Pepperstone Review – A Top Fintech Forex Broker with a Modern Approach to Trading

Pepperstone broker is a sensational Australian broker for Forex and CFD trading. Despite its comparatively late entry into the market, the broker has become a leader in the ultra-competitive world of retail Forex trading. The company is indeed a prime example of how a forward-thinking start-up makes good use of modern technologies to offer a great trading environment through its fintech platform. Direct market access trading, powerful trading platforms, competitive pricing, low spreads, and strong regulatory compliance are just a few of the remarkable benefits of trading with a Pepperstone Forex account.

In this Pepperstone review, we subjected the company to a stringent evaluation process, which helped us unravel several positive and some negative attributes of the broker. Our extensive review process mainly deals with understanding the real-world trading performance and determining the reliability aspects of the company from a trader’s perspective. Therefore, please read our complete Pepperstone broker review for a professional appraisal of the company before opening a Pepperstone FX trading account.

- 1200+ instruments

- Tight spreads

- Free training

- Multiple trading platforms

An Exploration of the Types of Pepperstone Forex Accounts and Signup Options

Even though the Pepperstone broker is considered a top choice by many retail FX traders, you should still evaluate whether the company is a good fit for your trading requirements. We have generated a brief list of the pros and cons in this section of our Pepperstone review to help you make an informed choice. Our in-house trading experts verified these findings, opened a real trading account, and invested real money at the broker for live trading. It certainly helped us keep this Pepperstone review Forex findings accurate and representative of the actual trading environment offered by the company.

- Direct market access broker with access to a deep liquidity pool.

- Highly regulated trading environment.

- Safety and security of funds.

- Very competitive trading conditions with low Pepperstone commission and spreads.

- Excellent choice of Pepperstone FX accounts and trading platforms.

- High Pepperstone leverage for Pro traders.

- Impressive Pepperstone withdrawal policies that ensure on-time withdrawal.

- EU safety standards and regulatory protection not guaranteed for international traders.

- Does not accept traders from the United States.

- Direct market access trading conditions may not be suitable for beginner traders.

The Pepperstone review Forex testimonials provided by existing clients of the company, along with our findings, have given us ample evidence that the broker has done a great job in offering a trusted Forex brokerage platform. The company has managed to offer satisfactory trading performance for most traders. It is undoubtedly one of the main reasons the company has more advantages than any real drawbacks, prompting us to recommend a Pepperstone Forex account to our readers.

Types of Pepperstone Forex Accounts and Their Features

The broker offers an identical trading environment for all traders irrespective of their initial investment or trading background. The default trading conditions include:

- Direct market access trading.

- A minimum Pepperstone deposit of 200 units of base currency (which includes the USD, GBP, AUD, and other major currencies).

- A minimum lot size of 0.01 lots.

- A maximum Pepperstone leverage of 1:400 for retail and 1:500 professional.

All orders are transferred to the liquidity pool without the involvement of any dealing desks, which ensures that the company does not trade against its clients. As a result, there is no conflict of interest, and traders can enjoy true ECN conditions with a 0 pip spread guarantee regardless of the trading platform. However, to satisfy the varying demands of the retail trading market, the broker indeed offers two categories of trading accounts to accommodate two separate pricing models. These models include a Pepperstone commission-based Forex pricing structure, offered under the Razor account plan, and a spreads-only pricing model offered through the Standard account.

