The XM broker is a Forex & CFD service provider that primarily targets the retail trading industry with a very low minimum deposit requirement of $5. Such a move has helped the company to garner unbelievable popularity among smaller retail traders. With over 3.5 million traders under its wings, the company continues to expand to newer markets and generate interest in emerging markets. However, despite its rise in popularity, the company has not skimped on any services in its product portfolio. The brokerage is also one of the safest companies in the market, with regulatory licenses issued by several tier-1 regulators, making it an attractive proposition for traders worldwide.

This XM review will offer detailed information about the different trading tools, services, products and advantages you will receive by trading with XM. We will also walk you through the account sign-up process, give you information on bonuses and provide you with all the updates you should know before registering for an XM trading account.

Then, we would like to touch on the company’s different brand names because, although the broker is marketed as XM, it is registered under the name of Trading Point of Financial Instruments in Cyprus, Australia and Dubai. Therefore, if you find any other website claiming to be an XM Forex broker without the mention of Trading Point, do inform us, as it is more likely to be an entirely different brokerage.

Features

- Real-time market execution

- Personal Account Managers in over 30 languages

- Free trading signals in over 25 languages

- 16 MT4- and MT5-based platforms

Special Offer

XM Sign Up – A Detailed Guide to Opening a Forex Trading XM Account

Before opening an account at the XM forex broker, it is imperative to understand how doing so can affect your trading goals. As one of the best forex brokers that target the retail trading industry, does the broker cater to larger traders according to our in depth XM review? What advantages do you get by signing up, and what are the pitfalls you need to avoid? In this section, we will discuss both the pros and cons of the company and even offer you information about the different XM broker account types, along with detailed step-by-step instructions for opening a trading account.

- Extremely competitive fees & trading conditions.

- Minimum investment starts at just $5 and minimum contract sizes start with 0.1 micro lots.

- Highly regulated broker with licences in the EU, Australia and the Middle East.

- Wide range of trading classes and assets for traders.

- Access to both MT4 and MT5 platforms.

- High degree of leverage for Forex pairs.

- Varied choice of accounts for both small and larger traders.

- Only ordinary trading conditions for shares and indices.

- Traders from the US are not accepted.

- No ECN account is offered, and the shares account is expensive.

- Questionable safety of the broker’s Belize operations.

There are several advantages to opening an XM broker account. There are also a few drawbacks, but they really don’t affect the trading experience for a majority of traders. For this reason alone, we highly recommend traders open an XM trading account. Regardless, we will cover some of the broker aspects critically and find out whether both international traders and traders from the EU can enjoy the same regulatory protection and trading conditions.

We are a bit apprehensive about the company’s licence in Belize, which presents its own risks. Nonetheless, we are confident about the safety of funds offered to the XM Global clientele, mainly due to the company’s long-standing positive reputation in the market.

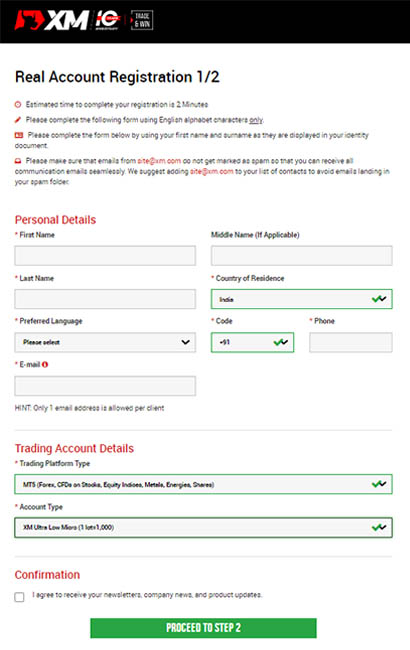

The registration process is quite smooth, and you can complete the entire sign-up process within two minutes. Click or tap on the ‘Open Account’ link from anywhere on the website or the XM broker app, and a two-step registration page will greet you. You will have to enter your personal information, select your preferred language and choose your preferred trading platform for your account.

