Forty years is a pretty long time to remain competitive in an evolving industry such as Forex trading. HYCM started its journey as a commodities exchange centre in Hong Kong in 1977, but over the next few decades, the company expanded its services to other financial markets, including Forex trading. The HYCM Forex broker now offers a comprehensive range of Forex, commodities, cryptocurrencies, stocks, indices and other CFD products, taking the total tally to more than 300 financial instruments.

HYCM renders its services to traders from 140 different countries, with offices in five prominent world financial capitals. The company has also achieved numerous global awards of excellence, ranking it above other brokers for its outstanding services. The Henyep Group constantly strives to keep abreast of the latest changes in the Forex market. As a result, its FX brokerage division has met with a tremendous amount of success, but there are a few shortcomings. Please read our complete HYCM broker review to determine the core areas in which the broker outperforms its competitors and a few areas that do not quite meet our expectations.

Features

- Covers all major asset classes

- Competitive speads

- Excellent ECN accounts

- MT4 and MT5-based platforms

Special Offer

Which HYCM Forex Account Offers the Best Trading Conditions?

A comparison of the different HYCM broker account types revealed an interesting array of findings. Our extensive HYCM review concentrated on dissecting the different account categories, including information on how the funds are protected, the different trading platform options, the bonuses available to traders and how the trading conditions affect traders. Accordingly, we have generated a short list of all the benefits of trading with the company, along with a collection of a few concerns that will affect an otherwise positive trading experience.

- Regulated Forex broker with over four decades of experience.

- Covers all major asset classes.

- Transparency in pricing and order execution.

- One of the fastest execution times in the market.

- Top-notch customer service.

- Offers both MT4 and MT5 platforms for trading.

- One of the best ECN accounts in the market.

- The spread for the Fixed and Classic accounts is high.

- Account inactivity fee.

- Entire range of instruments is available only with the MT5 platform and not with the MT4 terminal.

It is genuinely refreshing to see that we couldn’t find any serious drawbacks of HYCM Forex accounts. Sure, there are a few concerns, such as the high cost of trading for some account categories, but the overall trading conditions are much better than those offered by the company’s mainstream competitors. The proactive nature of the HYCM Forex broker and its constant endeavor to keep updated in Forex trading does help the company stay relevant amid the ever-changing needs of the online Forex trading community. We have outlined all of the company’s different features in the rest of this HYCM review, but if you wish to open an account, follow the detailed steps provided below.

Is the HYCM Account Registration Process Easy & Secure?

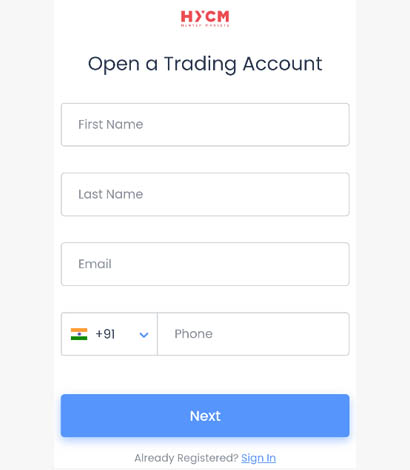

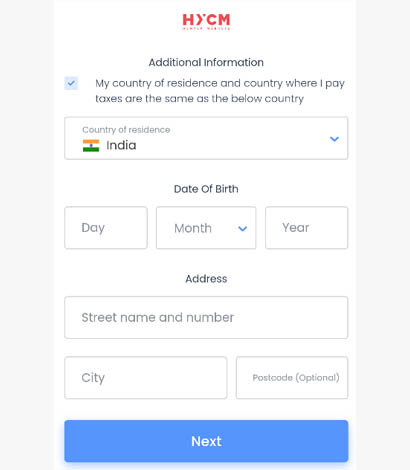

The broker’s sign-up page can be accessed through the website using the ‘Open Account’ link, which is available via both desktop and mobile browsers. There are five steps in total, with the first stage of the registration page asking you to enter your name, email and phone number. The second stage asks you to confirm your country of residence, date of birth and address, which completes the first part of the registration process.