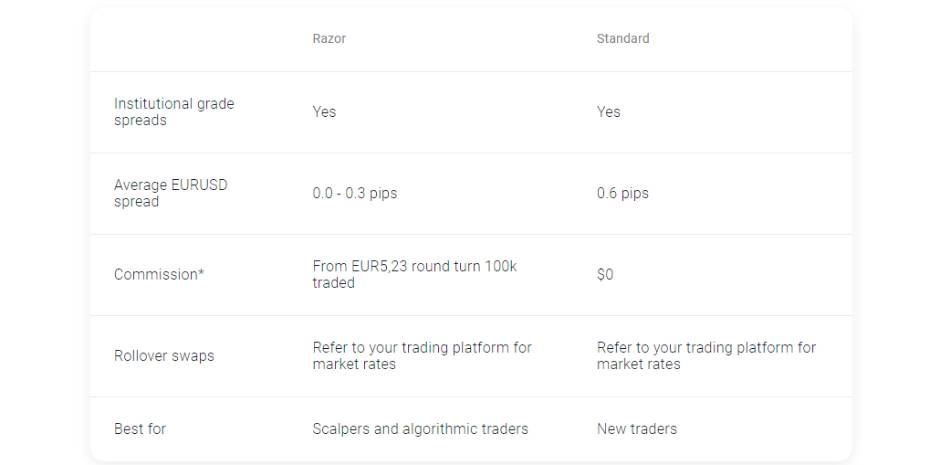

There are only a few subtle differences between the Razor and Standard accounts, chief among which is the changes in the pricing model. The Razor account offers very tight spreads that vary between 0 and 0.3 pips on the EUR/USD pair with no markups, which is extremely competitive.

There is also a Pepperstone commission of $7 for every round-turn 100K traded, equating to $3.5 per 100K for single-side trading. In terms of competitiveness, the Pepperstone commission is not the lowest that the market has to offer, but it is somewhat in the median range. Some of the company’s immediate competitors may offer a competitive commission as low as $2 per 100K for single-side trading, making the broker a slightly more expensive option for high-frequency traders. Nevertheless, the ultra-low spreads should make up for any higher costs incurred through a higher Pepperstone commission.

Suppose you are not a fan of commission-based pricing models. In that case, the company’s Standard account offers a spread-only trading environment, which charges a highly competitive 0.6 pip spread on an average for the EUR/USD pair. It offers the same trading conditions as the Razor account, minus the commissions, which ensures that traders only need to account for the markup spread that the broker quotes. Of course, this pricing model may not suit scalpers, who require tight spreads, but swing traders and beginners will certainly find the Standard account to their liking. Moreover, the absence of any conflict of interest is surely a bonus regardless of your choice of trading account.

The Pepperstone broker also offers the option of SWAP-free trading for traders from certain countries that follow Islamic religious beliefs, where it is illegal to pay or receive interest. The SWAP-free account does offer the same liquidity and trading conditions as the Standard and Razor accounts, but the spreads are slightly higher. For instance, the EUR/USD pair quotes around 1 to 1.2 pips on average, while SWAP-free account holders will also have to pay admin fees for positions held beyond 10 days.

A detailed analysis of the trading costs will be given in later sections, where we perform extensive Pepperstone review Forex costs for trading, deposits, and withdrawals. However, for now, let’s move on to evaluating the entire process of opening a Pepperstone Forex account and what you need to verify your identity and start trading.

