FBS has made some grand claims regarding its global operations. The company claims to have over 16 million customers from over 190 different countries, with the cumulative profits for these customers exceeding $500 million annually. If the numbers are indeed a true representation of the facts, then there is no doubt FBS is one of the largest brokers in the entire industry.

Keen football fans might also have noticed the broker’s partnership with FC Barcelona. This sponsorship arrangement with one of the most lucrative and successful football clubs on the planet indeed signifies the broker’s financial stability and its futuristic outlook. However, this FBS review is more concerned with the broker’s real-world trading performance and how it fits into the highly competitive Forex broker marketplace.

Features

- Wide range of account options

- MT4 and MT5-based platforms

- Intuitive mobile trading apps

- Excellent collection of promotions

Special Offer

The FBS broker has a reliable brokerage platform that offers several distinct advantages to FBS traders. It is one of the few brokers to have a cent trading account that stipulates a very low minimum deposit requirement of just $1. The company also encourages its customers to participate in seasonal trading contests, in which the total worth of the prize money and gifts can reach up to $1.2 million. Traders also get access to some of the most competitive trading conditions.

Therefore, the highly professional FBS Forex trading service hasn’t taken a wrong step since it started its brokerage in 2009. The company’s numerous awards and accolades are indeed a testament to its never-ending commitment to its customers. However, is an FBS trading account safe, or is there a serious issue lurking somewhere deep within the FBS platform? Join our journey to uncover the details in this expert FBS review.

Is the FBS Account Recommended for Retail Trading? Decoding the Account Types!

We would only recommend an FBS Forex account if we feel that the broker can meet the traders’ requirements. Therefore, we performed a thorough evaluation of the company’s entire product line-up and came across a few interesting findings. We have outlined a detailed list of pros and cons for FBS below to enable our readers to carefully consider the different features of the company and how these may affect their trading strategies.

- An award-winning brokerage with over 10 years of experience.

- Accepts traders from almost every country in the world.

- A wide range of account options, with the minimum FBS deposit starting at just $1.

- Timely processing for all FBS withdrawals.

- Access to both the MT4 and MT5 trading platforms.

- Offers ECN and STP accounts.

- CopyTrade feature for both traders and investors.

- A comprehensive collection of bonuses, contests and other promotions.

- The international brokerage is located in Belize and not regulated by any top-tier regulator.

- The choice of trading instruments is not as varied as hoped, despite the broker offering five different asset classes.

- The FBS spread for some account types is expensive.

It is undoubtedly refreshing to see that the company had a clear sense of direction while developing its products and services portfolio. However, the company is not without faults, as there is indeed some confusion regarding its international operations’ regulatory status. The company is also not the most economical from a cost-of-trading perspective, but there are a few FBS Forex accounts that do facilitate competitive pricing for most instruments. Overall, we would recommend an FBS trading account to our readers. You can read more about the types of accounts and the account registration process in the following two sections.

What Do Traders Need to Register for an FBS Account?

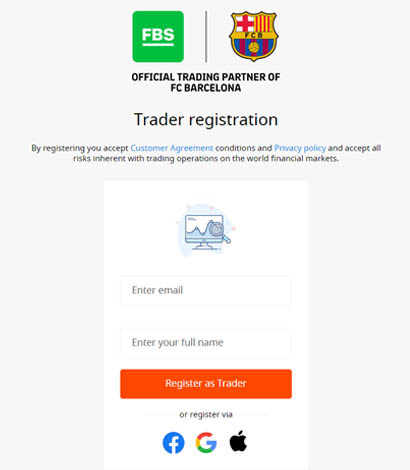

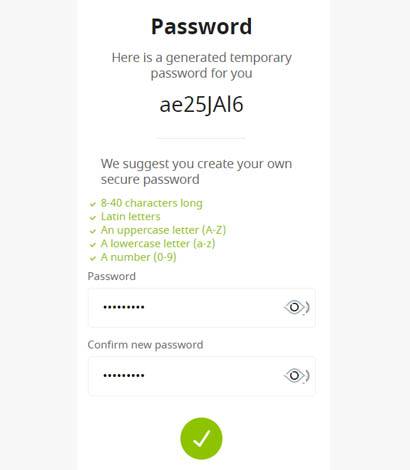

Traders can visit the ‘Open Account’ link on their desktop or mobile browser to open a trading account. All you need initially is an email address, or you can sign up using your Facebook, Google or Apple account. In the first step, you should enter your email address and your full name, which will take you to a pop-up window to choose a password. You can either proceed with the auto-generated password or choose an entirely new one if you prefer. The broker will send you a confirmation email with a link to verify your email address, which will take you straight to the remainder of the registration process.