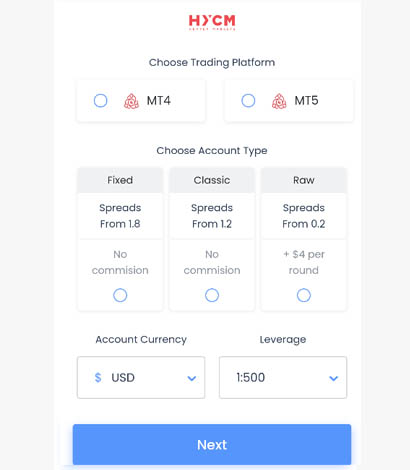

In the third stage, you will be asked to choose your trading platform, account type, account base currency and leverage. If you are confused about the account choices, you can refer to our full HYCM broker review before signing up. Alternatively, you can choose random account parameters to complete the sign-up, as you can always go back and add additional accounts with the trading conditions you prefer. Therefore, you needn’t worry about choosing the correct trading details at this stage.

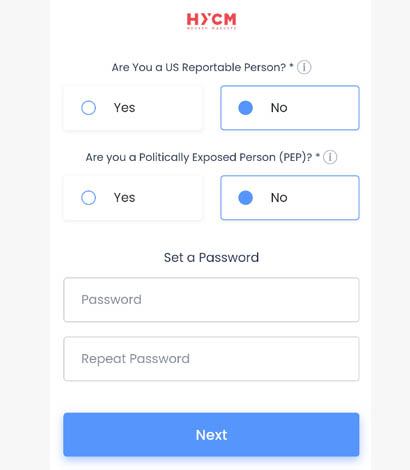

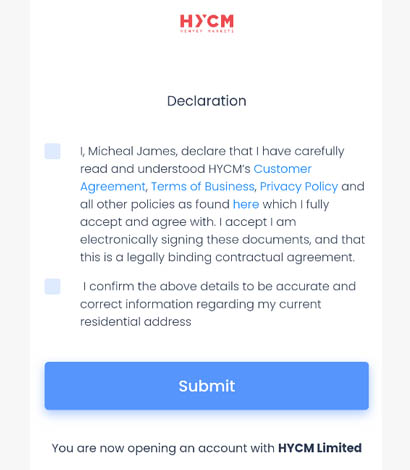

In the fourth step, the broker will ask you to declare that you are not from the US and not politically exposed. You will also be asked to set your account password during this stage, and, finally, the last step is all about reading through the terms, conditions, privacy policy and other contractual information. You should accept all the terms and click on ‘Submit’, which will take you to your account dashboard.

The entire process can be completed within a few minutes, and you can also verify your account by uploading all the necessary documents such as identity cards, passports, a driving licence, a bank statement, a utility bill or other government-issued certificates. Sure, you can deposit funds and start trading without completing your verification, but it is inherently better to verify your account before depositing funds. The entire verification process hardly takes two days at the most, but in our case, our trading account was verified within a couple of hours on a weekday. Account for delays if you are signing up over the weekend, but we found the entire account registration process very secure and convenient.