Opening a Pepperstone FX Account and Verifying Your Identity

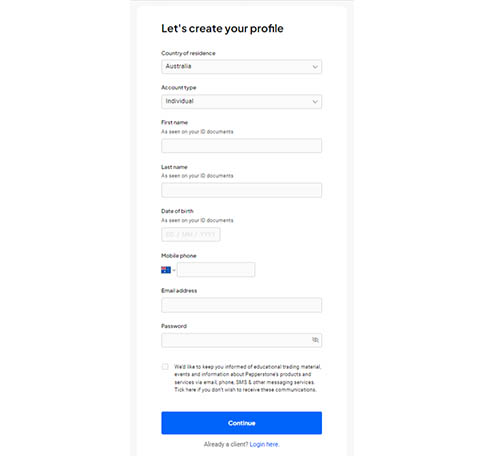

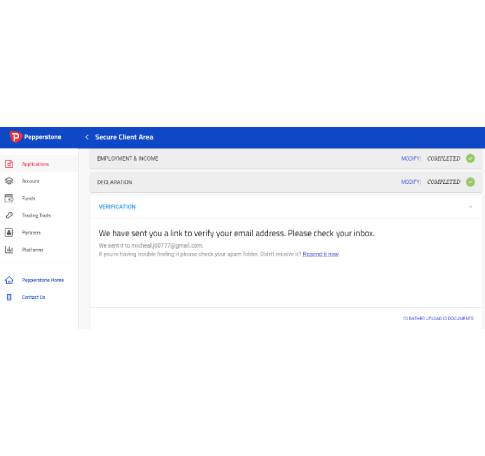

All you need to register for an individual Pepperstone Forex account is an e-mail address and a few identifying documents to confirm your ID. Alternatively, you can also register with your Google or Facebook credentials, linking your existing social media accounts to the Pepperstone broker account. Of course, you have the prerogative to choose your preferred option, but we would advise you to keep a separate e-mail address for trading purposes that is not linked to your social media accounts. It will help you keep your trading account separate from your social media profiles while enhancing privacy and security. You can access the signup page through your desktop, laptop, or a mobile device such as a smartphone or tablet. However, there isn’t a proprietary Pepperstone app for signing up, so traders must open up the website on their web browser to register for an account. Nevertheless, Pepperstone FX account registration can be completed in 4 steps, including account verification and making your first Pepperstone deposit. However, make sure you set aside ample time to submit all the information, as the entire account registration process can take more than 10 minutes.

Once traders submit their e-mail address at the first step of the registration process, the broker will ask them to choose the type of account (you have a choice between individual, joint, corporate, trust, and other account options), the country of residence, and a password for the client cabinet. Clicking on “Register” will take you straight to the Secure Client Area, where you have to complete the remaining steps of your application.

