XTB Review 2024 – A Serious Online Forex Broker

XTB online is a remarkable Forex and CFD brokerage that has been making a tremendous impact on the retail trading market for the better part of two decades. It has several positive attributes working in its favour, chief among which is the excellent cost structure, ensuring that traders can trade the FX markets with the tightest XTB spreads. The broker is also publicly traded and listed on the Warsaw Exchange, but perhaps its most pressing advantage is the company’s regulatory status. XTB online is strictly regulated in the EU and holds numerous FX broker licences in several international jurisdictions. These licences enable the XTB broker to offer its services to international traders, with a few exceptions.

XTB does not cater to traders from certain countries, including the US, Africa and some parts of the Asia-Pacific. We are indeed disappointed that traders from these regions miss out on one of the best brokerages in the market. Nevertheless, this XTB review contains all the key information about the company’s online Forex products, platforms, trading conditions and other attributes that can help our readers decide whether an XTB online account is suitable for their trading needs.

- Easy to use, fully customisable

- Superior execution speeds

- Trader’s calculator

- Charts trading

Who Can Open an XTB Trading Account & What Are the Account Types?

Anyone can open an XTB trading account, provided they reside in a country accepted under the broker’s terms and conditions. The company hasn’t provided a list of accepted or rejected countries per se, but you can check your eligibility by trying to sign up for an account. If your country is not accepted, the registration page will display an error message. Alternatively, you can get in touch with the customer service department through the live chat feature. Once you have determined your eligibility, you can head to the remainder of our XTB review and read the pros and cons before signing up.

- A leading broker in Europe with excellent regulatory compliance.

- Tight spreads and low-cost trading.

- Innovative trading platform developed in-house.

- Over 1,500 different financial instruments on offer.

- Trade recommendations, market analysis and news provided by leading financial institutions.

- Publicly traded company, which means the financials are audited to the best regulatory standards.

- Excellent mobile app.

- Does not accept traders from some major countries.

- No MT5 platform option.

- High fees for deposits.

There are so many advantages of choosing an XTB online account, such as the safety of funds, excellent trading conditions, superior platform and overall cost-efficient trading environment conducive to stress-free trading. There aren’t as many disadvantages as we anticipated, which is always favourable from a traders’ perspective. Read the following sections to learn more about the different types of XTB trading accounts and the steps involved in the account registration process.

Types of XTB Online Accounts

This broker has a strictly candid approach with regard to the type of XTB trading accounts. There are only two account options: one is the Standard account, while the other is an Islamic account. The limited choices help take the stress out of the trader’s mind when signing up for an account, as we have noted that traders often find it difficult to choose from among multiple types of accounts and trading options.

The Standard account is a regular market-maker account that offers more than 1,500 different trading instruments from the Forex, commodities, stocks, indices, crypto and ETF markets. The maximum XTB broker leverage for this account is 1:500, while the minimum XTB spread Forex starts from 0.5 pips. The spreads are higher for other markets, which means the tightest spreads are available only for Forex currency pairs. There is no commission for Forex, commodities and cryptocurrencies, but there is a commission of 0.08% for stock and ETF CFDs.

The minimum order volume is 0.01 of a standard lot, with no maximum restrictions on the number of positions or the lot size. Of course, the orders are filled only according to the market depth, which means larger orders may be only partially filled. The second category of account is the Islamic account, which has mostly the same trading conditions as the Standard account. The only difference is that the XTB spread Forex starts at 0.7 pips, as the broker compensates the losses in SWAP with a higher spread.

There is also a commission of $10 per lot for all instruments, including Forex and commodities, which is a bit baffling. We never found the Islamic account representative of an ECN account, but it offers SWAP-free trading conditions to enable Sharia-compliant trading.

Traders can also open a demo account before opening a real account, which will serve as a reference point to assess the XTB app. Of course, live trading is inherently different from demo trading, especially due to the effect of liquidity conditions, but it is still a great way to get familiarised with the broker’s trading platforms.

What Is the Account Sign-Up Procedure?

