eToro advertises itself as the first mover in the social trading scene. It launched its Forex brokerage in 2007 with a highly intriguing, animated trading platform, which lured a significant number of smaller retail traders into the world of Forex and CFD trading. Its initial attempt at creating a vibrant and playful trading platform was an instant hit, but it also brought a lot of customer dissatisfaction by way of trading losses due to traders’ inexperience.

However, in 2010, the company launched a social trading platform known as OpenBook, which revolutionised the way we perceive social trading today. These days, eToro continues to be the leading innovator in the social trading market, with its platform offering some of the best copy trade services in the entire industry.

Even though it wasn’t easy for eToro during the early days of its launch, it stuck to its principles and continued to concentrate on improving its services by listening to its customers. Eventually, we witnessed the company becoming a world-class CFD brokerage, which is properly regulated and secure enough to safeguard your funds from any financial malpractice. In this eToro review, we aim to evaluate the eToro broker as a CFD company and assess its social trading platform, trading conditions, account options and other factors that can impact your trading experience. We will also consider eToro reviews left by existing customers to understand how the company’s services relate to the market’s consensus.

Features

- Cryptocurrency trading platform

- eToro club

- Variety of market events

- Free demo trading account

Special Offer

Can an eToro Account Offer a New Trading Experience for Beginner & Advanced Traders?

Most Forex brokers attempt to follow an established format when developing their Forex trading services. Some rarely take the risk of thinking outside the box, and their success rate may be questionable. Regardless, eToro is one company that has managed to make it work with an innovative service offering. An eToro account is nothing like what anyone would expect from a conventional FX brokerage, especially considering its pioneering effort during the early days of its launch. To better analyse the company’s product portfolio and understand the overall eToro Forex trading experience, we have noted a few pros and cons of opening an eToro trading account.

- The first social trading platform innovator.

- A large community of traders for copy trading.

- Wide range of financial assets.

- A user-friendly trading platform.

- 30 Millions users globally

- An excellent range of payment methods.

- Free access to CopyTrader.

- No access to MetaTrader or cTrader platforms.

- Some known issues between the broker and a few customers in online eToro reviews.

- Not the most competitive trading conditions.

An eToro Forex account is indeed one of the best social trading accounts, especially if you are looking to take advantage of the CopyTrader feature. Of course, it does require effort from your side to find the winners and invest your funds by carefully choosing the best Professional Investors to copy. However, the greater benefit is that an eToro account makes it possible to do this without effort. Therefore, from our perspective, eToro is best suited if you have a very particular requirement for copy trading, as there are several other alternatives if you are looking for a conventional Forex and CFD broker.

Nevertheless, we will offer all the information you need about the eToro Forex broker and its numerous services in this eToro review.

eToro Account Options for Retail & Professional Traders – How to Use CopyTrader

Traders are given two different eToro trading account choices; one is the Retail client account, while the other is a Professional client account. The Retail eToro trading account allows regular traders with a lower trading capital, either with or without prior trading experience, to access all the company’s different products. The Professional eToro account is intended for traders with a larger capital outlay, but they will need to prove their experience in the markets and pass a test administered by the broker.

The Professional eToro Forex trading account has higher trading limits for larger position management, but traders do waive certain rights, such as protection of funds through the Investor Compensation Fund under the ESMA protection acts. Nevertheless, eToro Forex broker Retail account holders enjoy all the different protections on offer, but these are highly country-specific, as protection under the ESMA is offered only to traders from the EU. Both accounts offer negative balance protection, but the Retail account’s leverage is limited, while there are no such limitations for Professional accounts.

Retail account holders can adopt both manual and CopyTrader trading, but Professional account holders are allowed to trade only manually. This is understandable, as it may not be viable for larger traders to hold the same positions as a smaller trader. As far as the CopyTrader functionality is concerned, it is free for all traders. Traders can either copy other leading traders’ activity or become a Popular Investor. For copy trading accounts, traders need only open an account, and they can start copying trades instantly. There is no complicated approval process or additional fees, but there is a minimum requirement of $200 to copy one Professional Investor.

To follow additional investors, traders will have to deposit $200 for each investor, which can become a bit expensive if you want to copy multiple investors.

The Popular Investor program allows more experienced traders to make their trading activity public and earn money when other traders copy their trading strategies. The program has four different levels: Cadet, Champion, Elite and Elite Pro. The minimum investment required to enter the program is $1,000. Cadet is the lowest level, where traders don’t receive any monthly payments, and the minimum Assets Under Management (AUM) is $500. The Champion level is reserved for AUM of $50,000, where the monthly payment can range from $400 to $800, for a theoretical growth of 1% every month.