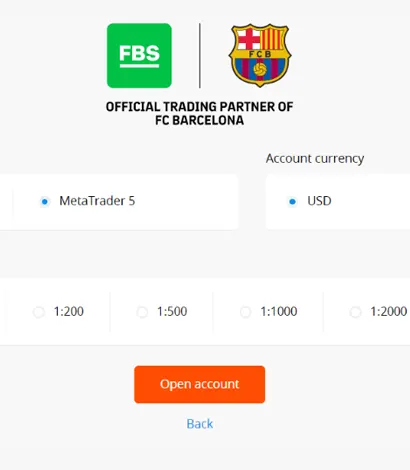

Next, you should choose your preferred trading platform, your preferred account currency and the maximum leverage you wish to use. When you click on the ‘Open Account’ link, a trading account will be created in your name and the website will display your trading login information. Ensure that you note down this information and safeguard it for future use, as the broker will not display the information again. You can proceed to your Personal Area or deposit funds for trading, but we suggest you proceed to your Account Cabinet and complete your account verification process.

The Personal Area dashboard is very simplistic and easy to use; you can verify your phone number and identity and manage your account all in one place. You will also be provided the links to download the trading platform or the FBS trader app, and you can open multiple accounts with different platforms, base currencies and trading conditions.

We also found that traders can download the FBS Mobile Personal Area app, which is available for Android and iOS devices. You don’t have to visit the website every time you want to modify or manage your account. You can use the app to sign up for an account through your mobile device, and you can even manage your account directly from the app. The app allows you to deposit funds, withdraw money, open additional accounts and access the trading apps.

Understanding the Key Differences between the FBS Trader Account Choices

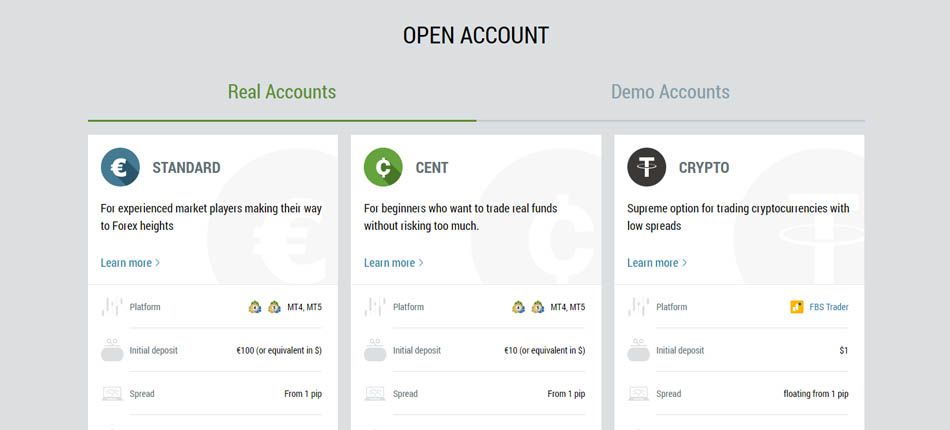

The company has paved the way for all upcoming brokers to follow a brokerage model that allows retail traders to trade the markets with an initial investment of just $1. It is indeed a significant departure from that of the brokers of the past, where the minimum deposit requirement used to be anywhere from $1,000 to $10,000. There are five different types of FBS broker accounts. With a $1 deposit, you can open the first category of trading account, known as the Cent account. It offers a $0 commission trading environment with STP trading conditions.

The broker promises market execution within 0.3 seconds, but we are not entirely sure whether the broker adopts an STP or market-maker protocol for its Cent accounts. Nevertheless, the minimum order volume ranges from 0.01 cent lots to 1,000 cent lots. The maximum leverage is pegged at 1:1,000, which is a huge margin for Forex trading.

For a slightly higher deposit of $5, traders can open the Micro account. The Micro account is better suited for standard lot trading with high leverage, where the minimum order volume is 0.01 standard lot and the maximum leverage on offer is 1:3,000. The Micro account is the most expensive account category with this broker, and we do not recommend it if you are looking for the lowest spreads and the most competitive trading conditions. If cost is a priority and you don’t have enough trading capital, you can open the Standard account, which requires a minimum of $100.

The Standard and Micro accounts are largely similar in terms of the trading conditions, but the spreads are low for the Standard account. Therefore, our pick would be the Standard account over the Cent and Micro accounts since all of these accounts have a maximum order volume restriction of 500 lots and a maximum order limit of 200 orders per trading account.