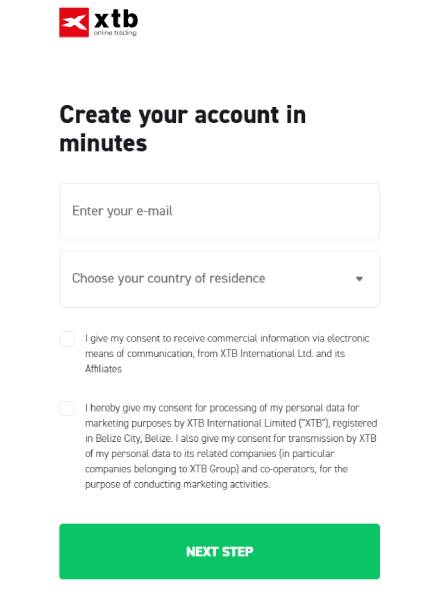

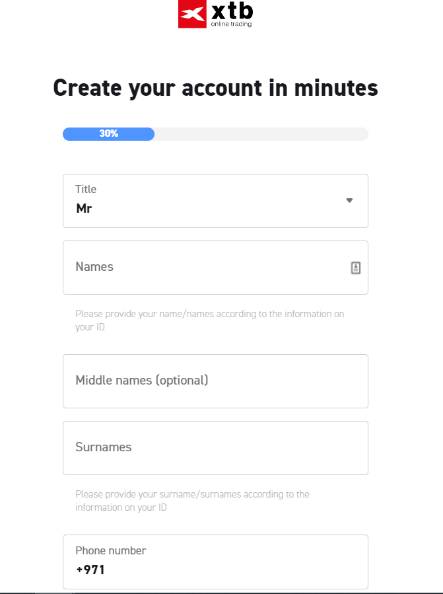

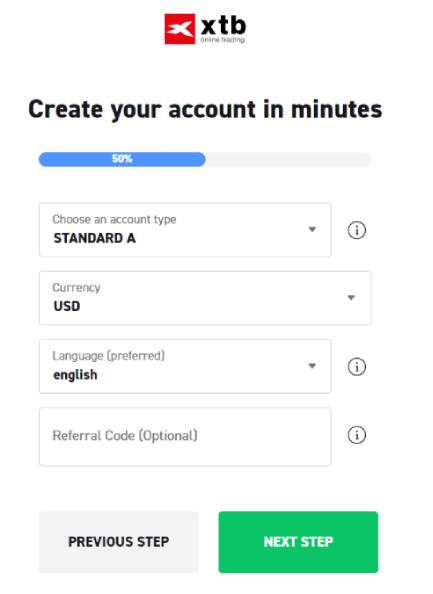

You can register for an account through the website or the XTB app. To create an account, you must first enter your primary email address on the registration page and choose your country from the drop-down menu, which will let you know whether you are eligible for an account or not. If the registration page asks you to set a password, you are free to sign up, and you can enter your preferred password to continue to the next step of the registration process. In the next step, you will be asked to enter your name, phone number, date of birth, FATCA declaration, annual income, planned investment in Forex trading, source of income and career information.

For the next few steps, you will be asked to fill in your address, choose your preferred account, and accept the broker’s terms and conditions. Once you have checked all the boxes and clicked on ‘Accept’, an account will be created in your name. You can then proceed to your account dashboard or the xStation 5 WebTrader platform, where you can complete the remainder of the account setup process, such as identity verification and funds deposits.

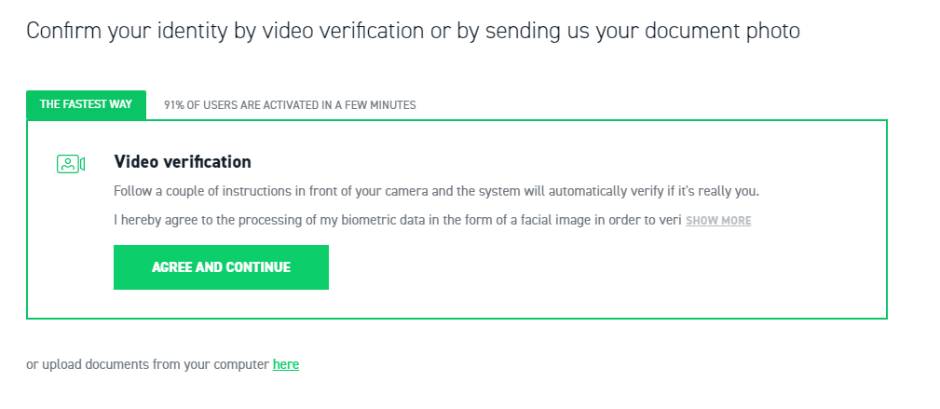

The xStation 5 platform prompts you to activate your account by uploading your identity documents. Alternatively, you can log in to your Client Office to perform all account management activities. You can opt for the video verification process, which will be completed within a few minutes, or choose the traditional method of uploading the documents and following a manual verification process.