Popular Investors can receive up to 1.5% payment based on average AUC (Assets Under Copy). Investors must meet several conditions to be a part of the eToro Forex broker Popular Investor Program, and the company reserves the right to accept or deny entry based on its policies and T&C. Read through all the company’s terms before opening an eToro account.

*61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Joining CopyTrader with an eToro Broker Account – How to Get Started

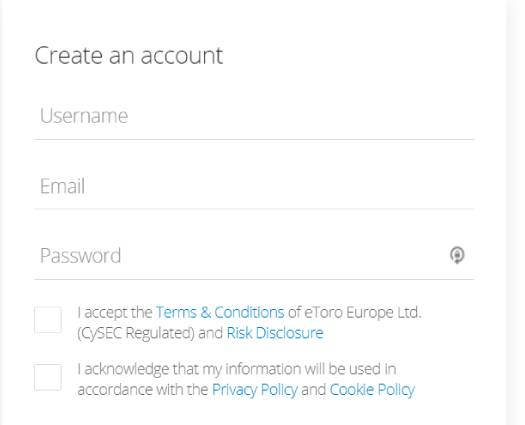

To enroll in the CopyTrader program, you must first sign up for an account by clicking on the ‘Join Now’ link. It takes you to the account registration page, where the first task is to create a username and password. You should also read and accept the company’s terms and conditions, along with signing your agreement to the various regulatory policies and guidelines. If you prefer, you can also sign up with your Facebook or Google account. Once you have created your account, you will be taken directly to the web-based eToro platform, where you will be asked to complete your profile by adding your personal information.

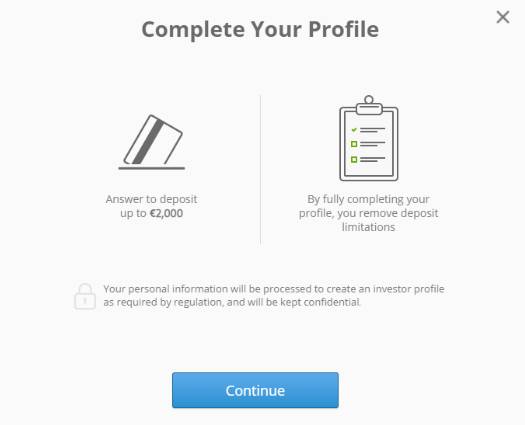

However, what worries us is that traders can deposit funds into their account without completing the verification process or even updating their profile. You can deposit up to $2,000 (or 2,000 Euros) without adding your personal information, which is risky considering that brokers may decline verification documents if they cannot be accepted. Therefore, we implore traders to always complete their account sign-up process, enter all the relevant information and verify their identity by uploading the necessary documents before depositing any money. Deposit funds into your account only after ensuring that your account is verified and that all documents are in order.

To complete your profile, you should enter your name, date of birth, address and passport number. Without entering your passport number, you cannot proceed with your account verification. Next, you should provide details of your experience with the financial markets and how much you plan to invest in leveraged CFD products. The company will also ask you to complete a short test to check your knowledge of the markets and understand your financial position. Finally, you will be asked to upload your documents for verification, but as we mentioned earlier, you can complete this step at a later stage and proceed to deposit funds. We do not recommend depositing funds without verifying your identity.

The Trading Features Offered by the eToro Trading Platform

The company forayed into the Forex trading industry with an innovative trading platform that showed the world trading could be fun. It had one of the best Windows trading platforms in the market, which took the guesswork out of trading. However, with the launch of several feature-rich third-party platforms such as MetaTrader and cTrader, the company quietly let go of its desktop app and instead developed the WebTrader in 2009. The current version is the evolution of its WebTrader, which did sacrifice a lot of its animation and graphics for a more rounded and subtle approach.