Of course, you can always add multiple accounts at a later stage, and you can even choose between the MT4 and MT5 by opening different accounts through your Members Area account dashboard after signing up. Therefore, you need not worry about making the correct choice right away. After entering all information in step 1 of the registration process, verify that the information that you have entered is accurate and matches your identifying documents.

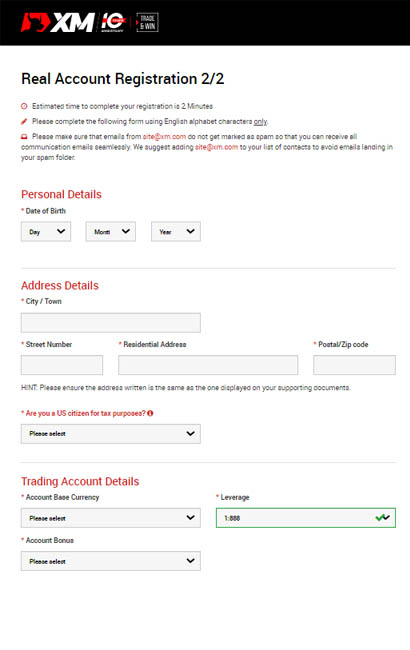

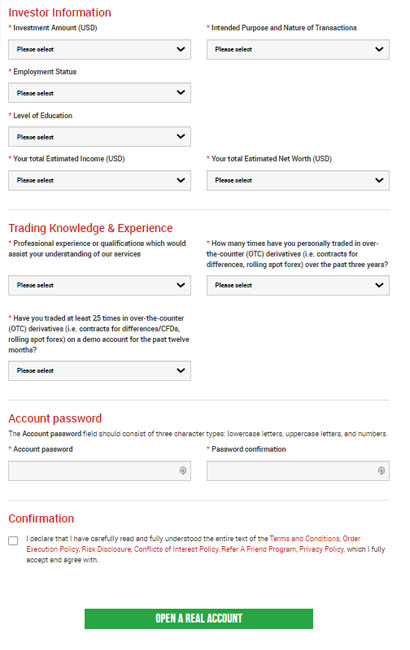

The second step requires you to enter your personal information in detail, including your date of birth, address and citizenship status for tax purposes. The information you enter here must match the details provided in your identity document, as any change in information can create issues during the verification stage. Therefore, take your time to fill in the details.

Step 2 also asks you to choose your XM trading account parameters such as account base currency, leverage, XM Forex bonus, investment amount and the nature of your transaction (purpose of trading). You will also be required to fill in the investor information that will ask you about your employment status, education level, estimated income, estimated net worth and trading knowledge.

Finally, you should also choose your account password and accept the broker’s terms and conditions before clicking on the ‘open a real account’ link. The broker will send you a verification email to verify your email address and unlock your account for trading.

Once you have opened your account, you can modify your trading information, open additional accounts and download the trading terminals through the Members Area dashboard. You can also deposit funds into your account right after signing up, but it is always better to complete your identity verification before depositing funds.

You can verify your identity by uploading documents to your profile dashboard and sending them to the verification team. If the information you provide matches your account documents and if all documents are in order, the verification process will usually be completed within two days.