Both options are secure, but we feel that video verification is certainly a better option. The broker will verify your identity quite quickly so that you can start trading within minutes of opening an account.

Is the XTB App as Good as Other Proprietary or Third-Party Trading Platforms?

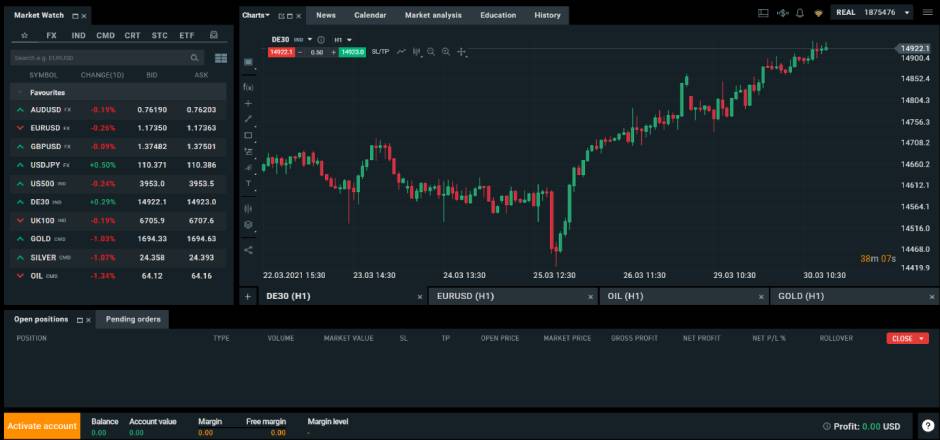

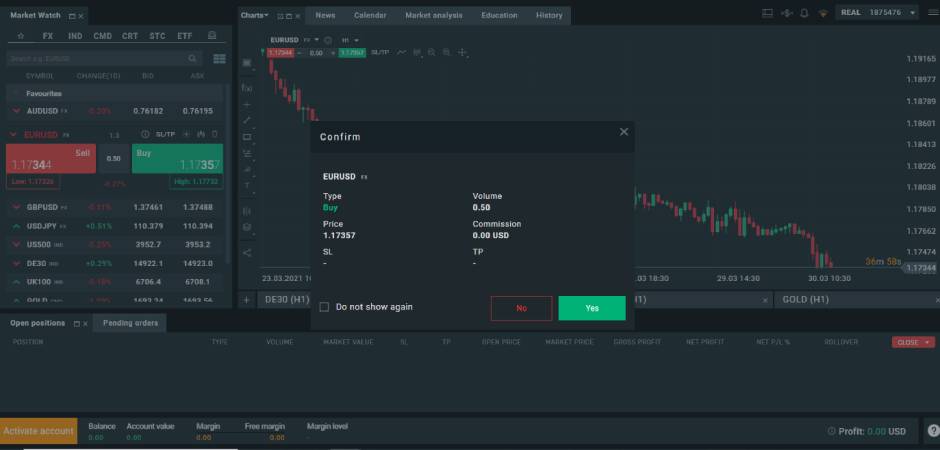

The XTB broker offers two different platforms to its traders. Its preferred XTB trading platform is the xStation 5 interface, a proprietary trading interface designed by its in-house development team. The xStation 5 platform is available either as a browser-based WebTrader application or as an installable platform for Windows and Mac OS users. The Web version and the desktop version are very similar in features and utility. Of course, some users might prefer the desktop version’s stability, but we found both interfaces equally good.

Our first impressions of xStation 5 were fantastic. The layout of the trading platform and the placement of the different sections of the interface were spot-on. In many ways, it does resemble the MetaTrader platform, which is a good thing. A few audible notifications were built into the platform, which we feel was a bit of an overkill, but some traders may prefer the audio prompts. If you are not a fan, you can always turn it off by modifying the platform settings.

Upon spending more time with the app, we couldn’t help but notice the similarities between xStation 5 and the MetaTrader platform. We do not doubt that the company has developed the proprietary XTB app with heavy inspiration from the MT4 and MT5 terminals. The good news is that the platform works brilliantly, and we found no issues with the overall performance of the app.

There are indeed some striking differences from MetaTrader as well. For instance, the trading window, the option to place orders and even trade management were a bit different from what you would expect from the MT4 terminal. We can’t say the options are unique, but they offer a slightly modified trading environment where traders can get more information about the instrument before placing an order. The xStation 5 platform is certainly a great tool to trade the markets, but if you are looking for a more reliable and feature-rich option, you may want to opt for the MT4 terminal.