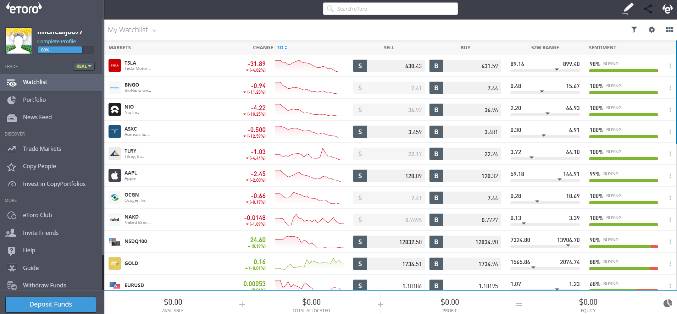

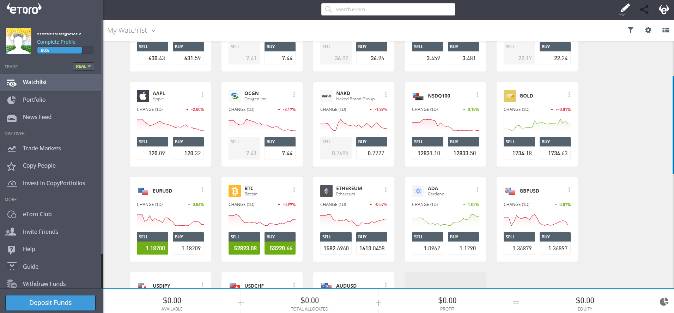

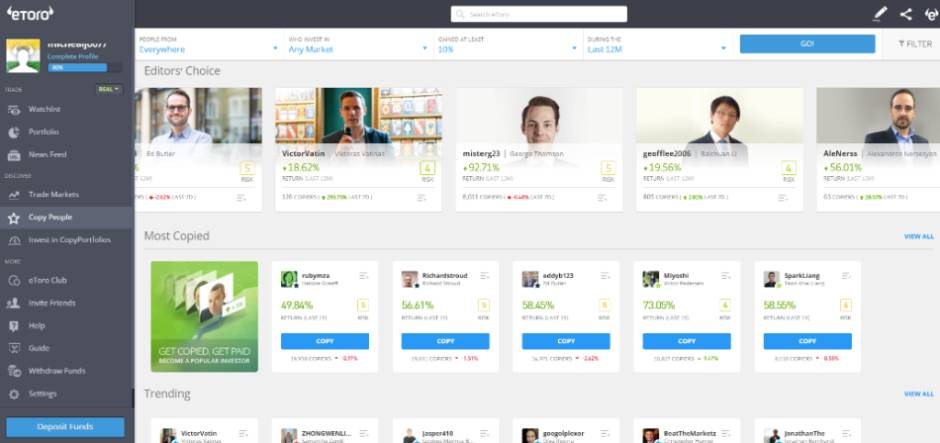

The basic layout of the browser-based eToro platform is strictly functional. We have the navigation menu to the left, a small search bar and settings menu at the top, and a sizeable area in the middle that is dedicated to displaying the markets, charts and popup trading terminal. The menu to the left offers several convenient links to manage your workspace, set a watchlist, track your portfolio and trade the markets. The menu also offers the option to copy other trades using the CopyTrader feature, along with access to the broker’s social network, the news feed, the settings menu, and the link to deposit and withdraw funds.

The eToro trading platform‘s central portion is customisable and can be modified to include all the different financial instruments from its varied asset portfolio. You can either have the interface display a list view or convert it to a grid view. You can create several watchlists with your preferred instruments, or you can click/tap on the filter link to display the different trading markets from a specific asset class. You can even rearrange the different instruments in any order you prefer.

While it is convenient to move the widgets according to your preferences, we couldn’t find a way to move multiple instruments together, which was a pain when dealing with multiple assets. Nevertheless, you can set price alerts; change between daily, weekly and monthly time frames; and enable one-click trading through the interface.

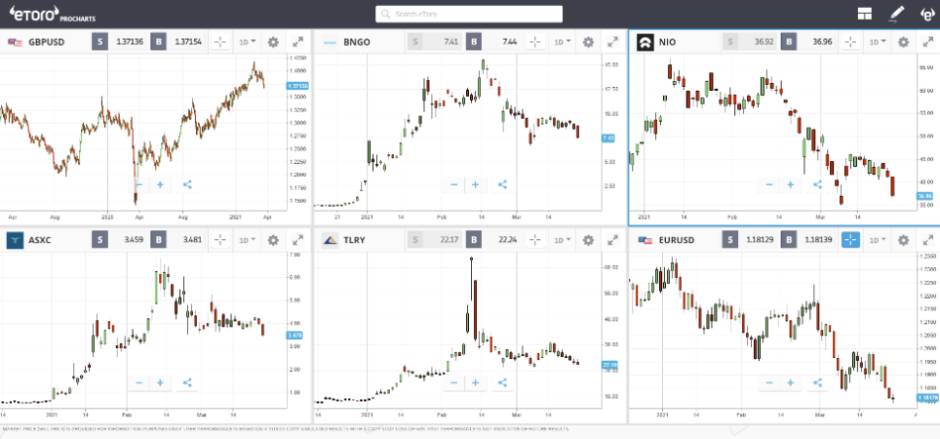

Clicking on an asset opens a detailed widget that provides access to the instrument’s news feed, provides various stats, and even opens a basic candlestick chart for historical price information. To add indicators and other tools, traders must access the ProCharts link on the eToro trading platform, which opens a separate web browser tab. ProCharts is a separate charting software which, to our surprise, is not integrated with the WebTrader eToro platform.