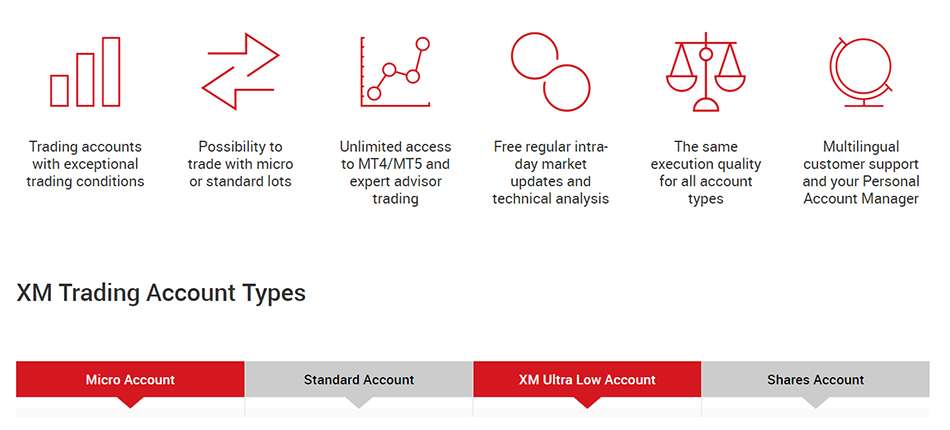

Which XM Broker Account Types Should You Choose?

There are four different choices of XM broker account types, each specifically designed to cater to a different segment of traders. The first category is the Micro account, which is geared towards the smallest retail traders. The minimum deposit starts at $5, and the minimum contract size of 1 lot equates to 1000 units of the base currency. It is the smallest contract size available in the market, which makes the XM Trading broker the preferred choice for micro-lot trading. Although the Micro account is a great option for small traders, there are some trading-related restrictions.

For instance, Micro account traders don’t get access to the entire range of financial instruments and there is a maximum lot restriction of 100 micro lots or 200 positions. Furthermore, if traders wish to increase their position sizes, they will have to switch to the Standard account, the second type of account offering in the broker’s portfolio.

XM Standard Account – Key Features and Restrictions

The Standard account is the regular account option, where one standard lot equates to 100,000 units of the base currency. Nevertheless, the minimum deposit requirement for the Standard account is also $5, which is quite low from a minimum margin requirement perspective. Trading with low initial capital can lead to a margin call with even a small market movement, which can be inherently risky for traders. Therefore, we wouldn’t recommend starting with a very low deposit for trading, but it is certainly an option for traders.

The account also provides access to the broker’s complete list of assets, but there is a maximum lot restriction of 50 per ticket and a maximum number of 200 orders per account. The XM spread for both the Micro and the Standard accounts starts at 1 pip, which is very competitive.

Ultra Low Account – Main Advantages and Drawbacks

For more competitive XM spreads that start at 0.6 pips, traders can opt for the XM Ultra Low account. The Ultra Low account requires a higher minimum deposit than the Micro or Standard accounts. You will have to deposit at least $50 to open this account, and although it is not a huge amount of money, other brokers are known to stipulate a minimum of $100 for their micro-accounts. All the other trading conditions for the Ultra Low account are similar to those of the Standard account.

This account is further divided into the Standard Ultra and the Micro Ultra, where the only difference is a calculation change in the lot size. The Standard Ultra account facilitates trading in standard lot sizes of 100,000 units, while the Micro Ultra account offers trade sizes starting from 1000 units. The lot restrictions also vary, with 50 being the maximum for Standard Ultra and 100 for Micro Ultra. The Ultra Low Account is our pick of all the account types since it offers the most competitive spreads and is less expensive than similar accounts offered by other brokers.

Shares Account – For Those Who Don’t Want to Trade Forex

The final type of account at the XM Trading broker is the Shares account, a dedicated account for trading shares. The minimum deposit requirement is $10,000, which makes it out of reach for smaller retail traders. The minimum contract size starts at one share per ticket, with the maximum lot restriction dictated by market liquidity. The spreads are also determined by the actual spreads in the stock market. The Shares account does not offer any leverage, but the most significant drawback is that it does not offer any Forex or CFD assets. Nevertheless, it is offered simply as an option to those who wish to indulge in share trading.

Islamic Account – Specifically for Muslim Traders

An Islamic account option is also available for all account categories, and it is indeed Sharia-compliant. The good part is that even the Shares account is Sharia-compliant, making it Islamic-friendly for traders following the Islamic faith. Coming to the leverage offered for various instruments, the maximum XM leverage for Forex and CFD trading is 1:888, a significant margin. It is incredibly risky, and we don’t recommend traders use such a high degree of leverage unless they have the necessary experience to manage their positions. The leverage is reduced to 1:200 for account balances beyond $20,000 and up to $100,000.