The MT4 terminal is indeed offered as an option for all users even though the broker does not outright promote its existence. The company seems more devoted to promoting its proprietary app, which is not a bad thing, but given a choice, professional traders will always opt for the MetaTrader terminals. Automated trading is supported for both account categories, and traders can install EAs, indicators and other tools in the MT4 platform. For the MT4 WebTrader, traders can access the trading interface through the MQL website. Ensure that you enter the correct server information, or you might face difficulties connecting to the trading server.

XTB App for Mobile – xStation 5 on Android and iOS

The xStation 5 app can be installed from the Google Play and Apple App Stores, where both apps have earned pretty high ratings from users. It adopts the same theme and functionalities as its desktop version, but the layout has been modified to offer a more mobile-oriented approach for both smartphones and tablets. As far as the actual trading experience was concerned, we found the app to be as good as, if not better than, the MetaTrader apps or other proprietary apps available in the market.

It makes sense that the broker continues to promote its mobile app to its customers, as the company appears to spend quite a lot of resources on updating the app with all the latest features. We also felt that the company has been listening to its traders’ feedback, as we found the trading experience to be quite positive.

Nevertheless, if you prefer the MT4 app over the xStation 5 platform, you can download it from the Play Store or the App Store and use your MT4 login information to trade. In our opinion, our readers will find the xStation 5 mobile app more convenient for trading, as it offers an excellent interface for professional trading. Of course, you can use both apps interchangeably and choose the one that suits your trading needs.

Any Offers or Bonuses for XTB Trading Accounts?

One significant downside of trading with a regulated broker is the lack of promotional campaigns, free offers or bonuses. We found the same issue with XTB online, as there is not a single bonus or promotion, even for international clients. EU regulation is very precise regarding what is allowed in terms of a bonus, preventing XTB from making any huge promises. Nevertheless, there is indeed a cashback offer for international traders, but you need to trade a minimum of 15 lots a month to qualify for the cashback program. The exact discount amount varies from client to client, but the cashback bonus can be withdrawn without any restrictions. Unfortunately, the cashback rebate program is not available to traders from the UK or the EU.

What Are the Funding Options and the XTB Minimum Deposit?

Due to the global extent of the broker’s services, the company accepts funds via bank wire transfer, credit card or e-wallets such as PayPal and Skrill. However, the deposits are not entirely free of cost. Credit card payments are free, but the broker charges a transaction fee for all deposits made through bank wire transfers or e-wallet payments. PayPal and Skrill payments will cost you 2% of the transaction amount as transfer fees, which is a massive drawdown on your trading capital even before you start trading.

The broker also warns about the transfer fee for bank wires, which it will not compensate. Therefore, we are immensely disappointed that the broker does not proactively absorb deposit fees, especially when other Forex brokers in the market gladly do so.

There are no XTB broker minimum deposit requirements, which theoretically means traders can start with just a $1 XTB deposit. However, the broker recommends an XTB minimum deposit of $250 for meaningful trading positions, which we also recommend. Due to the broker’s standard lot trading conditions, starting with a low amount can induce a margin call quite quickly, especially since the XTB broker leverage is quite high at 1:500. Nevertheless, the XTB deposit will be processed instantly, and you can start trading as soon as you deposit the funds.

| XTB Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Between 1-5 days | Min. Deposit: - | Deposit Fee: Depending on user’s reside |

|

Payment Methods:

SKRILL

BANK-WIRE

PAYPAL

|

||

XTB withdrawal is also as quick as a deposit. The broker processes all withdrawals on the same day, provided the XTB withdrawal request is placed before 1:00 p.m. broker time. Withdrawal requests placed after 1:00 p.m. will be processed the next day, but the transfer of funds is instant. Bank wire transfers may take a while, but an XTB withdrawal requested through an e-wallet will hardly take a few hours. The broker has ensured a transparent withdrawal policy under which customers receive the funds to their accounts without fail.

However, there is one requirement: traders must withdraw funds to the same account that was used to make an XTB deposit. The broker is very particular about its compliance with anti-money laundering laws and will even decline deposits if a trader’s bank or e-wallet account does not display his or her full name as submitted to the broker at the time of signing up for a trading account.

| XTB Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 1 business day | Min. Withdrawal: - | Withdrawal Fee: Depending on user’s reside and withdrawal amount |

|

Payment Methods:

SKRILL

BANK-WIRE

PAYPAL

|

||

Unlike deposits, the cost of withdrawing funds is not as expensive as we thought. XTB withdrawals within a threshold amount are chargeable, but beyond it, the broker processes the withdrawal free of cost. However, if you wish to withdraw a small amount, say, $100, the broker will charge 20% of the transaction amount as the withdrawal fee. The initial commission is in addition to the transfer fees incurred by the bank. Therefore, we recommend traders not withdraw smaller sums of money from the broker since the 20% fee can be quite a significant sum of money to lose while receiving your funds.