For full ECN conditions, you should opt for the Zero Spread account or the ECN account. The Zero Spread account has a minimum deposit requirement of $500, for which you get a fixed spread promise that starts at 0 pips. However, the Zero Spread account can be quite expensive since the broker charges up to a $20 commission per round lot traded, and there is a lot size restriction of 500 lots with a maximum order limit of 200 orders. The ECN account is the best option, in our opinion, since it charges only a $6 commission per round lot traded, and the spread starts from -1 pip. We are not certain how the negative spread works as it can lead to arbitrage, but the broker promises a spread value that can be below 0 pip.

The minimum deposit for the FBS broker ECN account is $1,000, which is slightly expensive. It is one of the very few drawbacks of the company, but we are willing to overlook it considering the excellent trading conditions on offer. The maximum leverage offered for the ECN account is 1:500, while the minimum order volume starts at 0.1 standard lot with a maximum limit of 500 lots. Nevertheless, there are no maximum trading limits since the ECN account transfers all clients’ orders to the liquidity provider.

Reviewing the Broker’s Trading Platforms – The MT4 and MT5 Terminals

The broker doesn’t have a proprietary FBS platform for desktop trading, which is not necessarily bad since it offers access to both the MT4 and the MT5 terminals for both STP and ECN trading. Both MetaTrader terminals offer some of the best trading tools and features commended by traders from all over the world.

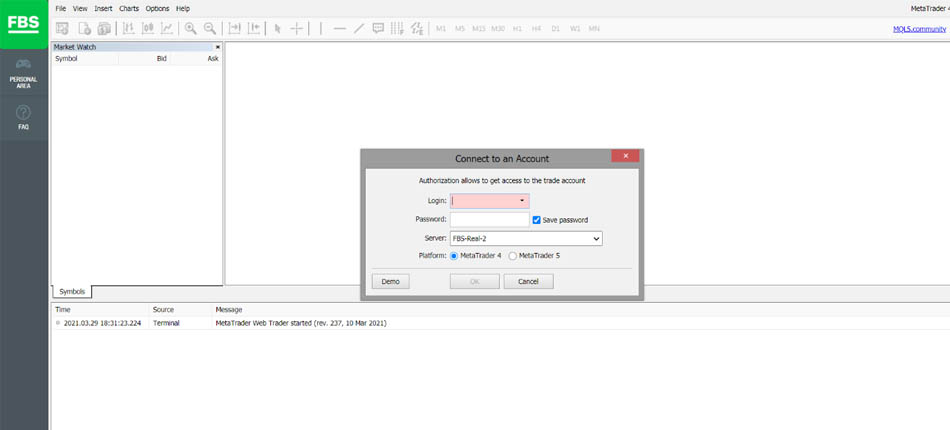

The broker gives full access to the entire suite of functionalities offered by MT4 and MT5, including EA access, custom indicators and the use of Multi-Terminal for MAM accounts. These platforms are offered as an installable platform for Windows and Mac OS users, or you can access your trading accounts through the WebTrader versions of these platforms. All you need is the login information you received at the time of registration, and you are good to go.

Unlike a few other brokers who link to the MQL website, FBS has hosted the WebTrader on its server and even offers Personal Area dashboard access within the terminal. It helps in accessing your account dashboard to make quick changes to your trading account, such as changing leverage, and we are impressed by the seamless transition between the WebTrader and the account cabinet.

Under live trading conditions, the MetaTrader platform’s performance attributes were quite predictable and in line with our expectations. The broker does not interfere with the trading conditions, apart from matching orders internally or passing them to the liquidity providers. Generally, the trading experience was quite positive, and we give full credits to the broker for the way it has integrated the MetaTrader terminals into its brokerage portfolio.

While we were satisfied with the broker’s platform options up until this point, we soon ran into a major issue when we tried to access the company’s CopyTrade platform. To our dismay, we found that the CopyTrade app was available only for mobile devices and not for desktop users. It could have been easily integrated into the WebTrader interface, just like the Personal Area dashboard, but we are clueless about why the company does not offer it for desktop users. Nevertheless, traders who wish to use the social trading feature may sign up for the MAM account option offered through the MT4 MultiTerminal, which offers a similar copy trade experience.

An Impressive Collection of FBS App Choices for Mobile Users

In this part of our in depth FBS Review we will take a look at the wide range of trading apps for mobile users. First, the MT4 and MT5 trading terminals are available to Android and iOS users through their respective app stores. You can use the same login information for mobile FBS apps, which means the MT4 and MT5 platforms work well for mobile devices. However, we were impressed with the FBS trader app, a proprietary mobile application that is available for download by Android and iOS users.