Nevertheless, the charting interface offers a customisable layout that can host up to six different charts and even includes the option to add almost all the known indicators available in the market. You can also change the time frame, change the time zone, choose the chart types and compare different charts through the charting software. Trading is also possible directly from the chart, but trade management is done through the eToro trading platform.

Past performance is not an indication of future results.

Despite a largely positive experience with the eToro Forex trading platform, we felt more inclined towards the more established platforms, such as the MetaTrader and cTrader terminals. We have been tracking the changes in the company’s platforms over the years, and we fear that the company may have shifted its focus to developing a platform that is more oriented towards social trading. In that respect, we find the eToro broker platform to be one of the best social trading platforms in the entire market. It is easy to use, and copying other traders is a breeze. It is very easy to manage positions by allocating funds to different Popular Investors, with traders having complete control over where to invest their capital.

There are tons of tools and filters to help you find the best traders in the CopyTrader community, and you don’t have to worry about the fees or any other aspect. You can add any trader to your CopyTrader portfolio, and you can stop copying at any time. Therefore, if you are looking for a leading social trading broker, look no further than the eToro Forex trading platform.

Is the eToro App Available for Mobile Trading?

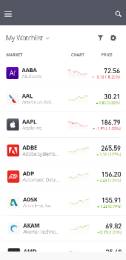

Mobile traders have the option to download the eToro app on both iOS and Android devices. The stand-alone app is developed entirely in-house, ensuring that traders can switch between the desktop and mobile interfaces without losing out on any features. The iOS and Android apps have similar performance and layout, with excellent compatibility for both smartphones and tablets. The mobile apps do resemble the desktop app’s design, but we felt that the mobile interface was much better in terms of usage and aesthetics.

The CopyTrader function, trading markets, charting options and other trading attributes remain the same for both desktop and mobile users. There are two different eToro apps for both iOS and Android platforms: one for global users that offers the entire range of products, while the other app is geared towards the US market by offering cryptocurrency assets. Both apps adopt the same layout and design, but the choice of assets varies. We have reviewed only the mobile app’s global version, as we couldn’t access the US version due to regulatory restrictions. Nevertheless, the performance levels were acceptable, and we certainly found the CopyTrader feature to be the best part of using the broker’s mobile app.

*61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Will We Receive an eToro Bonus for Social Trading or CFD Accounts?

The company does not mention an eToro bonus, which stands in stark contrast to its bonus programs offered in recent years. Of course, this is a compulsive move to comply with the strict regulatory guidelines concerning promotions and free money bonuses.

Insight into Deposits & the eToro Withdrawal Process

The minimum first deposit amount as well as the subsequent deposits vary depending on the country. Depositing funds can be done through e-wallets such as Skrill and Neteller, but if you are looking for a more conventional payment method, you can also use a bank wire transfer or card payments. You can deposit funds as soon as you sign up for an eToro account, but we recommend you upload your verification documents and wait for the broker to verify your identity before doing so. We can’t stress the importance of account verification enough, as this is one of the most contentious issues between traders and their brokers.

If you have deposited funds, you can indeed trade the markets; however, your eToro withdrawal will only be processed after your account is verified. While all deposits are free of cost, with the broker absorbing any transaction fees, conversion fees may apply to both deposits and withdrawals. Withdrawals are subject to a $5 charge per request.

eToro withdrawal transfers the funds to the account used to make the deposit, and in terms of card payment, the withdrawal will be processed to the card used to deposit funds. The broker has a good reputation in the market for its withdrawal policies, as it has ensured that the withdrawals for all verified users are approved without any restrictions. The only downside is that the withdrawals can take longer than normal, as the broker may provide an opportunity for its clients to reverse or cancel the withdrawal request. The promised withdrawal time is one to two days for most e-wallets, but credit/debit card and bank wire withdrawals can take upwards of eight days.