A Description of the HYCM Forex Account Choices

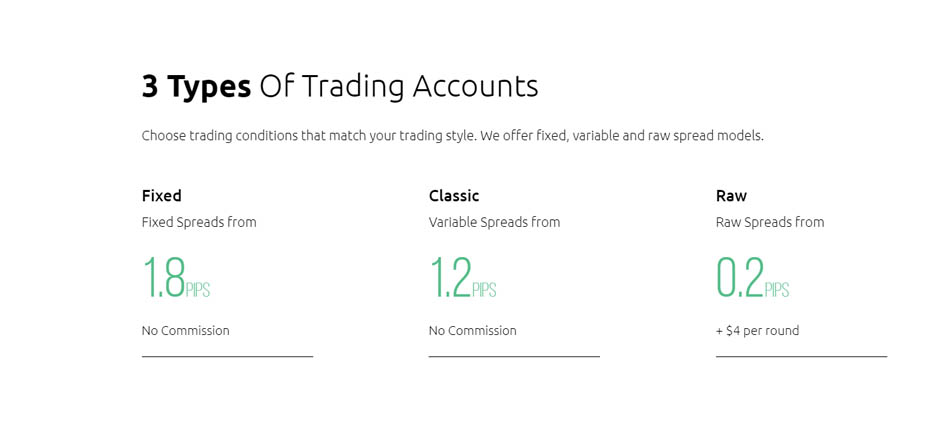

The company offers a retail account option for smaller traders and a VIP account for corporate clients who transact larger trading volumes. The retail account options are classified into three categories: the Fixed account, the Classic account and the Raw account. The minimum HYCM deposit requirement for the Fixed and Classic accounts is $100, while the Raw account mandates a slightly higher minimum HYCM deposit of $200. These barriers are quite low for smaller retail traders, and the minimum investment requirement is on a par with some of the other mainstream brokers in the market.

Of course, some companies offer trading accounts with minimum deposit requirements as low as $1, but we believe $100 is low enough for Forex and CFD trading. For VIP accounts, the minimum investment is decided on a client-by-client basis and can vary based on the trader’s minimum deposit capabilities.

The basic trading conditions are very similar for all account holders. The maximum HYCM leverage for Forex accounts is 1:500 for both major and minor pairs, while the leverage is reduced to 1:100 for exotics. For other instruments, such as indices and commodities, the HYCM leverage ratios are 1:200 and 1:133 respectively; but the leverage for stocks, ETFs and cryptocurrencies is reduced to 1:20. The minimum order volume is 0.01 of a standard lot, with no maximum restrictions on the order size or the number of open orders available for each trading account.

Furthermore, all account holders can opt for the Islamic account option, eliminating any SWAP for overnight positions. The Islamic account option is also available for VIP traders.

The HYCM Forex spread for the Fixed account starts at 1.8 pips, which is extremely high. Of course, the fixed spread cost may be manageable for the infrequent trader, but high-frequency traders will feel the burden of the high fixed spread at the end of the day. The only advantage is that the spread does not change significantly during volatile trading conditions. We found the case to be the same for the Classic account as well, where the HYCM Forex spread is around 1.2 pips. The typical spread for the EUR/USD pair is 1.4 pips, which is once again quite expensive.

However, there is no commission for both account categories. Some of the low-tier market-maker brokers offer a Forex spread for major pairs in the region of 0.8 to 1 pip. Therefore, when comparing the outright costs of different broker accounts, we should concede that the spreads are higher for the Fixed and Classic accounts.

If you are looking for tight spreads, then the Raw account is a much better option than the Fixed and Classic accounts. It is the company’s ECN offering, which charges a minimum spread of 0.2 pips. The spread is very competitive, and despite not promising 0 pips, the Raw account does appear to be an excellent proposition for trading with the lowest Forex spreads. There is also a $4 commission per round of lot trading, but this is one of the lowest ECN trading commissions in the entire market.

With a very low minimum deposit requirement of $200 for the Raw account, we find no reason to consider the Fixed or Classic accounts. It almost seems as if the broker is subconsciously coercing its traders to migrate towards the Raw account, as it is easily one of the best ECN accounts in the entire market. The Raw account supports trading through EA, which is also available for the Classic account. However, EA support is not offered for Fixed accounts – a bit surprising. Nonetheless, while we understand the company’s motive behind offering three distinct account categories, with each category geared towards a different retail segment, we would have very much preferred that it simply stick to the Raw account. It could certainly have helped the company to shed its image as a high-cost Forex broker. Overall, we find the trading conditions to be quite acceptable.

