a safe environment for traders. Using direct market access technology through STP and ECN bridges has also helped the company eradicate any conflicts of interest. Therefore, the company can offer a 0 pip Vantage FX spread guarantee, along with minimal slippage. While ECN and STP trading involve a sufficient amount of volatility and liquidity, traders must be prepared to face partial order fills and slippages during times of low liquidity or high volatility. These were more prominent for the Raw ECN account, which was in line with our expectations.

The real-time Vantage FX spreads for ECN accounts hovered around 0 to 0.2 pips for the EUR/USD pair, which was quite impressive. Of course, we saw a few spikes during volatile and low-liquidity conditions, but the overall spreads were very competitive. However, the commission of $3 per lot per side, which equates to $6 per lot round turn, is marginally on the higher side. Some of the best ECN brokers in the market offer ECN commissions that charge as low as $3 per lot round turn. Regardless, the ultra-low FX Vantage spreads do compensate for the slightly higher commissions.

On the contrary, we found the spreads to be quite high for the STP accounts. The EUR/USD pair charges a minimum of 1.4 pips, but we have seen the spread rising to 3 pips without warning. While STP accounts also present direct market access trading, the broker is compensated by spreads alone, and there aren’t any commissions for trading. Regardless, we feel that the spreads are indeed high for STP trading, and traders may benefit by opting for the Raw ECN account.

All accounts come with SWAP and rollover costs, which are interest rates associated with rollover trades or overnight positions. There is also a dividend adjustment component for overnight cash index CFD positions, which are calculated on a daily basis. These costs are credited to, or debited from, traders’ accounts or reflected in their positions. The company has provided detailed costs associated with SWAPs, dividend adjustments and rollover fees on their website to ensure complete transparency in trading costs. The broker offers a Sharia-compliant Islamic trading account for Muslim traders, but the broker will still charge administrative fees for carryover trades.

The broker provides several trading tools that can replicate an institutional platform for retail traders. The Smart Trader Tools Package for the MetaTrader terminals offers some of the most advanced tools such as Alarm Manager, Correlation Matrix, Correlation Trader, Excel RTD Link, EA and custom indicators from the MQL forums. Traders can even create their own EA or use other EAs from the forum and run them 24/7 through the broker’s third-party Forex VPS servers. These servers are back-tested to ensure minimal downtime, so that your EAs are up and running without any issues.

Traders can also use several other tools such as Forex sentiment indicators and the broker’s proprietary PRO Trader Tools, which offer several unique trading tools for comprehensive market analysis. These are provided alongside the social trading platforms such as ZuluTrade, DupliTrade and MyFXBook Autotrade. However, the PRO Trader Tools are only offered for premium users, which requires a minimum Vantage FX deposit of $1000. The maximum Vantage FX leverage is limited to 1:500, but the leverage can be adjusted through the Client Portal. The broker may also restrict the leverage for certain products or during specific economic events. Nevertheless, accounts with a higher account balance will naturally have a lower FX Vantage leverage.

Regulatory Information of the Vantage FX WebTrader & Forex Services

Vantage FX is an Australian Forex broker regulated by the Australian Securities and Investments Commission. It is subject to the same stringent regulatory restrictions enforced on other leading AU brokers, making it one of the safest FX brokers in the market. To enhance the safety of its clients’ funds, the broker moves them to segregated accounts in AA-rated Australian banks, aside from providing indemnity insurance in Australia.

The broker is even regulated by the UK’s Financial Conduct Authority (FCA ref. number 590299), which opens up the broker’s services to traders in the UK and surrounding regions. However, due to BREXIT’s recent restrictions and the EU laws governing Forex trading, the broker has not provided any detailed explanations regarding its EU operations. Nevertheless, ASIC and FCA are 2 top-tier organizations that enforce trust among the broker’s clients.

However, the broker’s international regulatory status may be a cause of worry to some traders. The company is regulated by two offshore jurisdictions through its offices in Vanuatu and the Cayman Islands. These licenses are issued by the Vanuatu Financial Services Commission (VFSC) and the Cayman Islands Monetary Authority (CIMA). The VFSC and CIMA are lower-tiered regulators that are not as proactive in maintaining a strict regulatory environment for the benefit of the traders.

However, they have adopted several measures to replicate the policies and monitoring framework of the top-tier regulators in the market. Nevertheless, we trust the broker’s overall regulatory compliance, ethics, safety policies and transparency in services, which should bypass any reservations that we might have regarding its international regulatory status.

Dispute Resolution and Customer Service

We were very impressed with the broker’s commitment to maintaining the highest customer satisfaction levels in the industry. The company has developed a customer-focused platform that listens to its clients’ suggestions and complaints to continuously improve service delivery. The customer service department is available 24/7 through live chat, email, phone and web contact form. Alternatively, the broker also lets its clients contact broker representatives through the mobile FX Vantage app, which further increases accessibility for traders on the move.

The company has also provided an option of one-to-one remote customer support through TeamViewer, which allows the company’s support team to be hands-on while debugging software issues, providing installation help, or assisting traders with other trading-related issues. These attributes have indeed helped the company achieve a high rating on TrustPilot, which is certainly a worthy testament to the broker’s commitment to maintaining a healthy relationship with its clients.