Our withdrawal request was processed within two days, but we were not entirely happy with the delay. We have received payments from other FX brokers within a couple of hours, which leads us to ask why this broker takes more time. Even so, we haven’t come across any serious concerns concerning withdrawal issues, aside from broker-trader conflicts that arose from several account, trade and verification-related concerns.

| eToro Deposit Options | ||

|---|---|---|

| Deposits Availability | Min. Deposit | Deposit Fee |

| Deposits Availability: 1 business day | Min. Deposit: from $50 | Deposit Fee: No commission |

| A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted. | ||

|

Payment Methods:

MASTERCARD

VISA

SKRILL

NETELLER

|

||

Is eToro Expensive for Forex & CFD Trading?

One of the main problems we faced while compiling this eToro review was that the trading fees and commissions were quite expensive. The minimum spread on the EUR/USD pair was quoted at 1 pip on eToro’s website, but during real-time trading, the spread was more in the region of 2-3 pips. Of course, the spread was also impacted while copying trades from Professional Investors through the CopyTrader feature, as the broker tends to factor the management fees into the spread.

The spread for minor pairs was even larger, while the fees for cryptocurrency assets were 1% of the transaction amount. CFD trading on stocks and ETFs was a bit more manageable, as the commission was around 0.09% of the transaction amount. Nevertheless, the cost of trading for most assets was quite expensive, which can put off professional traders or even high-frequency traders.

The only benefit of trading with eToro is the CopyTrader function’s availability, which seems to negate the effects of high transaction costs. Nevertheless, if you don’t plan on using the CopyTrader tool, you should try other brokers who offer much better and more competitive spreads. There are other fees for trading as well. The broker charges a SWAP fee for overnight trades, which adds to the cost of trading. Additionally, the broker may charge a $10 fee per month for inactive accounts, but the charge will be incurred only if the account remains inactive for more than a year.

| eToro Withdrawal Options | ||

|---|---|---|

| Transaction Time | Min. Withdrawal | Withdraw Fee |

| Transaction Time: 1 business day | Min. Withdrawal: $30 | Withdrawal Fee: $5 |

|

Payment Methods:

MASTERCARD

VISA

SKRILL

NETELLER

|

||

The broker uses a market-maker protocol for its dealing desk, which is another reason for the higher spreads. The broker matches orders internally or accumulates all orders and offsets them by taking the trades’ opposite position. These trades are then passed to the liquidity providers but considering the low-volume nature of most transactions, the broker can match its orders internally. There is indeed an instance of conflict of interest here, but the regulatory compliance requirements do enhance traders’ safety.

Additionally, the broker limits the maximum leverage offered to traders, at 1:30 for FX instruments. Trading with leverage involves high risk. It is quite a low amount of margin for smaller traders, and we don’t believe traders will be able to open any meaningful positions with low trading capital. Nevertheless, the minimum trade size starts at $1, but the broker recommends trading with at least $1,000 to manage meaningful positions.

Authenticity of the Regulatory Licences Issued to the eToro Broker

You will be pleased to know that four different regulators regulate the eToro Forex broker, making it a safe broker to trade the Forex and CFD markets. The company has an EU licence issued by CySEC, which brings it under the ESMA and MiFID derivatives. Therefore, traders from the EU are protected by several regulatory protection initiatives, such as the Investor Compensation Fund, which protects a portion of the traders’ capital in the case of broker insolvency. The broker also offers similar protection to traders from the UK through its FCA licence, where the Financial Services Compensation Scheme insures traders’ capital in case the broker files for insolvency.

For international traders, the broker has obtained a licence from Australia’s ASIC, which caters to the Australian market and the entire global clientele. Almost all global traders are offered an account under the company’s ASIC-regulated brokerage, which does offer a great deal of funds safety and investor protection. However, international traders may not expect the same levels of safety offered to Australian clients.

The broker has also opened a brokerage in the US for its cryptocurrency assets, registered as a Money Services Business under the FinCEN. Unfortunately, the dedicated cryptocurrency exchange is offered only to traders from the US, and international traders are redirected to the company’s Australian brokerage. However, the company is highly regulated and offers the best protection to its traders.

Does the Broker Take Care of Its Customers?

We have experienced mixed feelings while interacting with the customer support team at eToro. There is an information Help Centre and a detailed complaints procedure to ensure that all of its customers’ concerns are addressed. However, we found that there are a couple of concerns. First, there isn’t a live chat option, which can lead to delays in getting timely information. The company itself mentions that it may take up to 14 days to respond to any queries or tickets raised by clients, which is a long time. Second, the company may take a very long time to respond to email conversations or web-based tickets, during which time the customers may grow restless, leading to a conflict. Finally, the Help Centre is quite massive, but does not adequately provide all the vital information a customer might seek. Therefore, there is certainly room for improvement, and we would at least request the broker to add a phone number or a live chat option for immediate support.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.