The installation can be done via the Google Play Store and the Apple App Store, and if traders are unable to install the FBS trader app on their Android device, the broker also hosts an APK file on its download page. Therefore, the broker has covered all aspects of ensuring a positive mobile trading experience for its customers.

The FBS trader app is a new offering in which the company has aimed to remove non-essential features that its traders may never use. Therefore, if you want the full trading experience, you can download the MetaTrader apps. But if you prefer a faster app with a more fluid design, the FBS trader app will offer you a really pleasant trading environment. The charts, the trading terminal, the app’s overall design and the actual trading experience were quite vibrant and a step above those of the MetaTrader apps.

For first-time users, we feel the FBS trader app might be the preferred mobile trading solution, but with time traders may switch their focus to the MetaTrader apps for their full feature list and trading superiority. Professional traders will prefer the mobile MT4 and MT5 apps to serve as their default mobile trading platforms.

There is also an FBS Mobile Personal Area app available for download from both the Google Play Store and the Apple App Store. It serves as your account cabinet, where you can edit your account information, manage your accounts, deposit/withdraw funds and contact customer support. The Mobile Personal Area app is simply an account management tool and not a trading app, although you can view your trading progress and your accounts’ general health. For trading, you will need your FBS trader app or your MT4/MT5 mobile apps.

Finally, there is a CopyTrade app for Android and iOS devices, allowing traders to indulge in extensive social trading activities. The CopyTrade app is designed for both traders and investors, and it is free to download for all users. You can copy other traders by paying a commission, or you can become a trader and earn commissions for every trade copied by investors. The app offers several tools to manage investments, such as allocating funds to different traders, managing capital, stopping copy trades and evaluating trading performance. The FBS CopyTrade app is one of the best social trading platforms we have encountered, but it is a shame that the app is not offered to desktop users.

Promotion, Bonuses & Contests – How to Get Exciting Cash Prizes & Gifts

First, we would like to inform you that the CySEC-regulated version of FBS does not offer any promotions or bonuses. Therefore, traders from the EU do not qualify for any FBS international brokerage bonuses. That said, there are some truly amazing offers for new and existing clients from all over the world, and the list of promotions seems endless. The first offer is a 100% deposit bonus, which offers an unlimited bonus for each client’s deposit. We are not sure how the company can support unlimited bonuses, but there are no limits or time periods within which the bonuses have to be used.

Traders can trade a number of lots that is equal to one-third of the bonus amount and withdraw the bonus amount, but they can withdraw the profits made from the bonus amount without any restrictions. However, premature withdrawal of trading capital may render the bonus void, and the broker reserves the right to cancel your bonus at any time.

However, if you don’t want to deposit funds, you can always opt for no-deposit free bonus money through the Level Up Bonus program or the Quick Start Bonus offer. The Level Up Bonus offers a free $70 for confirming your email address and an additional $70 for downloading the FBS trading Broker Personal Area app. Therefore, you can trade with $140 risk-free for 20 twenty days, and you can keep or withdraw the profits. There are certain conditions for receiving this bonus, such as passing a test conducted by the broker, maximum leverage of 1:100, only five open positions at a time, no scalping and, of course, all conditions must be met within 40 days. If you satisfy all trading conditions, you can withdraw your profits without any restrictions.

The Quick Start Bonus, on the other hand, offers a free $100 no-deposit bonus, and you are required to hone your trading skills and earn profits. The profits can then be transferred to a real trading account, where you can withdraw them. Other offers include the promise of a free VPS service for high-frequency or high-volume traders, cash back and cash rebates that are worth up to $15 per lot or 20% of the spread, and a loyalty program that allows traders to trade in these points for cash or gifts. The broker also conducts seasonal trading contests that offer prize money, cars, fully paid trips to FC Barcelona games, and even invitations to parties, leaders’ summits and more. This broker is truly one of the best for bonus campaigns, and you can expect premium offers for your deposits.

FBS Broker Deposit & Withdrawal – Funding Methods & Processing Times

FBS offers tons of different funding methods, depending on the traders’ geographic location and the availability of the local funding methods. For instance, traders from the EU can make an FBS deposit using Visa, MasterCard, Maestro, wire transfer, Skrill and Neteller. However, for international traders, additional FBS deposit options such as PerfectMoney, SticPay and Bitcoin are available, but at the expense of a bank wire transfer. Instead, it uses local money exchangers, a method we don’t trust. Therefore, we recommend that our readers use their e-wallets or cryptocurrency accounts to deposit funds and use local exchangers only if all other options are unavailable.

| FBS Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Varies between immediate and 1-4 days | Min. Deposit: $10 | Deposit Fee: Sender may pay bank wire fee |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

