IC Markets is an Australian ECN broker that was founded in 2007. It is currently one of the leading financial service providers globally and caters to over 180,000 traders from Europe, Africa, the Middle East, and the Asia–Pacific. The monthly IC Markets Forex trading volume is approximately $1.11 trillion, with an average daily turnover of $29 billion, processed through the company’s partnership with several liquidity providers for institutional-grade trading. As a result, the prevailing IC Markets reviews from different independent rating agencies indicate that the broker has a high approval rating among existing clients.

However, we subjected the broker to our own exhaustive IC Markets review to uncover the real potential of the broker’s platforms and services. We evaluated several parameters, including IC Markets’ minimum deposit requirements, platform options, order execution policies, leverage, spreads, bonuses, and speed of deposits and withdrawals. We will also provide our informed view on whether IC Markets broker is conducive to small-volume and high-volume trading and whether you should open an IC Markets account.

Features

- Transfer funds with 0% commission

- Over 29 billion USD in FX trades

- Average execution speeds of under 40ms

- Free low latency collocated VPS available

Special Offer

Are There Any Real Incentives for an IC Markets Sign Up?

There indeed appear to be numerous advantages and extremely few downsides to making an IC Markets sign up. We have dug up some of the most impressive qualities of the broker and a few not-so-desirable attributes, which will help you make an informed decision before opening an IC Markets Forex account.

- Regulated in both Australia and Europe, thus ensuring a high degree of safety and security for traders.

- True ECN trading conditions with ultra-competitive IC Markets spreads.

- Facilitates institutional-grade trading through renowned liquidity providers.

- IC Markets fees and commissions are extremely low.

- Fairly high IC Markets leverage that facilitates low margin requirements for international traders.

- Low IC Markets' minimum deposit requirement.

- Excellent choice of IC Markets Forex trading platforms.

- Prompt IC Markets withdrawal.

- Social trading options through third-party CopyTrade services.

- Positive online IC Markets reviews with high trust ratings.

- Low regulatory protection for international traders.

- No IC Markets bonus, even though the broker operates with an international license.

- No proprietary desktop trading platform.

IC Markets has undoubtedly created one of the best brokerages offering institutional-grade Forex and CFD trading platforms for retail and institutional traders. We performed a real account IC Markets sign up to compile this IC Markets review, a process that we will outline in detail after providing you with an overview of the different trading accounts offered by the company.

Overview of IC Markets Forex Accounts

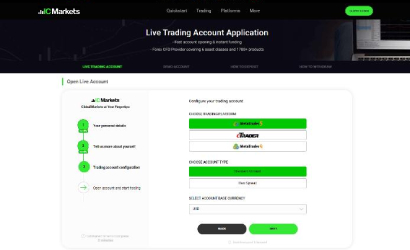

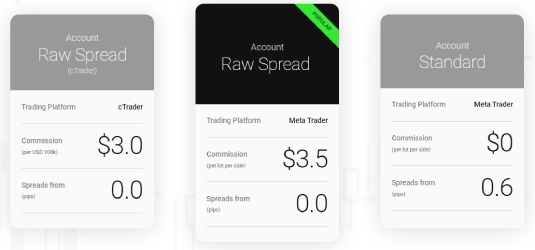

IC Markets broker accounts are classified into three according to the choice of trading platforms: cTrader Raw Spread, MetaTrader Raw Spread, and MetaTrader Standard. The IC Markets minimum deposit requirement is $200, irrespective of account choice, and the maximum IC Markets leverage is 1:500.

However, traders from the EU do not get access to this high degree of leverage, owing to EU’s regulatory guidelines that restrict brokers from offering any leverage higher than 1:30. However, there are a few subtle differences between the three accounts.

The cTrader Raw Spread account is the cheapest option for trading and has the lowest IC Markets fees in terms of spreads and commission. The cTrader account offers a zero-pip spread guarantee during peak trading hours and a nominal commission of $6 per lot round turn. There is an option to trade with micro or standard lots, and the trading server is located in London.