For account balances of more than $100,000, the maximum leverage is reduced to 1:100. To counter the ill effects of high leverage, the broker offers negative balance protection for all accounts, ensuring you won’t owe the broker anything if you get a margin call.

Does the XM Trading Platform Perform as Expected?

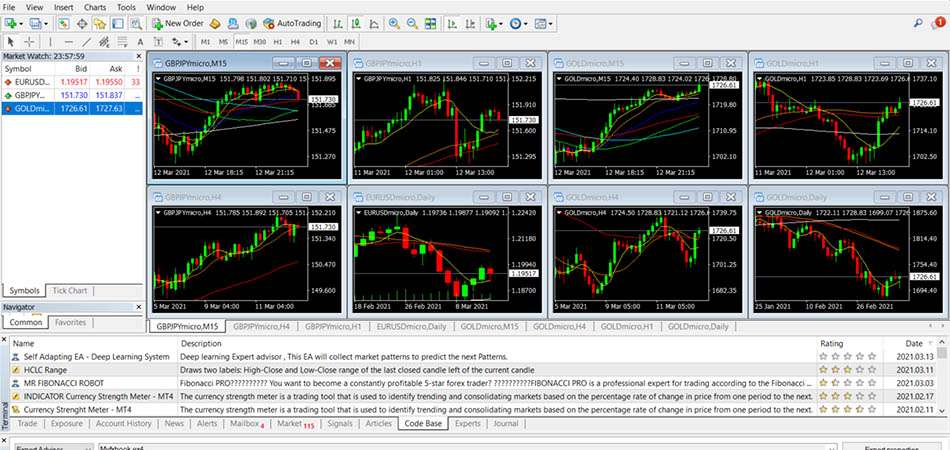

The default XM online trading platform is available in two trims, the MT4 terminal and the MT5 terminal, both of which are third-party trading platforms designed and developed by MetaQuotes. The MetaTrader terminals, as they are known, are tried and tested interfaces, making them the absolute favourites among both retail and institutional traders. XM has not fiddled with the platform, which is a good thing, as it is always better not to mend something that is not broken.

As a result, the XM trading platform performs exceptionally well in its stock form, and we are more than impressed with the speed of trading, ease of use and familiarity that we have come to expect from these interfaces. We also enjoyed the flexibility to add custom indicators, install different trading tools, test expertAdvisors and trading strategies, and collaborate with the trading community through the MQL forum, making the MT4 and MT5 the best trading platforms in the market.

Suppose you are looking for a modernised version of a trading interface. In that case, you are out of luck, as there is no proprietary XM trading platform or web browser-based XM online trading platform with fancy graphics or animations. However, we don’t feel that mainstream traders will miss the absence of fluid or responsive trading interfaces since the MetaTrader XM trading platform offers more trading tools and features in one place than any of the fancy proprietary trading interfaces available in the market. Additionally, both the MT4 and the MT5 are available as a WebTrader, which functions as the default XM online trading platform for browser-based trading.

Therefore, for both desktop trading and trading on the move, the broker’s MetaTrader terminals are indeed the perfect choice.

XM Trading App for Mobile – Trading on the Android & iOS Versions of the MT4 & MT5

You can trade the markets using your smartphone or tablet by installing the MT4 and MT5 XM apps available for Android and iOS devices. Mobile trading platforms do come with reduced functionality when compared with their desktop counterparts, but they are still great for trading on the move.

Interestingly, the WebTrader and mobile app versions of the MetaTrader terminals are similarly designed, which means you can use them interchangeably. The mobile app’s real-time performance is similar to that of the desktop terminals, and you can easily open a trade, set take-profit/stop-loss levels, open pending orders and close orders via the app.