How Does XTB Spread Forex & Cost of Trading Compare to Market Standards?

We performed a detailed analysis of the XTB spread Forex through this XTB review, and we found that the cost of trading is very low compared to the spreads offered by other leading STP brokers in the market. Although the company does not provide an ECN account for its international traders, the spreads were quite competitive. The company promises a minimum XTB spread of 0.5 pips, but we have seen the real-time spreads even lower than promised. It is indeed a surprise, considering that brokers tend to err on the safer side by quoting tighter spreads, while typical spreads may be higher.

In the case of XTB online trading, we were shocked to see that the broker quoted spreads that were way lower than what was promised, and sometimes we were even offered a 0 pip spread on major currency pairs such as the EUR/USD.

All trades will be subject to a SWAP fee for overnight positions, but the actual SWAP can be positive or negative, depending on the underlying interest rates. For Islamic account holders, the company has removed SWAP fees to comply with Sharia law, but the charges are built into the spread, eliminating any instance of interest payments. However, there is an additional $10 per lot commission for Islamic account holders, making Sharia-compliant trading quite expensive. The broker does not charge any commissions for Forex and commodities, but may charge a commission for stock and ETF CFDs. There are no other hidden fees for trading and no surprises when it comes to liquidating your positions at existing market rates.

Nonetheless, we are not entirely impressed by the costs associated with XTB deposits and withdrawals, especially the high fees incurred for e-wallet payments. That said, the broker’s fair and transparent pricing policy is a great way of knowing the trading costs beforehand, which can help traders evaluate their trading strategies and trade the markets accordingly. The highly competitive XTB spread Forex structure should also put the broker in good light, as it can offset any other charges. Overall, the cost of trading is quite impressive, and we are highly satisfied with the broker’s cost structure.

What Are the Regulatory Implications of XTB Trading Accounts?

Trust and regulation are a big part of how XTB operates in the Forex market. With a strong base in Europe, the broker caters to a global clientele through its offices in thirteen countries. It is listed on the Warsaw Stock Exchange, which, although unique in its location, gives the company an extra dimension of safety in terms of regulatory supervision and financial audit. The broker is currently regulated by the FCA of the UK, the CySEC of Cyprus, the KNF of Poland, the CNMV of Spain and the IFSC of Belize. The company offers its services to the international trader through its international brokerage located in Belize, but the regulatory compliance and safety aspects are in line with the broker’s EU operations.

The company has taken several precautionary measures to ensure the safety and security of its clients’ funds. First, the broker is highly specific about its policies related to handling its clients’ money, as all of its clients’ funds are kept in segregated accounts. Additionally, EU traders are offered insurance policies under various ESMA guidelines, which insure traders’ funds against broker insolvency. However, XTB has gone one step further by providing free insurance to clients through Lloyd’s of London, which gives coverage up to 1 million GBP, EUR or AUD, depending on the region. All existing and new clients are automatically protected under the insurance coverage, with no additional registration required.

In terms of fair trade executions and dealing desk policies, all orders are executed at market price. However, there appears to be a limited conflict of interest between the broker and the trader. The company does have a detailed policy document on the conflict of interest, outlining how it manages to mitigate the conflict of interest with its customers. Nevertheless, in terms of trading safety, pricing policies and order execution, XTB is right up there among the best in the industry.

What Is the Best Method to Contact Customer Support?

There are multiple methods to contact the customer service team at XTB. You can either send an email to the broker or call the support team to talk to your account manager or a customer service representative. On the other hand, the broker offers a live chat option and a web contact form, which are more convenient options for international traders. The broker also supports multiple languages through its customer service channels, with over 20 different countries and languages available for traders. The support is offered 24 hours a day and five days a week, ensuring around-the-clock support during open market hours.

However, the verification team is available 24X7, which means you can register for an account and verify your identity during the weekends. For trading and account-related queries, you can contact the customer support team only during the weekdays. The overall customer service experience was very satisfactory, with the company’s representatives eager to answer queries and resolve issues as soon as possible. We also felt that all support staff were properly trained to ensure they had a thorough knowledge of the broker’s different products and services. It certainly had a positive impact on the quality of interaction, which is why the broker continues to be successful in the highly competitive Forex market.