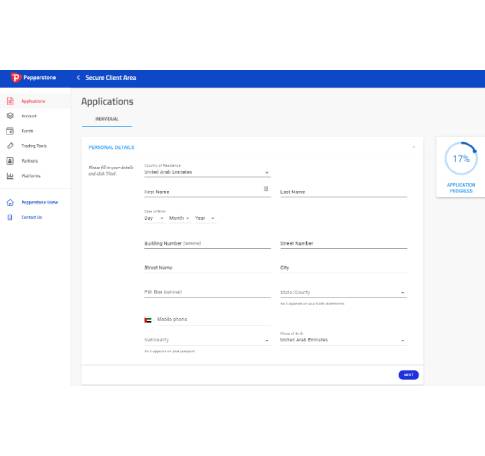

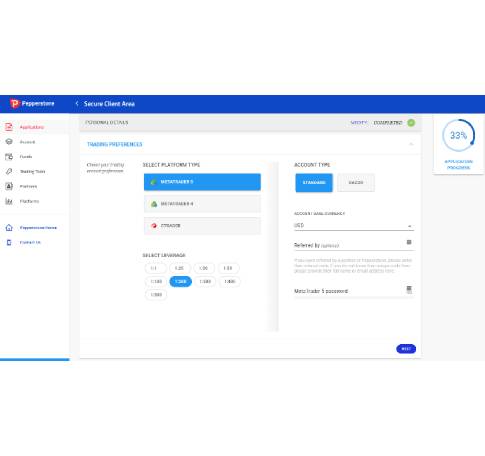

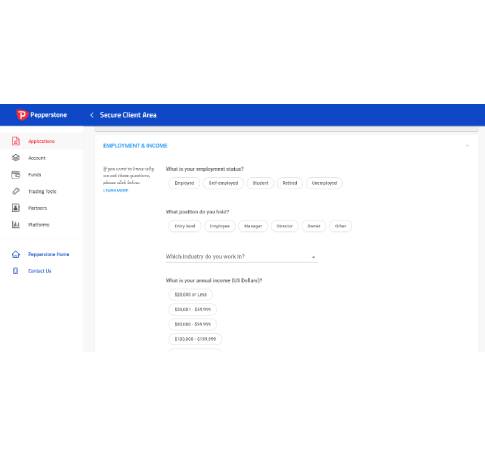

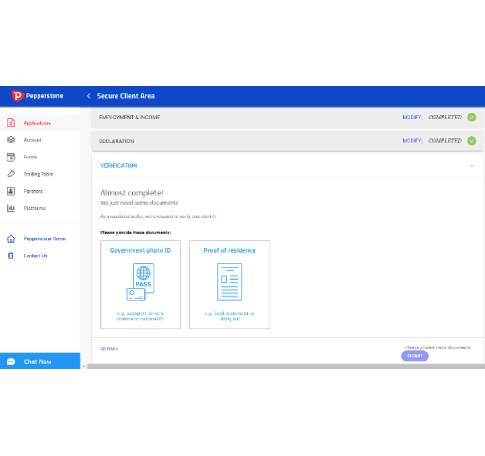

During the second phase of the Pepperstone FX account registration, traders are prompted to enter their personal details, trading preferences, choice of platform, type of account required, employment details, and income information. There is also an option to verify traders’ identity, which can be done by uploading a government-issued identity document and a utility/bank statement.

However, there is a small hurdle when it comes to choosing your preferred trading conditions. The maximum Pepperstone leverage is restricted for new traders unless they opt for the Pro account option, which requires traders to have prior experience in Forex and CFD trading. It is implemented to satisfy the regulatory requirements in place to minimize risk to new traders. Nevertheless, the broker does enable its clients to opt for the maximum Pepperstone leverage by submitting a self-declaration, outlining their expertise in the markets and their knowledge of the risks in leveraged trading.

A Pepperstone deposit can be performed as soon as you verify your identity. The broker allocates a trading account in your name, the details of which are displayed in the Client Area. Of course, it is also possible to open additional Pepperstone broker accounts through the Client Area dashboard, so you don’t have to worry about opening the wrong account at the time of signup.

Pepperstone App Choices and a Review of Their Real-World Trading Performance

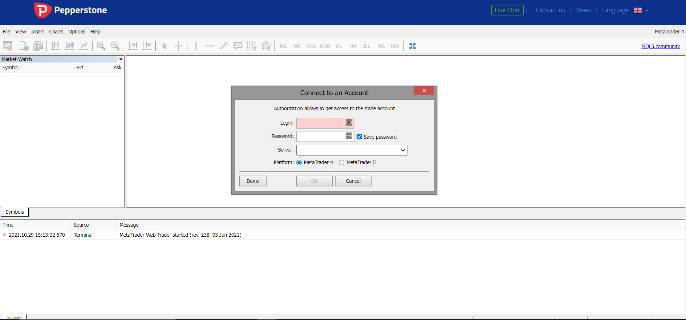

Traders are given access to third-party Pepperstone apps for both desktop and mobile trading. These include the popular MetaTrader 4, MetaTrader 5, and cTrader terminals. The MT4 and MT5 platforms are compatible with Windows and macOS devices, while cTrader is restricted to Windows OS. Nevertheless, all 3 apps are accessible via a compatible web browser, which does help traders who prefer trading the markets without a dedicated desktop device. We did notice the absence of a proprietary Pepperstone app, but we are more than happy with the option to choose between MetaTrader and cTrader platforms.

The Pepperstone apps are fully compatible with the broker’s direct market access trading conditions and provide interbank liquidity for all traders. All 3 platforms support automated trading, customizable charting options, and social/copy trading functionality through independent providers such as myfxbook, MetaTrader Trading Signals, and DupliTrade. However, there are a few differences between the apps, and you should choose a platform that suits your trading preferences. For example, share CFDs are only offered through the MT5 platform, while cloud-hosted profiles, templates, and passwords are only offered on the cTrader platform.

The cTrader is also pretty popular for its innovative features, such as detachable charts that can be opened simultaneously in multiple monitors, advanced take-profit/stop-loss levels, and flexible trading conditions. Meanwhile, the MetaTrader terminals are renowned for their EA trading support and a full-fledged MQL open-source forum. Therefore, you can use the option of a demo Pepperstone Forex account to test the 3 different platforms and choose the one you prefer. Of course, it is also possible to open multiple trading accounts through your Client Area and choose different trading platforms for each if it indeed suits your trading requirements.