You can also open the chart and customise it with various indicators. The only drawback is that only a maximum of two charts can be kept open simultaneously. In the desktop terminal, you can open multiple charts, but it is indeed a result of reduced available screen space in the mobile app. Nevertheless, all other trading conditions and parameters remain the same as in the desktop terminal.

You can download the MT4 and MT5 mobile apps on your Android or Apple devices by visiting the respective Play or App Stores. XM does not directly publish the MT4 and MT5 apps, but you can download them for free from the developer, MetaQuotes Software Corp. Hence, if you can’t find these terminals under XM’s brand name, don’t worry; the MetaTrader mobile apps are designed to enable traders to log in via their broker’s login credentials by establishing secure connections with the broker’s servers. Both the MT4 and MT5 XM trading apps are safe and secure, as they employ the best encryption technologies to prevent data theft or intrusions.

While searching for the broker’s trading app on the Play or App Stores, you may find a dedicated XM mobile app. This proprietary app is published by the company directly, and it allows you to manage your account, including depositing funds, withdrawing funds or changing your account information, directly from your smartphone or tablet. You can either download the app to manage your account through your mobile or access the Members Area by visiting the website and using your MT4/MT5 login information. Therefore, the company offers a lot of flexibility for both desktop and mobile users, and it is easy for customers to find a good combination that works.

Do Traders Receive an XM Bonus?

Forex and CFD brokers based in the EU tend to avoid bonus offers or promotions for their customers due to stringent EU regulatory guidelines. XM does have a presence in the EU through its CySEC licence, and hence does not provide any bonuses to its EU clients. However, global clients are offered up to a 15% XM Forex bonus for their deposits, with a maximum bonus amount of $500 per client. The bonuses are added as trading credits, which cannot be withdrawn. The bonus is available as either a lump sum for your initial deposit or a series of smaller bonuses with every recurring deposit, provided the lifetime bonus for your account does not exceed $500.

The bonus is credited as soon as you deposit funds. A word of advice: remember to choose the ‘Yes, I Want to Receive Bonuses’ option when you sign up for an account to be eligible for the company’s offers and promotions. If you fail to do so, you will not be eligible for an XM Forex bonus. The bonus itself is not withdrawable, but its profits can be withdrawn without any restrictions. However, be warned that withdrawing funds from your trading account will remove the trading credits as well, but proportionally. Therefore, partial withdrawal will not eradicate your bonus, but it can affect your margin, especially if you have open positions.

In this part of our XM broker review we cover their loyalty program. Traders can accumulate points, known as XMP, and redeem them for a cash balance or trading credits. The loyalty status is divided into four categories: Executive, Gold, Diamond and Elite. New clients are accorded the Executive status at the beginning, but their trading activity will enable them to climb up the status levels to accrue more XMP for bonuses. Elite status traders can accumulate more number of XMP at a faster rate, which can then be redeemed for cash or trading credits. Both are added to the trading account, and while cash can be withdrawn, trading credits are only available for trading.

Options to Deposit & Withdraw Funds – Will a Client’s Withdrawal Be Processed on Time?

XM has set up a diverse range of payment options to enable traders to deposit funds via an online wallet or through the traditional card or bank payment options. Generally accepted e-wallets include Skrill, Neteller, Perfect Money, and SticPay, while the broker also accepts geo-specific online or mobile wallet payments from traders in a particular country. Regardless, you can also deposit funds via your Visa, MasterCard or AstroPay card or wire funds from your bank account. All payments are handled instantly, aside from wire transfers, and the funds will reach your account within a few seconds. The best part is that the broker absorbs all deposit fees, ensuring the full amount is credited to your account for trading.

| XM Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Immediate | Min. Deposit: $5 | Deposit Fee: Sender may pay bank wire fee |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

MASTERCARD

|

||

You can also withdraw your funds at any time, irrespective of whether you have accepted a bonus or not. Bonuses are added as trading credits, which cannot be withdrawn, but a withdrawal from your main trading balance will lead to a proportional decrease in your trading credits. Nevertheless, you can withdraw your money only to the payment method used to deposit funds, and you must verify your identity before the broker can send you the funds. Once your withdrawal request has been accepted, the XM withdrawal is processed within 24 hours; our XM broker withdrawal reached our account within just ten minutes.

| XM Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: Varies between immediate and 5 days | Min. Withdrawal: $5 / $200 (bank) | Withdrawal Fee: Sender may pay bank wire fee |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

MASTERCARD

|

||

We can therefore testify that clients’ XM withdrawals will be processed on time, and there will be no issues concerning the safety or security of clients’ funds.