HYCM Platforms & Multi-Asset Trading

There were no surprises when we saw that the broker offered the MT4 and MT5 terminals as the default HYCM platforms for multi-asset trading. All the six different asset classes were supported through both terminals, but only the MT5 platform offered the entire range of financial instruments.

This is understandable since MT5 is a much newer and advanced version of MT4, developed entirely as a multi-asset trading platform. However, the MT4 platform does continue to be popular among traders due to a few minor advantages it holds over the MT5. For instance, the programming language for MT4 is simpler than that of MT5, and the MQL community has a much more augmented database when it comes to indicators, tools and custom EAs.

The HYCM platforms, both MT4 and MT5 versions, are available for trading on desktop, mobile and web. The installable desktop interface can be downloaded from the broker’s website or directly from the MetaTrader website. The company hasn’t made any changes to the interface, and traders are free to modify the platforms, add EAs or install custom tools/indicators. However, there is one slight problem for Fixed account holders: the broker does not support EA trading for Fixed spread traders. Nevertheless, the other two account categories enable complete EA trading without restrictions, and traders can indulge in open-source programming for both the MT4 and MT5 terminals.

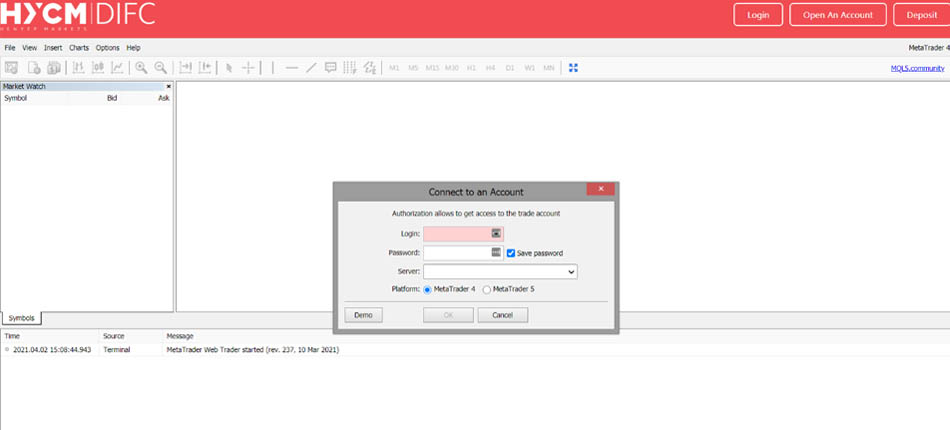

To use the WebTrader version of MT4 and MT5, traders should visit the platform’s web-based version hosted on the MQL website. Initially, we couldn’t find access to the MetaTrader WebTrader hosted on the company’s global website, but eventually we found an online version that was hosted on the company’s DIFC-regulated website. The company could have done the same for its global users as well, but considering its other positive attributes, we wouldn’t worry too much over the lack of a WebTrader on its company server. Nevertheless, you can use your MT4 or MT5 login information to access your trading account through the MQL server.

HYCM Platform for Mobile – Any Proprietary Apps for Android & iOS?

There are no proprietary HYCM apps for mobile trading since the MT4 and MT5 terminals are available for download on Android and iOS devices. Both MetaTrader versions offer full support to mobile users, including smartphone and tablet users, ensuring that all traders get access to the same trading conditions on their desktop and mobile devices.

However, the broker has developed an HYCM app for mobile users that can be downloaded from the Google Play Store and the Apple App Store. The proprietary HYCM app is a mobile broker wallet where customers can manage their accounts, deposit funds, initiate withdrawals, set price alerts and invite friends to the HYCM platform. The HYCM app is not an absolute necessity, especially if you have the mobile MetaTrader terminals installed, but it is a great tool for setting price alerts and managing your account on the move.

Will an HYCM Bonus Improve My Trading Prospects?