Real-world trading performance is one of the main Pepperstone review Forex parameters that we evaluate while reviewing a Forex broker. However, all Pepperstone app options were third-party options, which meant that we only needed to test the efficiency of the trading servers and the speed of real-time order execution. We have had plenty of positive experiences with the MetaTrader and cTrader platforms in the past, but combined with the liquidity conditions offered by the broker; we feel that traders will prefer Pepperstone over any of its immediate competitors.

A detailed analysis of the trading conditions will be provided later in this Pepperstone review, but in terms of the performance of the apps, we found them to be quite satisfactory. Latency was pretty low, and we did not feel any lags or issues with the trading servers. However, trading instances related to liquidity, such as partial order fills associated with direct market access trading, should not be misconstrued as a performance-related issue. As a result, we were pretty satisfied with the overall performance of the Pepperstone apps.

Mobile Pepperstone App Review for Android and iOS Devices

The company does not offer a proprietary mobile Pepperstone app since traders can access the mobile versions of MT4, MT5, and cTrader on their smartphones or tablets. All modern versions of the MetaTrader and cTrader platforms are available for Android and iOS users and can be installed directly from their respective app stores.

The performance of the apps, such as the order execution speeds, the latency of trading, and all other trading parameters, is similar to that of the desktop platforms. We couldn’t find any serious issues or problems while trading the markets with the mobile Pepperstone apps. Since we were already familiar with the performance attributes of the MetaTrader and cTrader apps, we were indeed satisfied with the overall performance of the mobile platforms.

*74-89% of retail investor accounts lose moneyCash Rebates, Bonuses, and Free Money Promotions at Pepperstone

We performed an extensive Pepperstone review into the broker’s free money promotions and found that the company does not offer any kind of bonuses. Free money is usually a massive incentive for new traders, especially since it provides an opportunity to scale up positions with more money than the initial deposit. However, most regulated Forex brokers nowadays shy away from bonus promotions or marketing campaigns that advertise free trading credits. It is indeed a result of strict regulations measured by leading regulators to prevent broker–trader conflict. We are not surprised that the company has also chosen to stay away from any free money campaigns.

There are some benefits for high-volume traders, which are offered as premium client benefits for traders who transact at least $15 million in notional FX, commodity, and CFD volumes. Aside from regular premium client benefits such as priority client support, advanced market insights, VPS services, and an invitation to premium events, these traders are automatically enrolled into the Active Trader Program (ATP). It is a lot-based discount program that offers cash rebates for a specific amount of lots traded per month. The discount for FX traders starts from 5% for a minimum of 100 lots/month, while traders transacting up to 500 lots/month qualify for 15% discounts.

The typical monthly discount ranges from $35 to $525, but the broker may offer higher discounts for traders transacting more than 500 lots per month. Your account manager may be able to offer you a custom-tailored discount program that suits your trading volumes.

*74-89% of retail investor accounts lose moneyReview of Depositing Funds & Pepperstone Withdrawal Options

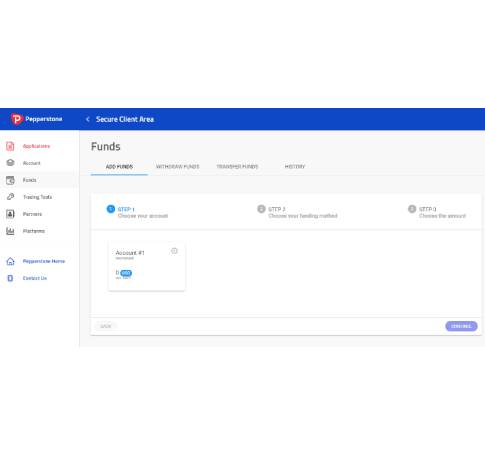

You can make your first Pepperstone deposit by visiting the secure client area and choosing the ‘Funds’ option from the navigation menu. Of course, it is vital to get your account verified before depositing funds, as this will prevent any verification issues and help you protect your money from any account blockade. It can take anywhere from 24 hours to 2 days for the broker to activate a trader account, while it can take even longer during weekends or national holidays.