On the other hand, the trading servers for both the MetaTrader Raw Spread and the MetaTrader Standard accounts are located in New York. Moreover, these accounts are slightly expensive in terms of the IC Markets fees charged for trading. For instance, the MetaTrader Raw Spread account charges a higher commission of $7 per lot round turn while promising the same zero-pip spread trading conditions as the cTrader account. Of course, if you don’t want to pay a commission, you can always opt for the Standard account, where the IC Markets spreads start from 0.6 pips, which is indeed low.

Aside from these minor differences, all accounts offer similar trading conditions, and the IC Markets spreads do remain competitive during most trading conditions. We will provide a detailed account of IC Markets fees and other trading costs in later sections of this IC Markets review.

Moreover, the company offers an Islamic Account option for traders who adhere to the Islamic religion, where interest payments are frowned upon. Hence, Islamic accounts do not include SWAP or any other form of interest payments, thus making them Sharia-compliant. Furthermore, before opening a live trading account, traders are free to open a demo account to test the different account options, trading platforms, fees, and other order execution conditions.

How to Start Trading with an IC Markets Account – The IC Markets Sign Up Process

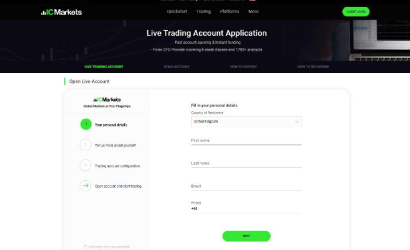

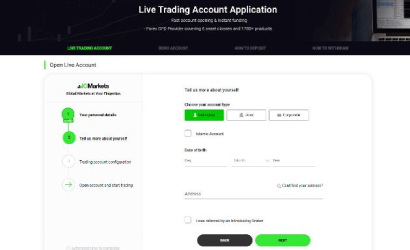

The IC Markets sign up process is a breezy affair, which can be done either through the broker’s website or its proprietary mobile app. It takes just a few minutes to complete. All you need is a valid email address, phone number, and a communication address that can be verified through a personal identifying document. Furthermore, you can choose your preferred trading platform, trading account, and account base currency at the time of the IC Markets sign up.

You are also free to open additional accounts at a later stage if you wish to experiment or trade with the broker’s other account and platform combinations. Furthermore, you will be required to read and accept the broker’s terms and conditions after which the broker takes you to your account dashboard.