BITCOIN

|

||

For an FBS withdrawal, traders can withdraw their funds as soon as they verify their identity and satisfy the bonus terms and conditions. If you have not availed yourself of any bonuses, you are free to withdraw your money at any time, and the FBS withdrawal will be processed within the same day.

| FBS Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: Max 2 days | Min. Withdrawal: $1 / $50 (bank) | Withdrawal Fee: Determined by broker's rate |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

BITCOIN

|

||

Most e-wallet payments are processed within an hour, but the company asks its customers to wait two full working days before contacting the broker to inquire about their withdrawal status. Of course, you should also remember to initiate your FBS withdrawal to the same account used to deposit money, as the broker must comply with AML guidelines concerning the transfer of funds.

Therefore, if you have initiated a withdrawal request to a different account, the withdrawal may be delayed or cancelled altogether. You should contact the customer support department if you have made any changes to your payment method.

Competitiveness of the FBS Spread and Fees of Trading

The FBS spread fluctuates between two extremes of competitiveness. The trading cost for the Standard and ECN accounts is very low, as the Standard account quotes a floating spread starting at 0.5 pips with $0 commissions, while the ECN account quotes a negative spread with a very low commission of $6 per round lot traded. The Standard account’s typical spreads are around 0.8 pips for the EUR/USD pair, while the ECN account delivers a spread quote of 0 pips for the EUR/USD pair during active market hours. Hence, these accounts are our preferred choices for low-cost Forex and CFD trading.

The Zero Spread account is also quite competitive in terms of the spreads, as the company does not charge these account holders any FBS spreads. However, traders must pay a higher commission of $20 per round lot traded. The Zero Spread account is useful for high-frequency traders or those who trade during volatile market conditions, as they are not impacted by the volatile spreads that can see wild swings in the cost of trading.

Finally, the costs for smaller retail traders are slightly high, as the Cent account charges a floating spread from 1 pip, with the actual spread in the region of 1.2 pips for the EUR/USD pair. The Micro account is even more expensive, with the fixed spread starting at 3 pips, but the spread remains the same across all market conditions. Therefore, you have to carefully consider your trading strategies and their cost implications before choosing an account type.

There are additional costs for trading, which include SWAPs for overnight positions. However, the advantage of an FBS Forex account is that the SWAP can be positive or negative, which means you can make profits with currency pairs that offer a positive SWAP for a buy or sell position. On the flip side, negative SWAPs can be quite expensive, especially if you hold your positions over weeks and months.

Nevertheless, the broker does provide a detailed list of the SWAPs for different currency pairs on its website, along with the costs of trading other instruments from different asset classes. Finally, you should consider FBS withdrawal fees, as withdrawal is not free, unlike with the company’s immediate competitors. It is a small inconvenience, as the broker may charge anywhere from 1% to 2.5% of the transaction amount as fees. Regardless, there aren’t any hidden fees or charges, and the broker more than makes up for the associated costs by offering several unique benefits such as a free VPS service, educational materials, the Fix Rate feature and more.

Does FBS Protect Its Traders’ Money? – A Brief Look at the Regulatory Status

Despite the company’s top-quality services, we did have a few concerns regarding FBS regulation and its compliance with safety guidelines. Of course, FBS is a safe broker for Forex trading, as it has consistently demonstrated its commitment to quality and investor safety by ensuring that all clients’ funds are handled with the utmost care.

Similar to other companies included in our best forex brokers list, FBS does possess a regulatory licence issued by CySEC and aims to offer its brokerage services to residents of the EU. EU regulatory guidelines ensure that traders are protected by ESMA and MiFID derivatives, by which traders are compensated through the ICF in case of broker insolvency.

However, the broker is regulated by the IFSC of Belize for international traders, which is not a top-tier regulatory organisation like CySEC. Therefore, traders cannot expect the same level of protection from the company as that offered to traders from the EU. Nevertheless, the company does safeguard its traders’ investments and holds them in segregated accounts to ensure that clients can access their funds at any time without fear of misuse.

What Are the Customer Support Options?

Customers can contact the broker through live chat or request a callback, and the company immediately responds to its traders’ queries. We couldn’t find a phone number for its international brokerage, but we did come across a few social media handles and live chat options such as WhatsApp, Telegram, Viber and the like. For its EU division, however, we were able to find a dedicated phone number and email address, which signifies the advanced nature of CySEC regulation in ensuring that customers can access the broker directly for any matter related to their accounts. Nevertheless, the broker’s customer support team is live on call 24/7, which means you can contact them to address your concerns even on the weekends.