Nevertheless, the company does enable its customers to deposit money before completing the verification process, and it can be done by selecting your preferred trading account from the account dashboard. Traders are presented with 3 Pepperstone deposit methods: a bank wire, credit/debit card payment, and e-wallet transfer. Accepted e-wallet transfers include Skrill, PayPal, and NETELLER, while credit/debit card deposits can be made through Visa or Mastercard.

All Pepperstone deposit methods are free of cost, and aside from the bank wire, all other funding options are available 24/7 to ensure instantaneous funding. However, traders can only start trading once the broker verifies their personal information. Therefore, it would indeed be wise to hold on to your deposit until the broker verifies and activates your trading account. Meanwhile, bank wire transfers can take longer, with funds credited into the trading account within 3 to 5 days. Therefore, traders should keep in touch with their account managers to learn about their account status before initiating a bank wire deposit.

| Pepperstone Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Depending on chosen method | Min. Deposit: $200 | Deposit Fee: Depending on user’s reside |

|

Payment Methods:

BANK-WIRE

MASTERCARD

VISA

SKRILL

PAYPAL

NETELLER

POLI

BPAY

UNIONPAY

MPESA

|

||

Since there are no bonuses or promotions, you can perform a Pepperstone withdrawal at any time without any restrictions. Traders can request a Pepperstone withdrawal through the secure client area, which will be processed within 24–48 hours. One of the main highlights of this Pepperstone review is that the company ensures that all withdrawal requests are processed on time unless there are issues related to user verification or third-party withdrawal requests.

| Pepperstone Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: Depending on chosen method | Min. Withdrawal: - | Withdrawal Fee: Depending on user’s reside and withdrawal amount |

|

Payment Methods:

BANK-WIRE

MASTERCARD

VISA

SKRILL

PAYPAL

NETELLER

POLI

BPAY

UNIONPAY

MPESA

|

||

As we mentioned earlier, always wait for the broker to activate your account and verify your personal information before depositing or withdrawing funds. Traders are also expected to initiate a Pepperstone withdrawal to the same account used to deposit funds, which is mandated to comply with anti–money laundering laws. Therefore, if all conditions are met, the funds will be sent to the trader within a day or two. In our case, we received our Pepperstone withdrawal a day after initiating the withdrawal request.

Pepperstone Commission, Leverage, Spreads, and the General Trading Conditions

Pepperstone commission is only charged for Razor accounts, which offer tight spreads that start from a minimum of 0 pips. The average spread for the Razor account on the EUR/USD pair is around 0.09 pips, closer to the broker’s 0 pip spread guarantee. For other major pairs, the average Razor spread is around 0.1 to 0.35 pips, again some of the lowest spreads in the entire market. Of course, traders will have to account for a Pepperstone commission of 0.0035% of the base currency for the cTrader platform, while MT5 will have to pay a commission of $7 per lot round turn for standard lot trading and $8 per lot round turn for micro lot trading.

For some reason, the Pepperstone commission is slightly higher for MT4 platforms, as the company charges around $7.53 per lot round turn. However, the micro-lot commission remains at $8 per lot round turn for MT4 traders. Nevertheless, the Pepperstone commission differs for accounts with different base currencies, and the broker provides a detailed breakup of commissions and spreads on their website.

The broker also charges SWAP for overnight positions, including single and triple SWAP for carryover trades. SWAP costs are applicable on Forex, indices, commodities, and shares, and the broker’s rates truly represent the underlying market conditions. Therefore, it is possible to pay or earn interest according to the underlying instruments.

Once again, a detailed breakdown of the SWAP rates for each instrument is provided on the broker’s website, as well as the trading platform. However, if you don’t wish to pay or receive SWAP for religious reasons, then the broker offers a SWAP-free option for Islamic traders. This SWAP-free account charges higher spreads and admin charges, which can be quite expensive for high-frequency traders.