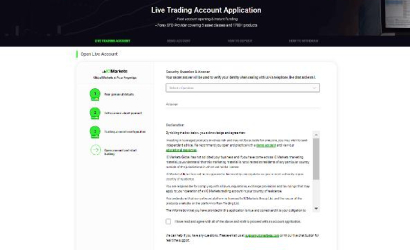

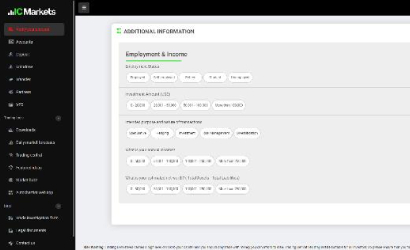

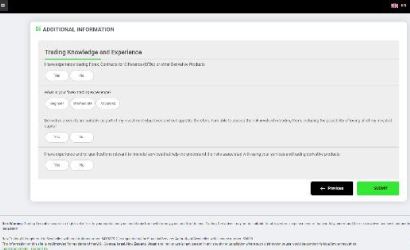

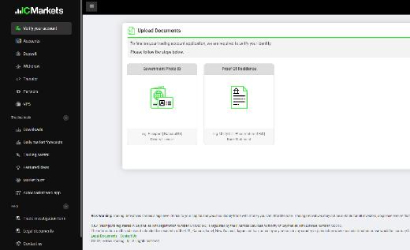

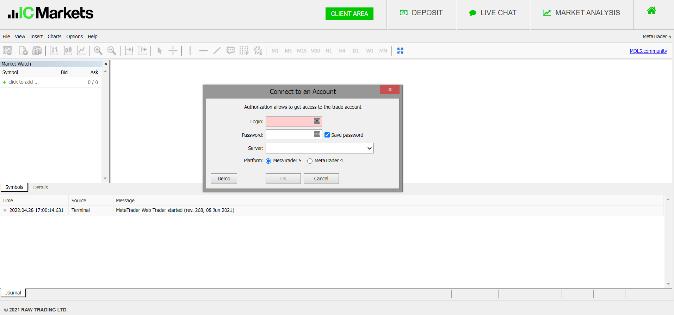

Once you have completed the initial sign up process, you will receive an email with your username and password, which are required to access your secure client area. Once you log in, you will be asked to provide additional information related to your financial situation and knowledge of trading. You will also be asked to upload copies of your identifying documents to prove your identity and verify your address. However, you can choose to skip this step and proceed to deposit funds and opt to upload the documents at a later stage. Nevertheless, you should upload your documents and have your account verified first, as this will prevent any complications when initiating an IC Markets withdrawal.

While performing our IC Markets sign up, we were able to set up our account and fully verify it within a day. We were also able to deposit funds and start trading instantly, which is a testament to the efficiency of the broker’s accounts department. We did not face any issues while verifying our account. However, traders may be required to upload multiple documents or even scan and upload clearer documents if there are any clarity or cropping issues.

Nonetheless, the broker has a great customer care team, which will ensure that you get your account up and running. Just make sure that the information you provide at the time of IC Markets sign up matches the information on your document, as this will help minimize delays to a great extent.

Analyzing the Options for Desktop Trading

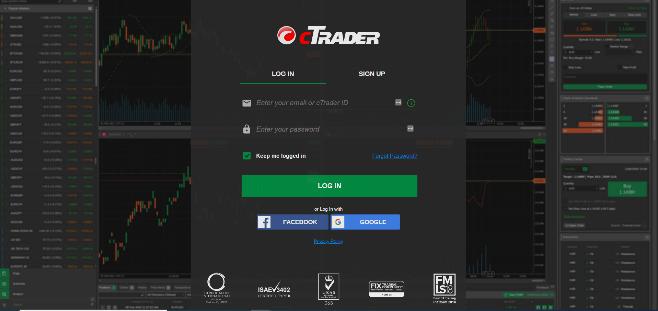

There are three choices of trading platforms for desktop users: cTrader, MT4, and MT5 terminals. The MetaTrader and cTrader terminals are quite popular among most mainstream brokers, with traders often preferring these interfaces for their outstanding features, excellent order execution conditions, and complete market access. It is no surprise that these independent third-party platforms cater to a significant majority of the retail trading market: the MetaTrader terminals lead the way for both ECN and automated dealing desk trading.

Traders are free to choose any trading platform out of the three, aside from having the flexibility to choose the pricing model that best suits their preferences. In terms of market connectivity, both MT4 and MT5 terminals are connected to servers in Equinix NY4 data centers located in New York. For its part, cTrader is connected to the LD5 IBX Equinix data center located in London. Despite the differences in servers, all platforms are routed through the broker’s internal automated dealing desk servers, ensuring that traders are treated to low latency and fast execution speeds through multiple top-tier liquidity providers.

All three platforms can be installed on Windows and Mac OS devices. However, if you prefer a mobile option for desktop trading, there are web browser-based versions of these trading platforms compatible with most modern web browsers.

Nevertheless, we prefer the installable desktop versions of both MetaTrader and cTrader platforms since they offer many more charting options, indicators, algo trading and trading performance. However, if we were to choose between the two, we would prefer cTrader for its competitive IC Markets fees and the overall speed of order execution. Nonetheless, we would be more inclined towards the MT4 and MT5 terminals for automated trading and for the use of the numerous third-party tools and indicators that come as part of the MQL community.

Additionally, the broker supports several advanced trading tools for the MT4 platform, making the MetaTrader terminal more conducive for high-volume professional traders.

The IC Markets spreads and commissions are higher on the MetaTrader terminals. However, this may not affect a majority of traders unless their trading strategies involve high-frequency or high-volume trading. The IC Markets leverage is pegged at 1:500 for both interfaces, but the usable leverage may depend on regulatory considerations for traders from specific regions, such as the UK and Europe. In terms of trading tools, the broker offers a VPS service, which can be useful for EA trading, but it requires a subscription fee of $20/month. However, if traders transact at least 15 standard lots per month, the broker may waive the fee.