Trading-Related Fees & Commissions – Are the Spreads Competitive?

The advertised XM spread starts at 1 pip for Micro and Standard accounts, while the Ultra Low accounts promise a highly competitive spread of 0.6 pips. However, in real-time, the regular spreads hovered around 1.2 pips for the major currency pairs such as EUR/USD, while minor pairs such as GBP/JPY quoted around 3-4 pips during regular trading hours. For Ultra-Low accounts, the spreads were not as low as advertised but were still quite impressive, with the EUR/USD pair quoting around 0.7 to 0.8 pips during normal trading conditions.

The Ultra-Low account is a regular market-maker account, which means there are no commissions. Regardless, overnight positions may incur a SWAP fee, which depends on the currency pairs and the existing overnight funding fees decided by the broker from time to time.

We are pleased to report that the broker charges only spreads and SWAP for its services, and there are no hidden fees or account maintenance charges. All services offered by the company, including educational materials, are free to all customers. Additionally, the broker has waived any fees for deposits, making it even more appealing for smaller traders.

Overall, we found the trading fees quite competitive, although we would have certainly welcomed an ECN account option. ECN accounts offer tight spreads that provide a zero-pip spread guarantee in exchange for a commission. Nevertheless, the Ultra-Low account with a $50 minimum deposit does appear to be one of the best account options in the entire Forex market.

Is XM Broker Regulated? – Are Your Funds and Investments Safe?

XM is located in four different regulatory jurisdictions and has four different licenses to offer Forex and CFD products to traders. The company’s global brokerage operations are handled by XM Global Limited, licensed and regulated by the International Financial Services Commission of Belize (IFSC). While the IFSC of Belize is not as well known a regulatory organisation as its European counterparts, it does issue a few regulatory compliance protocols to match the regulatory compliance levels of the market leaders.

Nevertheless, traders may find it difficult to register complaints or initiate legal actions against IFSC-regulated entities, but traders are indeed well protected in the XM Forex broker’s case. XM takes care of its clients’ funds because it is committed to protecting its brand image and avoiding a negative reputation.

Elsewhere, the broker is regulated by the Cyprus Securities and Exchange Commission under the name Trading Point of Financial Instruments Ltd., while in Australia, the company is regulated by the Australian Securities and Investments Commission under the name Trading Point of Financial Instruments Pty Ltd.

Finally, clients from the MENA region can sign up for an account at the broker’s Dubai division, which the Dubai Financial Services Authority licenses under the name Trading Point MENA Limited. The company is thoroughly regulated, especially in the EU and Asia-Pacific; however, it does not accept clients from the US. Regardless, the company has made it a priority to accept traders from most countries without infringing on its compliance requirements.

How Does the Broker Treat Its Customers?

Customers are free to contact the broker anytime to report complaints, make suggestions or seek assistance in managing their accounts. Traders can contact the customer support team via live chat, email and phone or open a ticket via their Members Area dashboard. Traders will receive an instant response via chat and phone, while email correspondence and response to complaint submission forms may take up to 24 hours.

Even though the customer support team is professional and quick to provide assistance, they offer assistance only five days a week. Therefore, if you run into any issues during the weekend, you will have to wait until the start of the next week to get help. As part of this XM review, we dug deep into the company’s relationship with its traders in third-party online forums and found that the trader consensus was generally good. Apart from a few disgruntled customers, we are extremely satisfied with how the broker treats its customers.