Are you looking for a massive bonus program that will double or triple your initial trading capital, even before trading? Well, sorry to disappoint, but HYCM is not the kind of broker that depends on its bonus programs to rope in new clients. The company operates under some of the top-tier EU regulators, which naturally prevents it from indulging in promotional campaigns. Regardless, it does offer a small bonus to its international traders. You have to deposit a minimum of $100 to receive a 10% deposit bonus, with a maximum bonus threshold of $5,000 per account holder.

Furthermore, traders must accumulate a minimum of 30 standard lots in trading volumes for every $1,000 received in bonuses, and the trading activity must be completed within sixty days. The minimum trading requirement depends on the bonus amount, but if for any reason the trader is unable to transact the minimum volume required, then the broker will cancel the bonus.

On the other hand, if you are looking for a cash bonus, you can earn a referral bonus by inviting your family members or friends to sign up for an HYCM Forex account. Each qualified referral stands you a chance to earn $200, but each referral must deposit at least $500 and trade a minimum of 3 standard lots. There are no withdrawal conditions associated with the referral bonus, but this bonus is not available to traders from the UK or the EU. The bonuses offered by the HYCM broker may not be massive, but they give you a bit of leeway to extend your market exposure.

Funding Methods for Your Account & HYCM Withdrawal

There are a total of five different HYCM deposit methods to fund your account. The more traditional way of sending funds, bank wire transfer, is the slowest, and the broker specifies a minimum deposit requirement of $250. The broker does not charge any fees for a bank wire transfer as such, but has clearly outlined that it is not responsible for any intermediary bank charges.

Therefore, if the intermediary banks charge any transfer fees, conversion charges or similar costs, you will only receive the remaining amount in your HYCM broker account for trading. However, other HYCM deposits, such as Visa/MasterCard payments, WebMoney transfers, Skrill transfers and Neteller transfers, offer much faster payments with the lowest costs. Deposits made through these online e-wallets are processed within an hour, and much quicker in some cases. The HYCM minimum deposit for e-wallets and credit/debit card payments is $20.

| HYCM Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: Varies between immediate and 3 days | Min. Deposit: $20 / $250 (bank) | Deposit Fee: Sender may pay bank wire fee |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

MASTERCARD

|

||

For an HYCM withdrawal, customers must use the same deposit method as when they funded their account to comply with anti-money laundering laws. The minimum HYCM withdrawal limit for a bank wire transfer is $300, while for e-wallets and credit/debit cards, the minimum withdrawal amount remains $20. Bank wire transfers are processed within five working days, but it may take up to a week for the funds to reach your account.

On the contrary, an HYCM withdrawal done using a card or e-wallet will be processed instantly, with a real-time processing time of around an hour. The company does not charge any fees for withdrawals, but the intermediary payment systems or banks may charge a transaction fee. Be especially careful of the 1% transfer fee for Skrill withdrawals, which is applicable to all amounts greater than $5,000. Nevertheless, zero deposit/withdrawal fees and quick processing times are a trademark of HYCM’s services portfolio. During our detailed HYCM review, we found that the broker has quite a positive reputation among its customers, especially due to its commitment to ensuring all HYCM withdrawal requests are processed within the same day.

| HYCM Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: Varies between 1-5 days | Min. Withdrawal: $5 / $200 (bank) | Withdrawal Fee: Determined by broker's rate |

|

Payment Methods:

VISA

SKRILL

NETELLER

BANK-WIRE

MASTERCARD

|

||

How Much Does It Cost to Trade the Forex & CFD Markets?

As we mentioned earlier, in the account choices section of this HYCM review, the cost of trading is quite high for Fixed and Classic accounts. With fixed spreads starting at 1.8 pips for the Fixed account and dynamic spreads starting at 1.2 pips for the Classic account, the cost of trading can accumulate quite quickly, particularly if you transact a significant volume of trades in a single day. Our real-time spread analysis of Fixed accounts discovered around 2.5 pips on average for the EUR/USD pair, while the same pair quoted around 2 pips for the Classic account. Additionally, non-Islamic account holders should factor in the SWAP rate for overnight trading, which will certainly add to the overall costs of trading.