The broker supports third-party CopyTrade platforms, such as Myfxbook AutoTrade and ZuluTrade for those who want to invest by copying successful traders. Since Myfxbook and ZuluTrade are independent service providers, the company does not assume responsibility for losses or any other issues arising from linking an IC Markets Forex account with them. Nevertheless, we appreciate the fact that the company has enabled access to two of the leading CopyTrade services in the market.

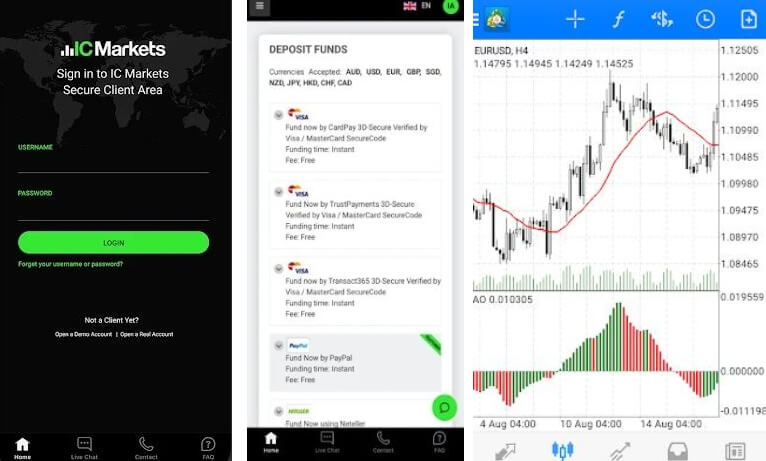

An IC Markets Review of Its Mobile Trading Platform Options

As with the broker’s desktop platforms, there are numerous mobile trading options for traders. First, we evaluated the broker’s proprietary mobile app, known as IC Markets Mobile App, which is an all-in-one interface that facilitates trading. It enables traders to perform account management functions, such as depositing funds, applying for an IC Markets withdrawal, checking out news events, and contacting the broker’s customer support department. IC Markets sign up is also possible through the proprietary app, which means that you only need to install the app on your smartphone or tablet to manage your account and trades. The IC Markets Mobile App is supported on both Android and iOS devices.

For a more conventional mobile trading platform, traders can download mobile versions of MT4, MT5, and cTrader platforms on their Android or iOS-enabled device. These platforms are updated routinely to offer some of the best trading conditions on mobile devices. However, you may find it difficult to manage your account through the MetaTrader or cTrader platforms. Therefore, you may have to download the IC Markets mobile app alongside the MetaTrader and cTrader mobile apps for full flexibility and convenience on the go.

Even though the mobile trading platforms are excellent for trading on the move, for professional trading they may not be as advanced as their desktop counterparts. For instance, the mobile platforms do not support EA trading, custom indicators, or support for CopyTrade systems, such as Myfxbook AutoTrade and ZuluTrade. Therefore, for full-fledged trading, we still prefer desktop trading platforms. Mobile apps can be used to monitor the market and manage trading accounts on the go.

IC Markets Bonus: Are There Any Offers or Incentives?

The broker’s international presence shimmered a ray of hope regarding the availability of an IC Markets bonus for international clients. However, we were thoroughly disappointed to learn that the company does not offer any bonuses or offers. We were even more disheartened to learn that there are no cashback promos, rebates, or trading contests.

Of course, we understand that the broker is bound by EU regulations, which prevent it from offering any free money to its EU clients. However, the broker appears to have standardized its services portfolio by adopting a uniform policy across multiple regions, which may ultimately benefit its clients. Yet this still does not account for the discrepancies in IC Markets leverage across its divisions. Nevertheless, the absence of any incentives or IC Markets bonus is one of the very few drawbacks found in this IC Markets review.