The direct market access nature of Pepperstone FX trading ensures that there are no hidden costs and absolutely no conflict of interest between the broker and the trader. All orders are passed to the interbank liquidity pool, with the broker only acting as a bridge that facilitates the transaction. Therefore, the orders are filled at market conditions, resulting in DMA conditions such as partial order fills and slippages. The order execution speeds are also high, especially with the help of powerful and efficient servers employed by the broker.

However, traders will have to make a conscious decision when choosing the Pepperstone leverage for their trading accounts. The maximum Pepperstone leverage is pegged at 1:30 for traders holding an account at the company’s ASIC, DFSA, BaFIN, CySEG and FCA divisions. However, for traders opening an account at the broker’s SCB brokerage, the maximum Pepperstone leverage is 1:200 for regular traders and the CMA offer 1:400 for retail.

In contrast, Pro traders can avail up to 1:500 leverage by submitting a self-declaration. Pro traders are required to submit all the relevant details that outline their knowledge of leveraged financial products and their understanding of the underlying risk in the market. Although trading leveraged products using high leverage is risky, it is commendable that a high Pepperstone leverage option is offered to professional traders.

Pepperstone License – What You Need to Know about the Broker’s Regulatory Compliance

Pepperstone broker is a reputed company with a good track record of offering a fair and secure trading environment. Ever since it launched its services in the Australian financial market, the broker has seen exponential growth in its client base, supported in part by the excellent Pepperstone license and regulatory compliance. The company is regulated by multiple regulators in different markets to cater to the widest retail trading market. The primary Pepperstone license is issued by the ASIC of Australia, where the broker has its headquarters. Still, the company is also regulated by other top regulators such as the FCA of the UK and the DFSA (Reference number F004356) of the UAE.

However, for international traders, the broker offers its services through its SCB brokerage, which is located in the Bahamas. Naturally, such a jurisdiction allows the company to offer a high Pepperstone leverage, more freedom in CFD trading, and a generally relaxed trading environment.

Of course, traders may be apprehensive about the overall reliability and security of the broker’s SCB division, especially concerning the insolvency policies, trader protection policies, and security of funds. However, while compiling this Pepperstone review, we haven’t found any instances of financial malpractice perpetrated by the company, signaling its commitment to ensuring the best in safety for its clients.

Upon deeper inspection in this Pepperstone review, Forex trading products and services discovered that the broker employs a series of measures to comply with the strict regulatory requirements mandated by the FCA,ASIC,SCB,DFSA,BAFIN,CMA and CySEC. The company is required by law to hold a minimum operating capital, which should be kept away from its traders’ funds. Therefore, all funds are segregated daily, which ensures that clients can request a Pepperstone withdrawal without worrying about any liquidity crunch. Of course, all of the broker’s financial transactions are routinely audited to ensure complete transparency in the way the company handles its clients’ money.

In the event of broker insolvency, eligible traders from the EU, Australia, and the UAE may also qualify for investor compensation through dedicated insurance programs. However, international traders do not enjoy such privileges. It may be a minor hindrance for the global retail trading community, but it is the same case with every other broker. Therefore, after considering all the different factors that affect traders from a regulatory perspective, we are satisfied with the Pepperstone license and the regulatory compliance measures adopted by the company.

Customer Support and Dispute Resolution

We have experienced nothing but the best customer service at the company since it seems genuinely interested in minimizing customer conflicts. All trader disputes are resolved through proactive efforts from members of different departments, which ensures speedy resolution. The broker provides multiple contact options, including a phone number, live chat, e-mail, and web contact form available 24/5.

As a result, traders should be able to contact the broker during live trading hours, and the broker will usually look into the problem within 24 hours. For minor concerns, the company has also provided a detailed frequently asked questions (FAQ) section, which offers detailed explanations. Overall, the customer support aspect at