We did enjoy a respite in the cost of trading with the ECN Raw account, where the minimum spread quoted was around 0.2 pips, with real-time spreads quoted in the region of 0.5 pips. The ECN commission is also very low, with commissions for all pairs quoted at $4 per round lot traded. The commission is very competitive because most reputed ECN brokers charge anywhere from $6 to $16 per round lot traded. Nevertheless, trading with a Raw account will also attract a SWAP fee for holding overnight positions, the cost of which is generally similar to those of the Fixed and Classic accounts.

The broker may also charge an inactivity fee from its users, which can cost around $10 per month, charged after 90 days of inactivity. The broker will deduct this amount every month until the customer resumes trading activity. Apart from the spreads, commissions, SWAP and inactivity fees, there are no other hidden costs. Of course, deposits and withdrawals are also free of cost, but the broker will not compensate you for any losses incurred during the transfer of deposits.

For example, wire transfers may incur additional charges during transfer, including conversion rates and intermediary bank fees. These fees are to be borne entirely by the client, reducing the available trading capital by a significant margin. We have seen other brokers reimburse them as a goodwill gesture, but no luck at the HYCM broker. Nonetheless, all funds are moved to segregated accounts held at tier-one banks, and the details of HYCM’s safety and regulatory protection are outlined in the next section.

Are HYCM Forex Account Holders Protected by Good Regulation?

The broker is well regulated by some of the top regulators in the industry. The Henyep Group has a regulatory licence to offer Forex and CFD brokerage services in the UK that is issued by the Financial Conduct Authority, while for the European Union, the company has obtained a Forex and CFD brokerage licence from the Cyprus Securities and Exchange Commission (HYCM licence). These entities are regulated according to the highest regulatory standards and supervised according to the ESMA and MiFID derivatives. The broker offers insurance against broker insolvency through FSCS and ICF compensation programs, which safeguard clients’ funds against any form of broker redundancy.

The broker’s global operations are handled by its brokerage in the Cayman Islands, regulated and licensed as a Forex and CFD broker by the Cayman Islands Monetary Authority. The company has also set up a registered office in Saint Vincent and the Grenadines, which works in conjunction with the Cayman division to cater to traders from all over the world. The international version of the brokerage is not as safe or secure as its European counterparts, but while researching the company for this HYCM review, we did not find any regulatory sanctions, serious concerns or allegations levelled against the broker.

The Henyep Group has also installed a brokerage in Dubai with a DFSA and DIFC licence and an office in Kuwait to cater to clients from the MENA region. In Asia, the broker’s entire operations are headquartered in Hong Kong, continuing to be one of the most prominent financial companies there. Considering its many regulatory licences and strict regulatory supervision, we are quite satisfied with the company’s safety aspects. Of course, it also helps that the company has been expanding its services across the globe for more than 40 years, which increases the trust and safety we expect from a Forex broker.

How Does the Customer Support Team Treat Its Clients?

No company can successfully navigate a highly competitive market without the continued support of its customers. Good customer support and high customer satisfaction are two main pillars of a company’s future success. It is no wonder that HYCM continues to expand to new markets globally while adding a ton of happy customers to its fold.

The broker offers customer support to its clients 24/5 through live chat, phone support, email and a web contact form. Of course, the absence of customer support access during the weekends may be an issue, but representatives will respond to emails on the very next working day.

The broker has a separate section on its website for client support, account opening, general inquiry, and complaints, thereby ensuring that you can receive qualified responses to your queries. Clients can also visit the broker’s office to resolve any issues or for general help, but we feel that the live chat feature or an email to the broker will help resolve the most common issues.