Review of IC Markets Minimum Deposit, Withdrawal, and Funding Methods

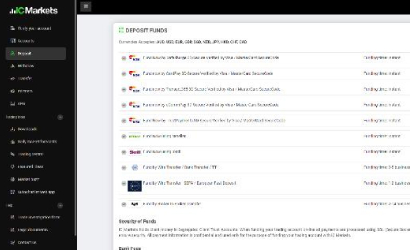

The company supports over 15 different funding methods and allows its clients to manage accounts in 10 different base currencies. The IC Markets minimum deposit is $200 or an equivalent in other currencies, and the minimum deposit requirement is the same for all traders across different account categories. The most common deposit methods include credit/debit card payment, bank wire transfer, PayPal, Neteller, Skrill, UnionPay, BPAY, FasaPay, and POLI.

Interestingly, the company also facilitates a broker-to-broker deposit option, where traders can transfer funds from their existing brokerage account to an IC Markets Forex account. Traders are not charged any IC Markets fees for deposits, but any transfer fees charged by intermediaries are out of the purview of the broker.

| IC Markets Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Instant | Min. Deposit: $200 | Deposit Fee: No fees |

|

Payment Methods:

CREDIT-CARD

BANK-WIRE

PAYPAL

NETELLER

SKRILL

|

||

Traders can place an IC Markets withdrawal through the secure client area, but they are required to verify their identity before initiating a withdrawal request. The absence of a bonus makes matters easy for traders since they do not have to abide by any bonus T&C. However, that does not mean that the broker will blindly process all of its clients’ withdrawal requests, as there are several safeguards put in place to comply with global financial regulatory guidelines.

For instance, the broker has adopted a strong anti-money laundering policy, which means traders can only withdraw funds to the account from where the funds originated. Furthermore, the company does not accept third-party deposits or withdrawals, and IC Markets withdrawal requests will only be processed after full account verification. All withdrawals are free of cost—the broker does not charge anything for processing your withdrawal. However, you may have to pay intermediary transfer charges that might be deducted by a bank when doing a bank transfer or by an online payment processor for e-wallet withdrawals.

Most e-wallet and credit/debit card payments are instant while bank wire and broker-to-broker transfers may take anywhere from two to five business days for the funds to reach your trading account, but all other payment methods ensure instant account funding. However, IC Markets withdrawals may take longer since every payment needs to be approved by the broker’s finance department.

The broker has also implemented a withdrawal request cut-off time of 12:00 AEST/AEDT. Therefore, any requests placed after this time will only be processed during the next business day, and, in case of any holidays, the withdrawal processing may be delayed. Nevertheless, all IC Markets withdrawal requests placed before 12:00 AEST/AEDT on a business day will be processed on the same day, and if you are requesting funds via an e-wallet, you should receive your funds as soon as the broker approves the withdrawal request.

| IC Markets Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 2-5 business days | Min. Withdrawal: - | Withdrawal Fee: No fees |

|

Payment Methods:

CREDIT-CARD

BANK-WIRE

PAYPAL

NETELLER

SKRILL

|

||

Trading Conditions, Order Execution, Spreads, and IC Markets Leverage

For this IC Markets review, we opened a real account with the broker to understand the different trading conditions and the overall quality of the company’s products portfolio. At the outset, we discovered that IC Markets is a true ECN broker which adopts a fully automated dealing desk protocol that connects traders directly to a liquidity pool. IC Markets broker is not a market-maker and does not act as a counterpart to its trader’s position.

The company has partnered with several leading liquidity providers, which ensures a deep liquidity pool with excellent order execution conditions and very competitive IC Markets spreads. The company has promised the best fills for orders of up to 200 standard lots, with no requotes and minimal slippage. Nevertheless, direct market access trading may induce slippages and partial filling of orders, but the order execution speeds are outstanding. A third-party audit of the broker’s order execution speeds put the average speed at 40 ms for order placement and registered very fast order executions.

As far as the IC Markets leverage is concerned, the company offers a maximum leverage of 1:500 for international clients while limiting the leverage to 1:30 for its clients in the UK and the EU. Professional traders in the EU region can trade with a higher leverage if they can prove their proficiency and knowledge of financial instruments, but they are required to waive their rights and protection under ESMA guidelines. Nevertheless, the high IC Markets leverage is undoubtedly one of the key benefits of trading Forex and CFDs. However, we recommend our readers be extremely cautious while trading on margin and use leverage responsibly.

The broker’s cTrader account is a most competitive offering in terms of IC Markets fees and commissions. Traders are only charged $3 per lot single side or $6 per lot round turn for major currency pairs while they are offered a zero-pip spread guarantee during regular trading hours.

The real-time IC Markets spread quoted by the cTrader account was in the region of 0 to 0.2 pips for the major pairs, which is impressive. The MetaTrader Raw Spread account quoted similar spreads under the same trading conditions, but we were a bit disappointed with the higher commission of $3.5 per lot single side or $7 per lot round turn trading. However, if you wish to avoid commissions altogether and do not mind trading with marginally higher spreads, the MetaTrader Standard account offers very competitive IC Markets spreads in the region of 0.6 to 0.8 pips.

Traders will also need to account for SWAP if they plan on holding on to their trades overnight or for a long period. The SWAP rates are determined according to the market rates of the underlying instruments, and the broker provides detailed information on their website on SWAP and other parameters of every instrument. Moreover, if you hold Islamic religious beliefs, the broker offers an Islamic account that is Sharia-compliant. However, the Islamic account may have other trading costs to compensate for the elimination of SWAP. Nevertheless, in terms of IC Markets fees and the overall cost of trading, we believe that IC Markets is one of the best brokerages in the market.

Safety and Security Aspects of IC Markets’ Regulation

The broker started its operations in Australia in 2007 and has been regulated by the Australian Securities and Investments Commission (ASIC) since the beginning. ASIC is a very robust and efficient regulator, which gives due importance to protecting the interests of investors. ASIC is renowned for its proactive investor-education programs. It believes that learned investors are always bound to make the most informed decision that protects their financial security.

>ASIC often takes cues from several leading international regulators and implements stringent guidelines for investor protection. These include maintaining a minimum operating capital, segregation of clients’ funds, routine independent auditing of financial activities, and protecting investors from financial malpractice.

In the EU, the broker is regulated in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), the go-to regulatory organization for Forex trading in the European market. CySEC works under the MiFID II guidelines of the European Securities and Markets Authority (ESMA), where investors are given top priority. All Forex brokers regulated by CySEC are mandated to maintain sufficient operating capital to meet or exceed the capital adequacy ratio, which is a minimum of €730,000.

Furthermore, CySEC requires its regulated entities to provide sufficient protection to investors in the event of insolvency, with the Investor Compensation Fund taking care of the fair reimbursement of investors if the broker files for bankruptcy or is rendered insolvent. EU regulators also instruct their regulated companies to hold clients’ funds in segregated accounts to prevent financial malpractice or misuse of these funds. All financial transactions and other operations are routinely audited and verified by independent agencies, which adds another dimension of security to investors’ capital.

However, the broker’s European division only caters to traders in the EU region, and its Australian division has its fair set of challenges while operating on the global stage. Therefore, to cater to an international community of retail traders, the broker has set up an office in the Seychelles, where it is regulated by the Financial Services Authority (FSA). We realize that the FSA is not as reliable as the regulators in the US, the EU, or other parts of Asia; but the company has adopted a standardized operating protocol to ensure the same levels of safety for all clients across the globe.

As a result, the broker continues to be one of the most secure options for Forex and CFD traders. We are not worried about the safety of its global brokerage division.

Staying in the Loop with an Outstanding Customer Support

One of the primary concerns of a global financial broker is that their customer support department may often lack the professionalism or expertise needed to promptly address traders’ concerns. However, there are no such worries with IC Markets broker. With a multi-lingual customer service department that can handle more than 17 languages, its customer service department is online 24 hours a day and 7 days a week to tend to its clients’ concerns.

The broker offers a live chat option for instant online support, and traders can also call the broker directly through the international phone number provided by the company. If you cannot put your concern across in a detailed manner through these options, you can also send a detailed email to any one of these four departments as the case may require: client relations, support, accounts, and marketing. The broker usually responds to an email within the same day, but if the concern requires any additional clarifications, you may only receive a response during the next business day. Nonetheless, the IC Markets Forex customer service department is certainly one of the best that we have encountered.